BUSINESS

Banking Central | How long can MPC ignore inflation and remain 'accommodative'

The divided vote indicates that MPC may not continue with the stance for too long and if inflation continues to surprise on the upside, the change may be coming sooner than expected

BUSINESS

Jayanth Varma continues to be the lone dissenting voice in RBI’s MPC

Varma continues to question the relevance of the MPC forward guidance.

BUSINESS

Exclusive| Vodafone Idea: Believe Govt will work out some way to deal with the situation, says IDFC First's Vaidyanathan

"We hope it doesn’t go that way for the sake of the country and its citizens, but as a Bank if it were to go that way, we are already prepared," Vaidyanathan said.

BUSINESS

RBI likely to revise inflation estimate upward to 5.5%, says BoB Chief Economist Sameer Narang

The driver of economic recovery this year will be exports and government spending, says Narang. Domestic consumption will pick up with a lag once the vaccination rate increases; GDP growth is expected at 9.7 percent in FY22, he says

BUSINESS

Vodafone Idea: How will banks get impacted in the event of a default?

Larger banks may not have to worry much because as a percentage of their books, the exposure is not very high. Also, most banks had started preparing for the potential default by providing for likely losses from VI.

BUSINESS

Analysis | SBI gives no negative surprises in Q1

SBI has logged steady numbers in Q1 in a tough market. Slippages remained high but that is largely in line with the industry trend.

BUSINESS

RBI monetary policy announcement today at 10 am: Will MPC revise interest rates, inflation target?

RBI Monetary Policy: The MPC will most likely retain status quo on interest rates in this round. But watch out for the inflation forecast.

BUSINESS

PNB never objected to housing finance arm’s deal with Carlyle, only asked it to follow SEBI directions: MD & CEO

CS Mallikarjuna Rao says the bank will follow whatever directions are issued by the appellate tribunal. In an announcement on May 31, PNBHFL had said that Carlyle Group, its affiliates, existing investors, and Puri’s family investment vehicle will invest up to Rs 4,000 crore in the housing finance firm.

BUSINESS

Banking Central | The curious case of Videocon insolvency

The insolvency and bankruptcy code was designed to ensure a meaningful recovery for banks in a time-bound manner and give a graceful exit to promoters but some recent cases have exposed loopholes that allow former promoters to get back control of their businesses

BUSINESS

Over 100 RBI directives on co-operative banks so far in 2021, three licences cancelled; how deep is the mess?

According to senior industry officials and bankers, the high alertness from the central bank, the increased scrutiny and a raft of rule changes are a result of rising number of institutional failures in the co-operative banking industry.

BUSINESS

Kotak Mahindra Bank will not shy away from taking 'bolder bets', says Uday Kotak

During the year, the bank has undertaken a mindset shift to make retail and commercial lending focus, in addition to the corporate and deposit franchise, the veteran banker said in his message at the 2020-21 annual report.

BUSINESS

Exclusive | Lower regulatory costs helped NBFCs scale up over the last decade, says IIFL's Nirmal Jain

The reform progress on some of the sectors like agriculture, power, logistics etc. continues to lag the overall reform momentum. This is partly because these reform measures need a broader Centre-State consensus, the Founder of IIFL Group said.

BUSINESS

Yes Bank, Indiabulls ink pact for co-lending:10 Key questions answered

It was in November last year, the Reserve Bank of India came up with guidelines on co-origination of loans or co-lending of loans under which banks and NBFCs (non-banking finance companies) can lend to priority sector or economically weaker sections. The idea is to encourage credit flow to this segment.

BUSINESS

Explainer | Why a higher insurance cover is big deal for smaller depositors

The government's decision to make available deposit insurance within 90 days is big news for smaller depositors across banks. A series of bank failures and imposition of moratorium by the Reserve Bank of India had resulted in a widening trust deficit among depositors.

BUSINESS

PMC Bank scam case: Rakesh Wadhawan's bail plea denied

Rakesh Wadhawan was arrested in October, 2019, along with Sarang Wadhwan in connection with the irregularities submitted in the Punjab and Maharashtra Co-operative (PMC) Bank case.

BUSINESS

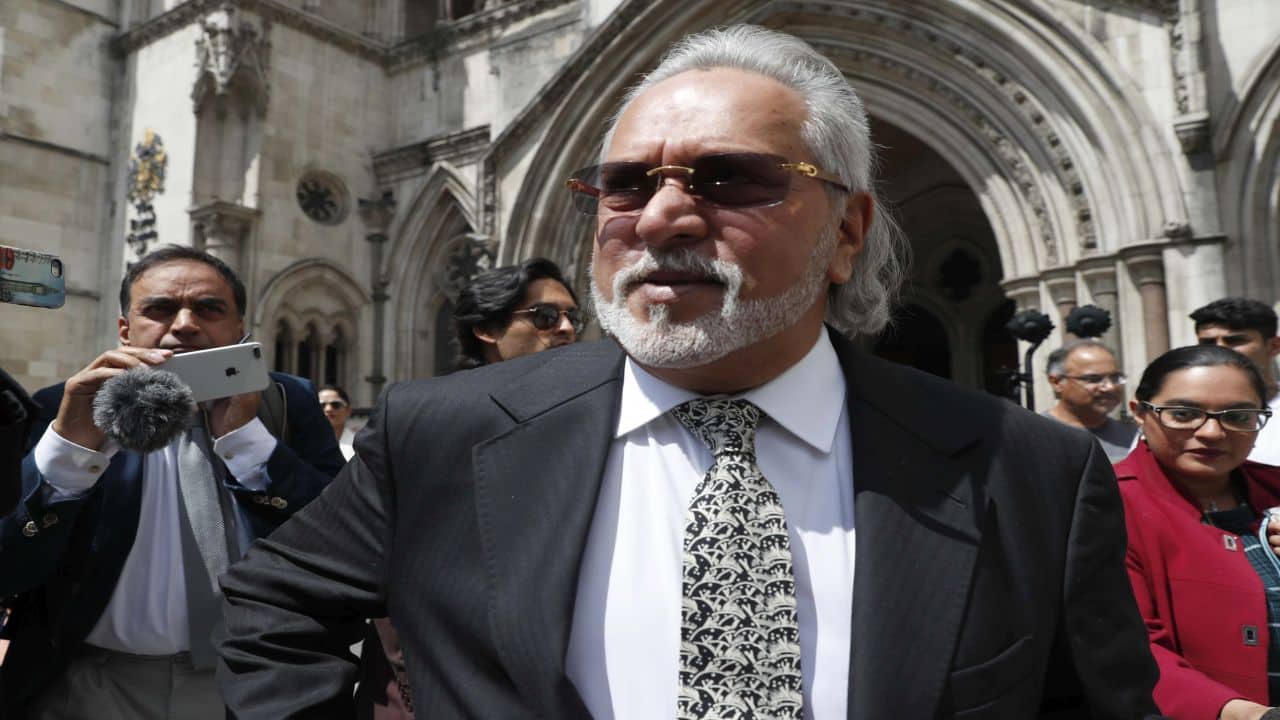

Can a bankrupt Vijay Mallya still live as a baron?

Legal experts have mixed opinions over what the tag of bankruptcy granted by a UK court means for Vijay Mallya.

BUSINESS

Analysis | NPA woes continue for banks, NBFCs in Q1; will the next quarter be better?

For the banks, the hit on the books has been softer than 2020, still, the second wave has affected collections and recoveries at all levels. NBFCs, however, have been hit harder

BUSINESS

All eyes on Dhanlaxmi Bank Board meeting this week; 3 new appointments, including Ravi Pillai, likely

Pillai is one of the two major shareholder who has close to a 10 percent stake each in the Thrissur-headquartered bank. The other is CK Gopinathan

BUSINESS

Banking Central | Which is a safer asset for banks in the pandemic era?

Banks have been trying to de-risk their loans books from lumpy corporate assets, especially in the aftermath of crises such as IL&FS and Yes Bank. The logical shift was to retail but has it worked out?

BUSINESS

ICICI Bank Q1: Is the aggressive retail bet turning risky in the second wave?

Most banks, including ICICI Bank, had turned aggressively to retail loans last year to lower risks. But some part of that bet may be turning risky. Q1 numbers suggest abundant caution.

BUSINESS

Explained | What is a central bank digital currency, what does RBI say? 8 key questions answered

Digital currencies are gain popularity and central banks across the world are under increased pressure to come up with their virtual coins. The RBI seems willing to take the plunge but how it will work out remains to be seen

BUSINESS

Karuvannur Co-operative Bank scam: Administrative panel dissolved, borrower allegedly dies by suicide

The Karuvannur scam is the latest in Kerala, after the Popular Finance fraud last year, and a series of similar incidents involving several smaller co-operative banks

BUSINESS

Central bank digital currency has many benefits and some risks, says RBI Deputy Governor T Rabi Sankar

Noting that setting up CBDC will require careful calibration and a nuanced approach in implementation, the deputy governor said drawing board considerations and stakeholder consultations are important.

BUSINESS

Fake loan applications, banker-real estate nexus: The story of Rs 100-crore Karuvannur Co-op Bank scam

Yet another scam has shocked hundreds of customers in a Kerala-based co-operative bank. The modus operandi involved drawing loans using property documents without the knowledge of land owners. But there is more than meets the eye.