BUSINESS

Aiming for a turnaround: New stocks that bottom-quintile funds added

Schemes looking for a revival attempt to improve their performances by adding stocks that could deliver better returns in future. Here’s how some of them are plotting their comeback

BUSINESS

These smallcap multibaggers rewarded MF investors with up to 848% returns in a year

As the market continues its record run, some smallcap stocks, including housing and infrastructure firms, have gained up to 848 percent in the past year, clocking big gains for mutual funds invested in these companies

BUSINESS

Decoding the EV ecosystem, stocks, sectors: Nifty EV and New Age Automotive ETF

Mirae Asset Nifty EV and New Age Automotive ETF was launched on June 24. This ETF aims to capitalise not just from electric vehicles but also future disruptions like hydrogen fuel cell and autonomous vehicles.

BUSINESS

Quant MF cherry-picked these smallcap stocks lately. Do you own any?

Quant mutual fund’s stocks selection process helped many of its schemes to be ahead of the pack and deliver outstanding performance in their respective categories. Many of such stocks turned multibaggers and rewarded the investors handsomely. Here are the recent small cap additions in the portfolio of Quant mutual fund schemes over the last three months

BUSINESS

PMS fund managers fell in love with these 12 midcap gems in May. Do you own any one?

These quality midcap stocks were identified by PMS managed ahead of the election results that could hold up well regardless of the election outcomes

BUSINESS

ELSS isn't all about tax savings, these 10 funds help grow your wealth too

Equity-Linked Saving Schemes (ELSS) or tax-saving equity funds stand out due to their lowest lock-in and pure equity-linked return in the crowded Section 80C tax deduction basket. ELSS have delivered better return if held for long-term

BUSINESS

'Strong buy' micro-cap multibagger stocks picked by mutual funds in May

Micro-cap stocks carry very high risk, but also have the potential to deliver high returns. Fund managers apply various parameters to choose micro-cap stocks that have the potential to outperform over the long term

BUSINESS

Index mutual funds grab investor attention; here’s how to get the best out of them

Investors looking at market-linked returns, reduce the chances of underperformance and not wanting fund manager’s involvement can consider index funds. Index funds with low tracking error and low expense ratio are preferred investment options

BUSINESS

Why you should keep an eye on liquidity, price deviation and tracking error while investing in ETFs

Exchange Traded Funds are superior in structure as they can mimic their benchmark indices more closely than the other passive variants -index funds. With more than 200 ETFs available in the market, it is important for investors to choose the right ETFs for their portfolio to achieve their financial goals

BUSINESS

Worried about market volatility? Here are 7 hybrid funds that can provide stability, high growth

Investors with a medium risk profile can consider investing in the aggressive hybrid funds. These schemes are good picks as they allow you to participate on the upside, while cushioning your downside as compared to pure equity funds

BUSINESS

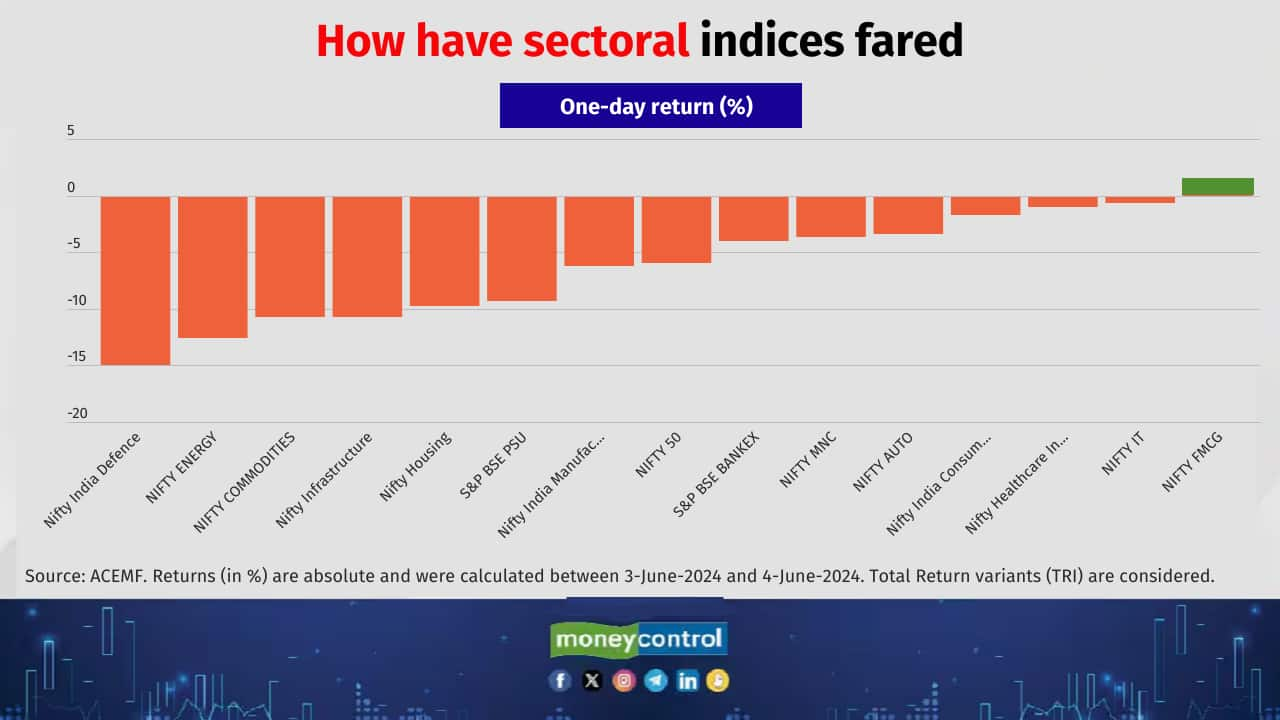

Equity mutual funds meltdown: The biggest losers on the day of Lok Sabha election results

All equity-oriented mutual fund categories were battered on June 4 after it became clear that the BJP won't go past the majority mark on its own and would be heavily dependent on support from allies, with investors being jittery about the stability of the government and 'compulsions' that a coalition regime might face. However, experts advise investors not to be swayed by short-term gyrations and focus on long-term investment goals instead.

BUSINESS

Ignore short-term gyrations. Here are five simple index funds for long-term wealth creation

Don’t be swayed by short-term gyrations, stick to your asset allocation and focus on long-term goals. Here are five passively managed index funds each from the mega, large, mid, small and microcap segments can help you get better returns over the long run

BUSINESS

Check out these election-proof sectors; Are you invested in them?

While some sectors are more sensitive to the possible electoral outcomes, there are those that are impervious — a prudent, defensive hedge, regardless of the results. Here are few sectors that would not be affected by who comes to power, according to six portfolio managers

BUSINESS

Sector, thematic funds: How to choose the best of the lot

As per AMFI, there are 161 sector and thematic funds. Of these, 64 were launched since the start of 2020. Thematic and sector funds are gaining popularity, not just across the globe, but also in India. And advisors and distributors are warming up to them.

BUSINESS

Nvidia stocks continue to rock markets. Have Indian investors benefited?

There are 15 fund houses have invested in the stock of Nvidia either through their international schemes or domestic schemes. A restriction is in place that prevents many investors from participating in the rally.

BUSINESS

10 newly added stocks by MFs that make hay from special situations

Special Situations funds aim to make money from unique events that companies face like corporate restructuring, regulatory changes, technology-led disruption and innovation, new trends and emerging sectors and companies

BUSINESS

Explained: How to get the best out of your direct plans in mutual funds

Lower expense ratio results in direct plans earning higher returns than regular plans. But only savvy investors who can cherry pick mutual funds on their own can opt for direct plans. Do-it-yourself (DIY) investors who are new to equity markets may end up choosing an unsuitable scheme if they pick schemes just by look at the difference in the expense ratio between direct and regular plans.

BUSINESS

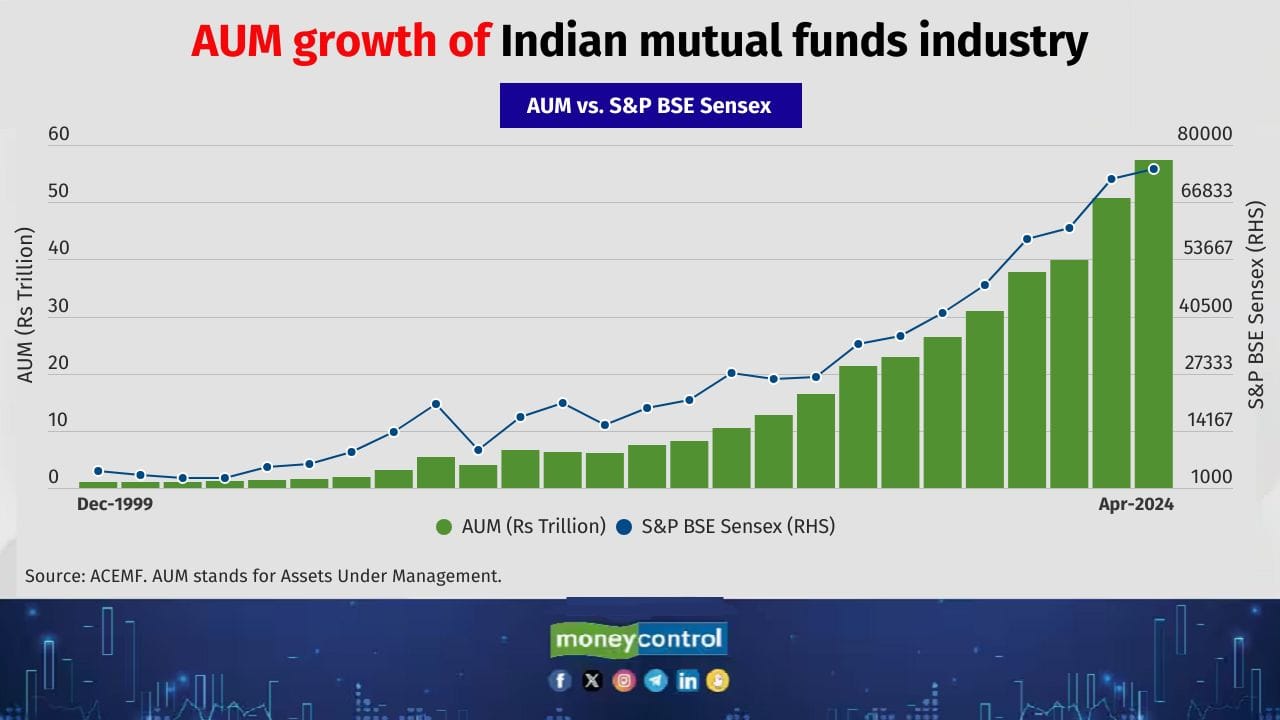

Retail investors drive MF growth, here's how they played the game

Retail investors now form a significant chunk of mutual funds investors, which has translated to a monthly SIP contribution of around Rs 20,000 crore

BUSINESS

Fund managers on a treasure hunt in these 10 sectors. Check your portfolio

Fund managers look for sectors with healthy growth potential and consistent profitability. These are the top sub-sectors wherein the fund managers have increased exposure significantly in these sectors over the last three months

BUSINESS

Nifty Realty index delivered 110% last year; check out the hot stocks among fund managers

Rising affordability and stable interest rates have resulted in higher sales of residential properties. Policy support from the government by way of up to 100 percent FDI for townships and settlements, and rising commitment from the PM Awas Yojana have also aided realty companies

BUSINESS

Akshaya Tritiya is not the only reason to buy gold now. And Gold MFs are a good bet

For small investors, SIP in gold funds can help ride out the volatility in gold prices without taking on the risk of bad timing. Further, buying and selling gold funds is as simple as regular mutual funds schemes at the prevailing net asset value on any working day

BUSINESS

10 mid-cap stocks that large-cap MFs love to hold for higher returns

The outperformance of large-cap mutual fund schemes lies in, among other things, how efficiently fund managers manage the remaining 20 percent portion that they have to invest in small- and mid-cap stocks. These 10 mid-caps stocks tend to spice up the return of large-cap funds thus, in turn, likely to outperform the benchmarks.

BUSINESS

Mid-cap and Small-cap Funds: How can retail investors get the best out of them?

Midcap and smallcap funds have been wealth creators over the long run. However, it is crucial for small investors to be cautious when investing in mid and smallcap funds depending on their risk tolerance. Here we elucidate how small investors can approach mid-cap and smallcap funds

BUSINESS

Top 10 stocks that power MC30 equity schemes

MC30 top funds: The top 10 stocks in a mutual fund scheme, especially an equity scheme, holds significance as a higher weight in them dictate fund performance