Come Akshaya Tritiya and many investors love to buy gold as an auspicious thing to do. But festivals aren’t the only reason why gold is one of the most sought-after assets in the last two to three years. In fact, there are more compelling reasons to invest in this precious metal.

As an asset, gold has excelled over the past few years delivering around a 13 percent compound return over the past three years. Geopolitical tensions, expectations of US rate cuts, and the notable accumulation of yellow metal by central banks worldwide have been contributing factors for the surge in prices.

Indian investors have actively participated in the gold rally by investing in financial investment products such as gold exchange traded funds (ETF) and sovereign gold bonds (SGB). For instance, retail accounts in gold ETFs increased by more than 15 times over the last five years.

On the auspicious occasion of Akshaya Tritiya, investors wishing to invest in gold may prefer gold funds as an option.

Gold funds, also called gold Fund of Funds (FoF), have been popular among smaller investors for its liquidity and ease of investing.

What are gold funds?Gold funds invest predominantly in gold ETFs, which in turn invest in the physical gold of 99.5 percent or higher purity. A gold fund’s net asset value (NAV) is linked to gold’s price in the local market.

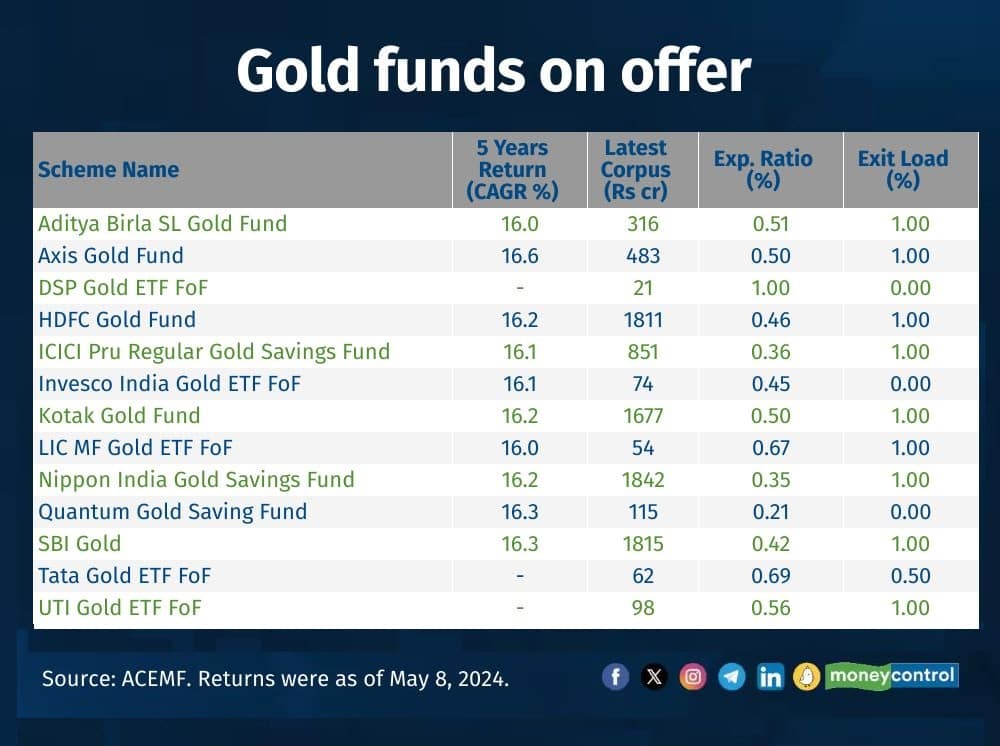

Currently, there are 13 gold funds available with collective assets under management of over Rs 9,218 crore. There are two funds that invest in both gold and silver. These gold funds invest in their own gold ETFs. Since they are passively managed, the returns are close to those the gold ETFs.

Also read: Gold rewards investors. But don’t go overboard, it’s just an asset allocatorApart from the operational structure, there is not much difference between gold ETFs and gold FoFs. Although, it’s easier to buy/sell gold FoF at the prevailing net asset value (NAV) at any time.

Gold MFs also allow you to invest through Systematic Investment Plans (SIP).

Gold funds score over gold ETFs and SGB on high liquidity. Buying and selling gold funds is as simple as regular mutual funds schemes at the prevailing net asset value (NAV) on any working day.

Meanwhile, Gold ETFs can be bought or sold at the stock exchanges during market hours, since they trade like any other stock. However liquidity has been an issue with most ETFs in India. Barring a few (Nippon India ETF Gold BeES, ICICI Prudential Gold ETF, SBI Gold ETF, HDFC Gold ETF, and Kotak Gold ETF), the traded volume in other gold ETFs is relatively lower.

Also read: This gold ETF scores on impact costs and volumesOn the other hand, SGBs are issued by the RBI time to time with a tenure of eight years. RBI enables a premature exit at the end of the fifth, sixth, and seventh years. These SGBs are also listed in the exchanges and traded like stocks and ETFs in the cash segment of the BSE and the NSE.

Investors can buy and sell units of SGBs during market hours. Most of the SGBs are thinly traded in the exchanges. Buying and selling in SGBs with lower liquidity could be difficult, which could result in higher acquisition costs.

Gold funds enables SIPThe good part about gold MFs is that they allow systematic investment plan (SIP); gold ETFs and SGBs don’t allow SIPs.

SIPs in gold funds are convenient for retail investors while gold ETFs and SGBs are more suited for DIY (do-it-yourself) investors. You can start your SIP in a gold fund with as little as Rs 500 a month.

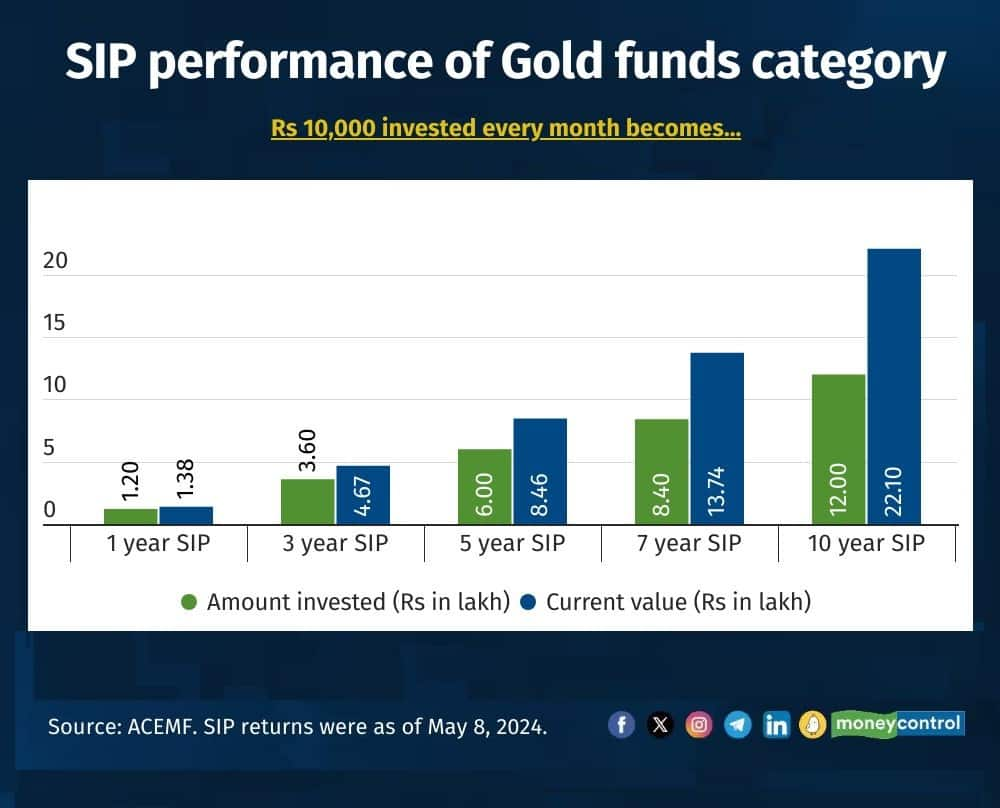

SIP in gold funds reward the investors well. For instance, a monthly SIP of Rs 10,000 in the gold funds category in the last 10 years (the total investment of Rs 12 lakh) would have grown to Rs 22 lakh.

As far as the total return is concerned, SGBs score over all other instruments as they also offer a fixed interest rate. The interest rate and capital appreciation together determine the overall return of the SGBs whereas the total return of the gold ETFs and gold funds are based on only capital appreciation.

Investors strategyFor small investors, SIP in gold funds can help ride out the volatility in gold prices without taking on the risk of bad timing.

While the yellow metal has yielded excellent returns in recent years, it has also experienced the highest levels of volatility in the past.

Gold may not be an outperforming asset class all the time but it is a hedge against market uncertainties and a useful portfolio diversifier. It can account for 5-10 per cent of your portfolio at any point of time.

See here: Explained in charts: The spectacular rise of Gold ETFs and what lies aheadDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.