Fund managers on a treasure hunt in these 10 sectors. Check your portfolio

Fund managers look for sectors with healthy growth potential and consistent profitability. These are the top sub-sectors wherein the fund managers have increased exposure significantly in these sectors over the last three months

1/12

The growth of Indian equities has slowed down over the past five months after a strong performance in 2023. The changing market dynamics provide fund managers with opportunities to identify stocks and sectors that have turned in favour. These are the top sub-sectors where active mutual fund managers either made new positions or significantly increased exposure during the past year. Only actively managed equity schemes and hybrid schemes (except arbitrage funds) have been considered. Data shown below is as of April 30, 2024. Source: ACEMF.

2/12

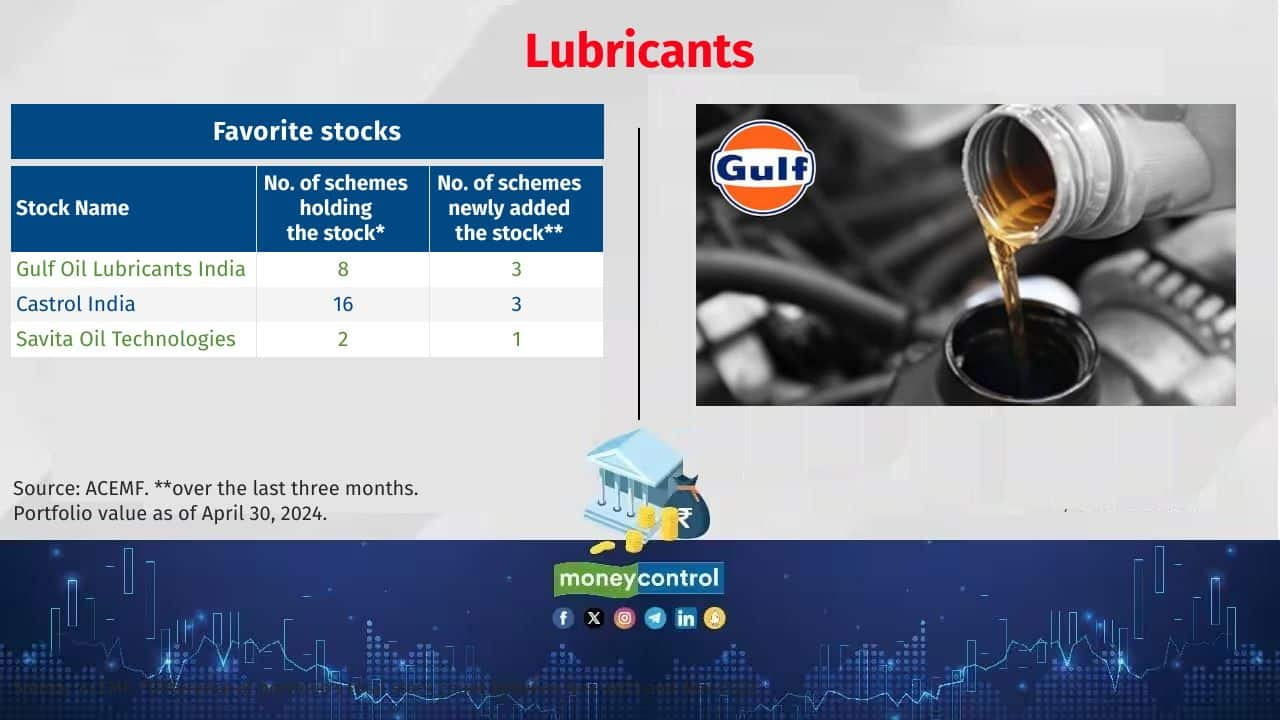

Lubricants

Growth of MF investment over the last three months: 48%

Current market value of the MF investment: Rs 1,191 crore.

Also see: Mid-cap and Small-cap Funds: How can retail investors get the best out of them?

Growth of MF investment over the last three months: 48%

Current market value of the MF investment: Rs 1,191 crore.

Also see: Mid-cap and Small-cap Funds: How can retail investors get the best out of them?

3/12

Diesel Engines

Growth of MF investment over the last three months: 42%

Current market value of the MF investment: Rs 16,522 crore.

Growth of MF investment over the last three months: 42%

Current market value of the MF investment: Rs 16,522 crore.

4/12

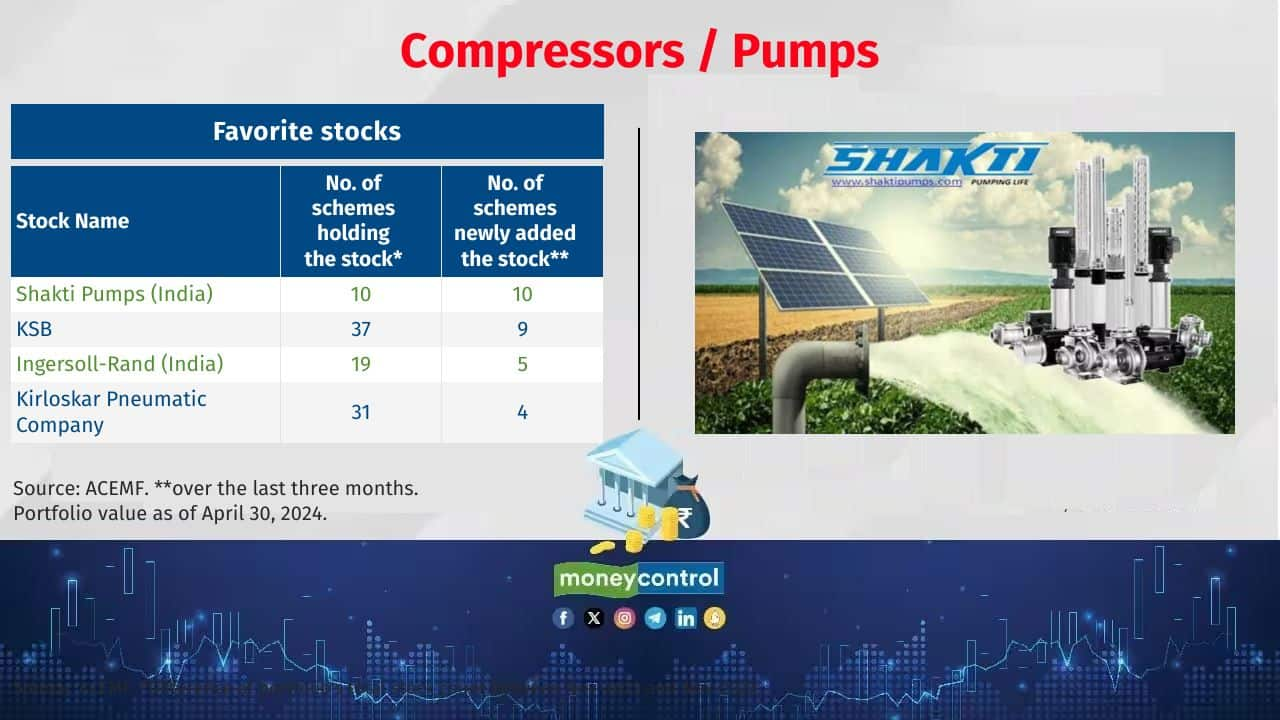

Compressors / Pumps

Growth of MF investment over the last three months: 40%

Current market value of the MF investment: Rs 5,214 crore.

Growth of MF investment over the last three months: 40%

Current market value of the MF investment: Rs 5,214 crore.

5/12

e-Commerce

Growth of MF investment over the last three months: 40%

Current market value of the MF investment: Rs 28,184 crore.

Also see: 10 mid-cap stocks that large-cap MFs love to hold for higher returns

Growth of MF investment over the last three months: 40%

Current market value of the MF investment: Rs 28,184 crore.

Also see: 10 mid-cap stocks that large-cap MFs love to hold for higher returns

6/12

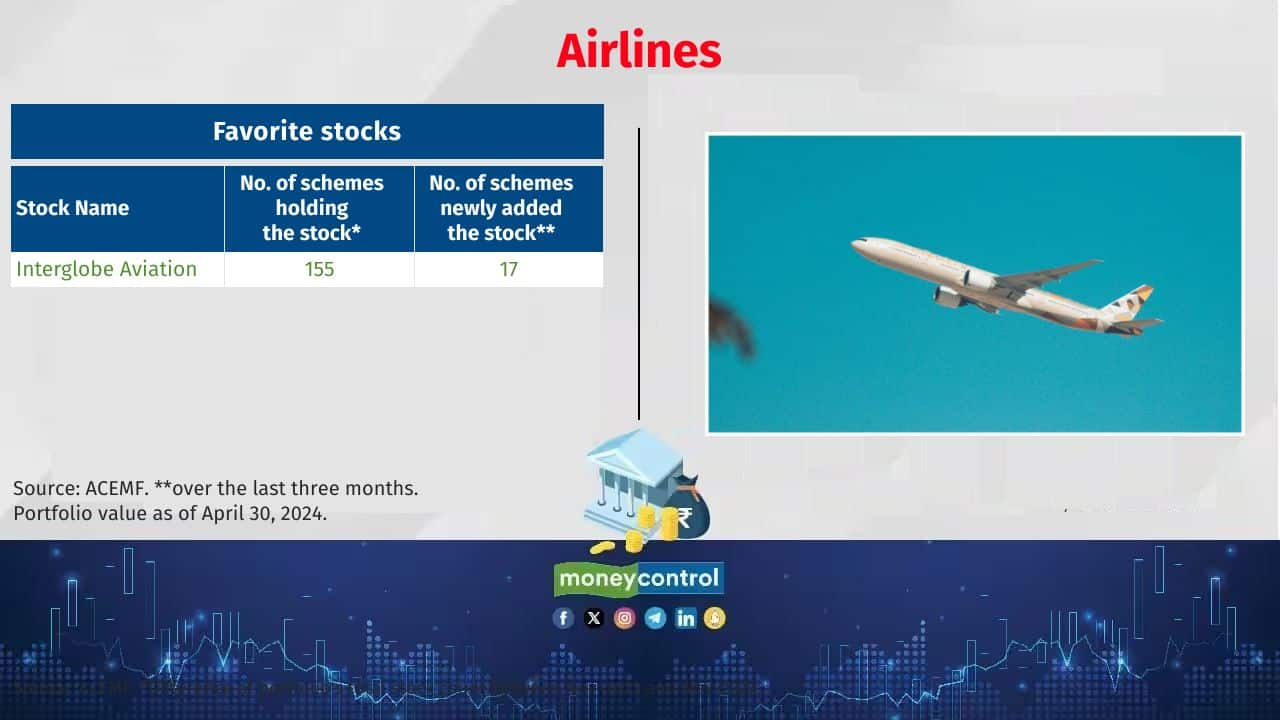

Airlines

Growth of MF investment over the last three months: 40%

Current market value of the MF investment: Rs 17,356 crore.

Growth of MF investment over the last three months: 40%

Current market value of the MF investment: Rs 17,356 crore.

7/12

Aluminium & Aluminium Products

Growth of MF investment over the last three months: 39%

Current market value of the MF investment: Rs 2,721 crore.

Growth of MF investment over the last three months: 39%

Current market value of the MF investment: Rs 2,721 crore.

8/12

Steel/Sponge Iron/Pig Iron

Growth of MF investment over the last three months: 37%

Current market value of the MF investment: Rs 10,880 crore.

Growth of MF investment over the last three months: 37%

Current market value of the MF investment: Rs 10,880 crore.

9/12

Ship Building

Growth of MF investment over the last three months: 37%

Current market value of the MF investment: Rs 1,112 crore.

Also see: Nifty Realty index delivered 110% last year; check out the hot stocks among fund managers

Growth of MF investment over the last three months: 37%

Current market value of the MF investment: Rs 1,112 crore.

Also see: Nifty Realty index delivered 110% last year; check out the hot stocks among fund managers

10/12

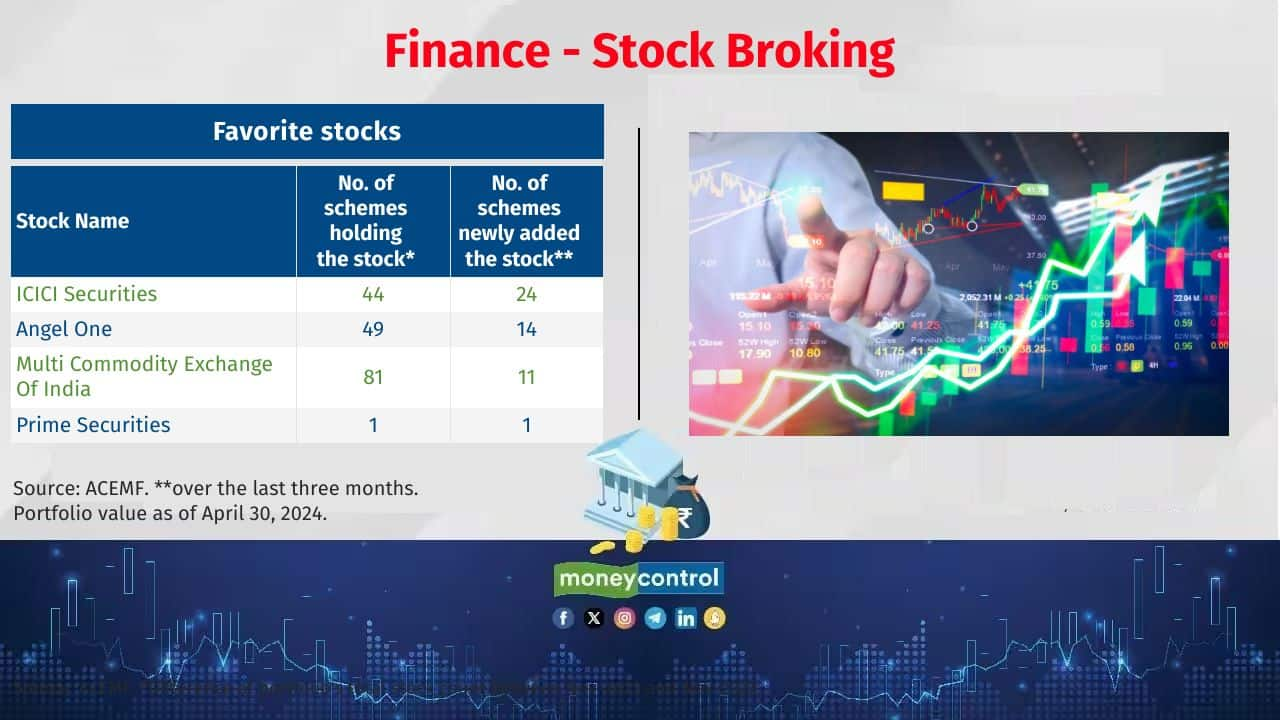

Finance - Stock Broking

Growth of MF investment over the last three months: 36%

Current market value of the MF investment: Rs 12,609 crore.

Growth of MF investment over the last three months: 36%

Current market value of the MF investment: Rs 12,609 crore.

11/12

Automobiles-Tractors

Growth of MF investment over the last three months: 36%

Current market value of the MF investment: Rs 3,313 crore.

Growth of MF investment over the last three months: 36%

Current market value of the MF investment: Rs 3,313 crore.

12/12

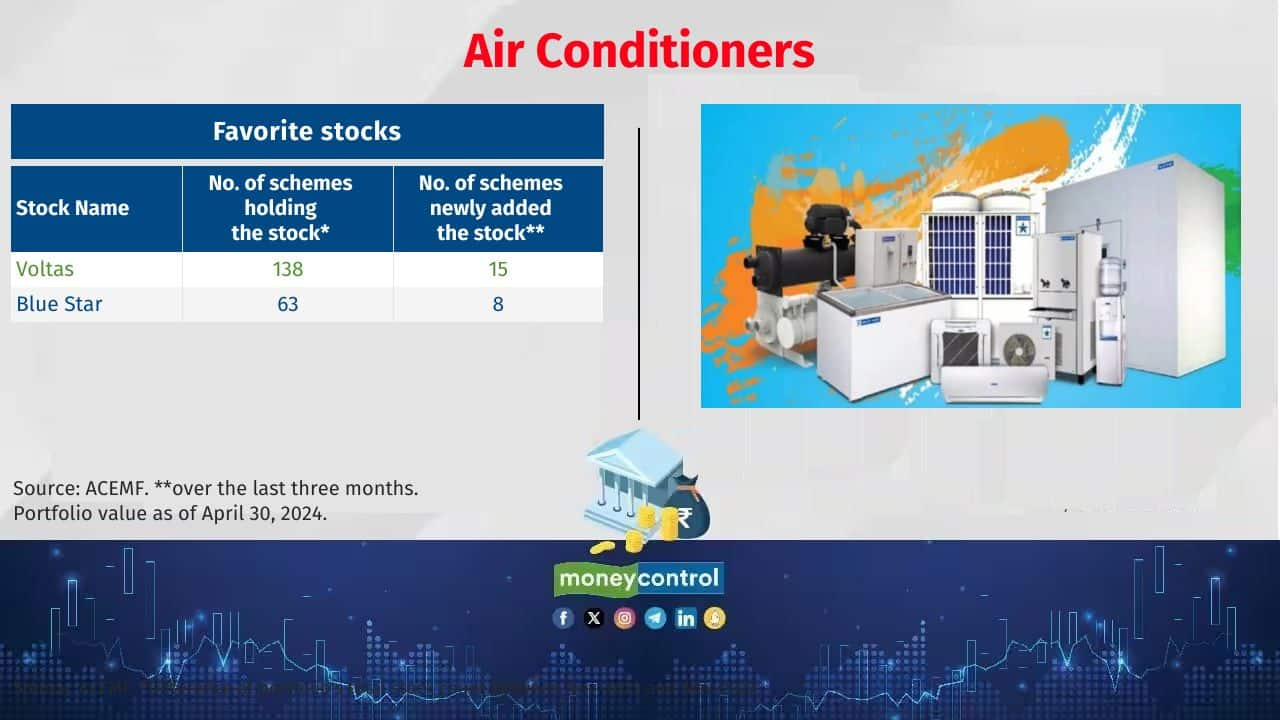

Air Conditioners

Growth of MF investment over the last three months: 36%

Current market value of the MF investment: Rs 20,230 crore.

Also see: SIPs in MC30 top mutual funds deliver consistent returns

Growth of MF investment over the last three months: 36%

Current market value of the MF investment: Rs 20,230 crore.

Also see: SIPs in MC30 top mutual funds deliver consistent returns

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!