Indian equity markets have been on an uptrend and record-making spree over the last 12-15 months. Though the barometer indices reached their all-time peaks, they subsequently experienced corrections attributed to global and domestic factors. The heightened volatility is likely to continue going forward due to escalating geopolitical tensions and uncertainty around the general elections, experts believe. Investors with a medium risk profile who are concerned about the current market volatility can consider investing in the aggressive hybrid funds that are part of the MC30.

See here: The sparkling list of MC30MC30, a curated basket of 30 investment-worthy mutual funds (MFs), selects its schemes across asset classes. The schemes in the MC30 basket cater to all types of investors - with varying risk profiles, time horizons and financial goals. For instance, an investor with a high-risk profile can select equity schemes from the list to meet his/her long-term goals. Similarly, a conservative investor can select debt schemes from the basket to ensure stability. Investors with a medium risk profile can pick hybrid schemes that invest in equity and debt.

Does it make sense to invest in aggressive hybrid funds?MC30 offers you two schemes from the aggressive hybrid category. Aggressive hybrid funds are mandated to invest 65-80 percent in equity and the rest in debt assets. These schemes are good picks for many portfolios as they allow you to participate on the upside, while cushioning your downside as compared to pure equity funds.

Also read: How to use MC30?One of the main advantages of the aggressive hybrid funds is that they rebalance their asset allocation based on market conditions. Fund managers have the leeway to allocate the remaining 35 percent of the assets into debt and other permissible securities. The debt portion is designed in a way that will cushion the overall portfolio when the equity portion undergoes turbulence. This help the funds to deliver a balanced better returns over the long run.

Aggressive hybrid funds also act as an effective asset allocation tool. Investors who have achieved their financial targets with this current rally can consider shifting their investments from high-risk investments such as mid- and small-cap funds to relatively less risky aggressive hybrid funds.

Let’s meet our picks from the aggressive hybrid funds category.

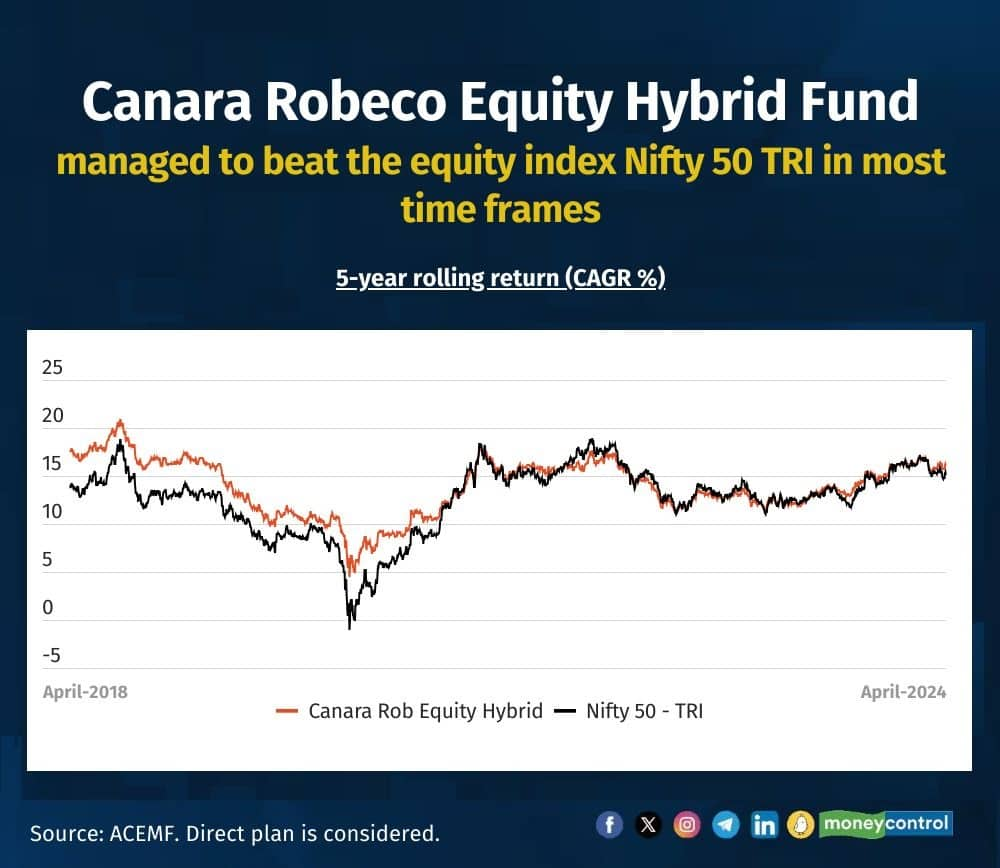

Canara Robeco Equity Hybrid FundCanara Robeco Equity Hybrid Fund (CREHF) has been the least volatile in this category (as measured by the standard deviation calculated from the last five year NAV history ended December 31, 2023). The scheme’s low volatility has led to superior risk-adjusted returns when compared to those of peers over the long term. That’s what this category aims to achieve due to its debt holdings.

It has consistently beaten the average returns given by largecap funds over the long run. However, CREHF has posted below average return over the past 15 months. Its major allocation towards growth and quality stocks weighed down as value style outshined in the recent period.

On the equity side of the portfolio, CREHF follows a multi-cap approach, with bias for largecaps. On the debt side, the fund follows a blend of accrual and duration strategies. It is one of the few schemes in the category that invest exclusively in the highest-rated debt instruments.

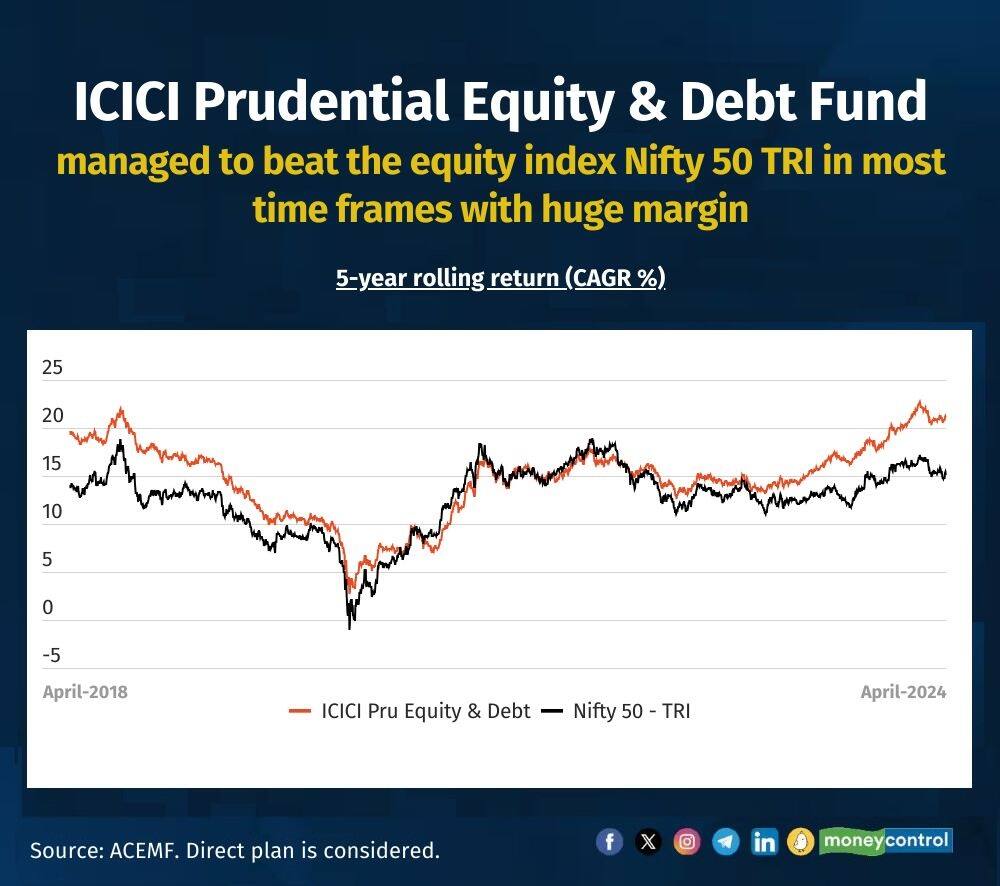

ICICI Prudential Equity & Debt FundICICI Prudential Equity & Debt Fund (IEDF) has been among the best performing schemes in its category of aggressive hybrid fund. With assets worth Rs 32,429 crore, it is also the second largest in the category.

IEDF has managed to deliver a compounded annual growth return of 18 percent over the last 10 years, beating comfortably the Nifty 50 Total Return Index that posted 14 percent returns during the period.

Five fund managers, Mittul Kalawadia, Sankaran Naren, Akhil Kakkar, Manish Banthia and Sri Sharma jointly manage this fund.

“There are three sources of alpha creation for this fund: one is changing the allocation between equity and debt, two is changing the market cap allocation among large, mid and small-cap segment, and finally the stock selection process,” says Mittul Kalawadia, the Equity Fund Manager of the fund. In the stock selection process, we prefer to follow counter cyclical in sector selection, contrarian style of investing and more of bottom up approach, Kalawadia adds.

The average allocation to the debt portion was 20 percent over the last three years, which has been managed with moderate duration in most of the time frames.

See here: First-time equity investor? Limit your risks with large-cap funds from MC30Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.