BUSINESS

Pratip Chaudhuri arrest: Former SBI Chairman Rajnish Kumar calls the move a motivated, high-handed action

On November 1, Jaisalmer Police arrested former State Bank of India (SBI) Chairman Pratip Chaudhuri in an alleged loan scam.

BUSINESS

Banking Central l Pratip Chaudhuri’s arrest and its potential ramifications

Former SBI Chairman and Cahduhduri’s successor in SBI, Rajnish Kumar, calls this arrest a motivated, unfair action. Other top bankers agree with him.

BUSINESS

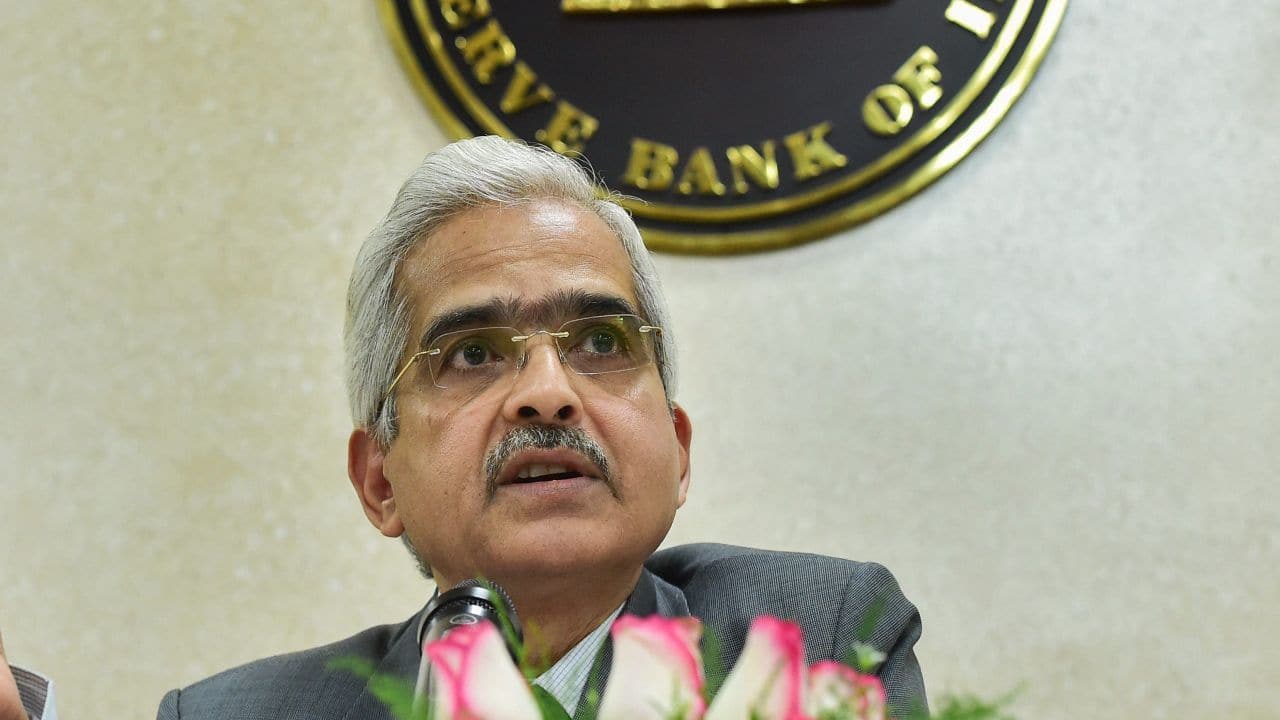

Shaktikanta Das gets 3-year extension: Why the Centre loves the DeMon spearhead

A liberal inflation target, absence of public spats with the government, and an impressive Covid response all helped Das get another term.

BUSINESS

Government reappoints Shaktikanta Das as RBI Governor for 3-years

Shaktikanta Das also served as India’s Alternate Governor in the World Bank, Asian Development Bank (ADB), New Development Bank (NDB) and Asian Infrastructure Investment Bank (AIIB)

BUSINESS

As Citi India seeks a buyer for its retail assets, employees look for safer pastures

A number of employees in the mid- and senior-management levels are on the lookout for job opportunities; many senior executives have already left, people with knowledge of the matter said.

BUSINESS

Who will win the Dhanlaxmi Bank boardroom battle? Division bench asks single judge to decide on merits of ex-directors’ plea

A Kerala high court division bench says there was no specific ruling by a single-judge bench on whether the writ petition by former directors seeking seats on Dhalaxmi Bank's board was maintainable and sends back the case to the judge to decide on the issue.

BUSINESS

Banking Central | Can Kerala's CSB Bank make peace with its trade unions, government?

Unlike other states, Kerala’s private sector banks are dominated by trade unions backed by political parties. Breaking away from this culture isn’t easy; there needs to be a balance

BUSINESS

India needs robust audit system for dynamic, resilient economy, says RBI Governor Shaktikanta Das

The expertise and independence of auditors need to be leveraged for a healthy financial system, the country's top banker has said

BUSINESS

Wage issue: Fresh trouble likely for Kerala-based CSB Bank as unions step up pressure

Private bank negotiates with employee unions on wage settlement; trade unions threaten to escalate agitation to national level

BUSINESS

Analysis | Are banks relying too much on personal loans for growth?

Credit growth is starting to improve, but the central theme of this recovery is personal loans, which has implications for the asset quality of banks.

BUSINESS

Delhi cyber police arrest 12, including 3 HDFC Bank employees, for fraud

HDFC Bank said it suspended the three employees pending the outcome of the investigation.

BUSINESS

Banking Central | HDFC Bank’s rising retail restructured loans hint at fate of other banks

There was an aggressive shift to retail loans after Covid, but for big banks this is turning to be a tricky change. The latest restructuring numbers of HDFC Bank give evidence of fresh round of stress in the retail segment.

BUSINESS

Why the scrapping of PNB Housing Finance deal is a setback for Aditya Puri and Carlyle

For the Carlyle-Puri partnership, PNB Housing Finance offered an opportunity to gain entry into the booming Indian mortgage market. The Puri factor was supposed to benefit Carlyle after the acquisition. The termination of the deal is a setback for both parties.

BUSINESS

Srei Episode: Eight vital questions answered

The RBI has moved quickly to act on the Srei issue and bankruptcy proceedings are on. What lies ahead for Srei now?

BUSINESS

Srei employees plan to approach RBI administrator seeking clearance of salary arrears

Lenders had capped the salaries of Srei executives at Rs 50 lakhs per annum in December last year. The salary cap was removed in April this year. However, even after around six months, the arrears are yet to be paid to Srei employees.

BUSINESS

RBI staff writes to Governor Shaktikanta Das on delay in wage settlement; no resolution yet

RBI staff wages are decided through a bipartite settlement once in five years through negotiations between management and employee unions. The current round of wage revision is pending since November, 2017.

BUSINESS

Banking Central | A ‘Navratri’ celebration that didn’t go quite well

Senior executives at PSBs often act like feudal lords to please their bosses, and employees at lower levels often bear the brunt. This is where trade unions act as a corrective force. Though these unions have weakened over the years, they do have a significant role to play when it comes to banking sector employees’ issues.

BUSINESS

Analysis| MPC doesn’t have too many options left till COVID abates

COVID remains the key challenge for the policymakers and MPC will have to continue with a growth-supportive stance till the pandemic threat goes away.

BUSINESS

SREI founder Hemant Kanoria: Not exploring legal options, only tried for resolution outside IBC

SREI founder said the group didn’t move the Bombay High Court against the RBI decision but was only trying for a resolution outside the IBC mechanism to avoid a huge haircut to SREI’s lenders.

BUSINESS

Bombay High Court dismisses Srei Group's writ petition against RBI

Srei Group promoters, Adisri commercial private ltd, had sought a stay on initiating insolvency proceedings against Srei Infrastructure Finance Ltd (SIFL) and Srei Equipment Finance Ltd (SEFL).

BUSINESS

Exclusive Interview | HSBC bullish on India consumption story: India Commercial Banking Head Rajat Verma

For the first six months of the 2021 calendar year, the commercial banking segment in India has delivered a PBT of $146 million, up 76 percent from $83 million for the corresponding period in 2020, says HSBC India Commercial Banking Head Rajat Verma.

BUSINESS

Srei Group promoters move Bombay High Court against RBI action

Srei Group promoters have sought stay on any insolvency proceedings against the two companies.

BUSINESS

Five things to note as RBI gears up for Friday policy decision on rates

The MPC has, so far, adopted a cautious stance on rate decisions given the tricky economic scenario presented by the Covid-19 pandemic. But there is some comfort this time due to the easing inflation and recovery in economic growth.

BUSINESS

End of the road for Srei promoters?

Triggered by the liquidity crunch that accompanied the IL&FS collapse in late 2018, the Srei group’s problems worsened over time. With the RBI cracking the whip, it is probably end of the road for Srei promoters.