SIPs in MC30 top mutual funds deliver consistent returns

Systematic investment plans (SIP) in mutual funds are used to channelise regular investments in mutual funds. A Moneycontrol study shows that equity schemes from MC30 have largely delivered better returns than the category and the benchmark returns over five-year periods.

1/16

As per AMFI (the Association of Mutual Funds of India), there are about 8.4 crore SIP accounts as of March 2024. The question is: Do SIPs in MC30 work? We have compiled 5-year SIP returns on a rolling basis over the last 11 years to check how MC30 equity schemes have performed. The study throws up interesting results. MC30 equity schemes have managed to outperform their category and their respective benchmark in most of the time frames. ‘MC30’, a curated list of Moneycontrol’s 30 MF schemes, can help you to identify investment worthy schemes to achieve your financial goals. Note that past performance is not indicative of future results. Data source: ACEMF.

2/16

Scheme name: Canara Robeco Bluechip Equity Fund

Category: Large Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 14%

Average 5-year SIP return (XIRR) of large cap category over the last ten years: 11.7%

Also see: First-time equity investor? Limit your risks with large-cap funds from MC30

Category: Large Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 14%

Average 5-year SIP return (XIRR) of large cap category over the last ten years: 11.7%

Also see: First-time equity investor? Limit your risks with large-cap funds from MC30

3/16

Scheme name: HDFC Top 100 Fund

Category: Large Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 12%

Average 5-year SIP return (XIRR) of large cap category over the last ten years: 11.7%

Category: Large Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 12%

Average 5-year SIP return (XIRR) of large cap category over the last ten years: 11.7%

4/16

Scheme name: Mirae Asset Large Cap Fund

Category: Large Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 13.6%

Average 5-year SIP return (XIRR) of large cap category over the last ten years: 11.7%

Category: Large Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 13.6%

Average 5-year SIP return (XIRR) of large cap category over the last ten years: 11.7%

5/16

Scheme name: Edelweiss Mid Cap Fund

Category: Mid Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 16.3%

Average 5-year SIP return (XIRR) of mid cap category over the last ten years: 14.8%

Category: Mid Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 16.3%

Average 5-year SIP return (XIRR) of mid cap category over the last ten years: 14.8%

6/16

Scheme name: PGIM India Midcap Opp Fund

Category: Mid Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 17%

Average 5-year SIP return (XIRR) of mid cap category over the last ten years: 14.8%

Also see: Worried about market volatility? Check out these MC30 schemes that provide stability and high growth

Category: Mid Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 17%

Average 5-year SIP return (XIRR) of mid cap category over the last ten years: 14.8%

Also see: Worried about market volatility? Check out these MC30 schemes that provide stability and high growth

7/16

Scheme name: SBI Magnum Midcap Fund

Category: Mid Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 14.9%

Average 5-year SIP return (XIRR) of mid cap category over the last ten years: 14.8%

Category: Mid Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 14.9%

Average 5-year SIP return (XIRR) of mid cap category over the last ten years: 14.8%

8/16

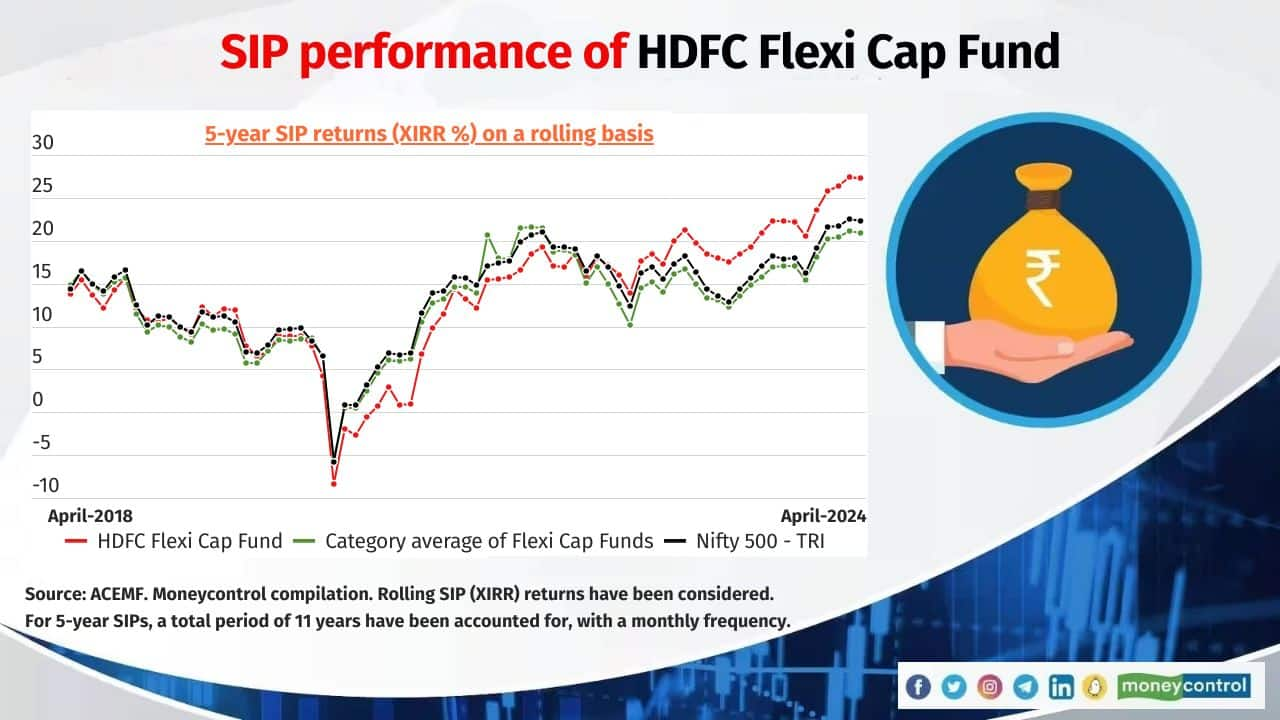

Scheme name: HDFC Flexi Cap Fund

Category: Flexi Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 13.6%

Average 5-year SIP return (XIRR) of flexi cap category over the last ten years: 12.8%

Category: Flexi Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 13.6%

Average 5-year SIP return (XIRR) of flexi cap category over the last ten years: 12.8%

9/16

Scheme name: Kotak Flexicap Fund

Category: Flexi Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 13.1%

Average 5-year SIP return (XIRR) of flexi cap category over the last ten years: 12.8%

Category: Flexi Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 13.1%

Average 5-year SIP return (XIRR) of flexi cap category over the last ten years: 12.8%

10/16

Scheme name: Parag Parikh Flexi Cap Fund

Category: Flexi Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 17.6%

Average 5-year SIP return (XIRR) of flexi cap category over the last ten years: 12.8%

Category: Flexi Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 17.6%

Average 5-year SIP return (XIRR) of flexi cap category over the last ten years: 12.8%

11/16

Scheme name: Nippon India Small Cap Fund

Category: Small Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 20.5%

Average 5-year SIP return (XIRR) of small cap category over the last ten years: 16.4%

Category: Small Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 20.5%

Average 5-year SIP return (XIRR) of small cap category over the last ten years: 16.4%

12/16

Scheme name: SBI Small Cap Fund

Category: Small Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 20.1%

Average 5-year SIP return (XIRR) of small cap category over the last ten years: 16.4%

Category: Small Cap

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 20.1%

Average 5-year SIP return (XIRR) of small cap category over the last ten years: 16.4%

13/16

Scheme name: SBI Focused Equity Fund

Category: Focused

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 14.6%

Average 5-year SIP return (XIRR) of focused category over the last ten years: 12.8%

Category: Focused

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 14.6%

Average 5-year SIP return (XIRR) of focused category over the last ten years: 12.8%

14/16

Scheme name: Sundaram Focused Fund

Category: Focused

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 13.6%

Average 5-year SIP return (XIRR) of focused category over the last ten years: 12.8%

Category: Focused

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 13.6%

Average 5-year SIP return (XIRR) of focused category over the last ten years: 12.8%

15/16

Scheme name: Canara Rob Equity Tax Saver Fund

Category: ELSS

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 14.8%

Average 5-year SIP return (XIRR) of ELSS category over the last ten years: 12.5%

Category: ELSS

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 14.8%

Average 5-year SIP return (XIRR) of ELSS category over the last ten years: 12.5%

16/16

Scheme name: Kotak Tax Saver Fund

Category: ELSS

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 14%

Average 5-year SIP return (XIRR) of ELSS category over the last ten years: 12.5%

See here: The sparkling list of MC30

Category: ELSS

Average 5-year SIP return (XIRR) of the scheme over the last ten years: 14%

Average 5-year SIP return (XIRR) of ELSS category over the last ten years: 12.5%

See here: The sparkling list of MC30

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!