BUSINESS

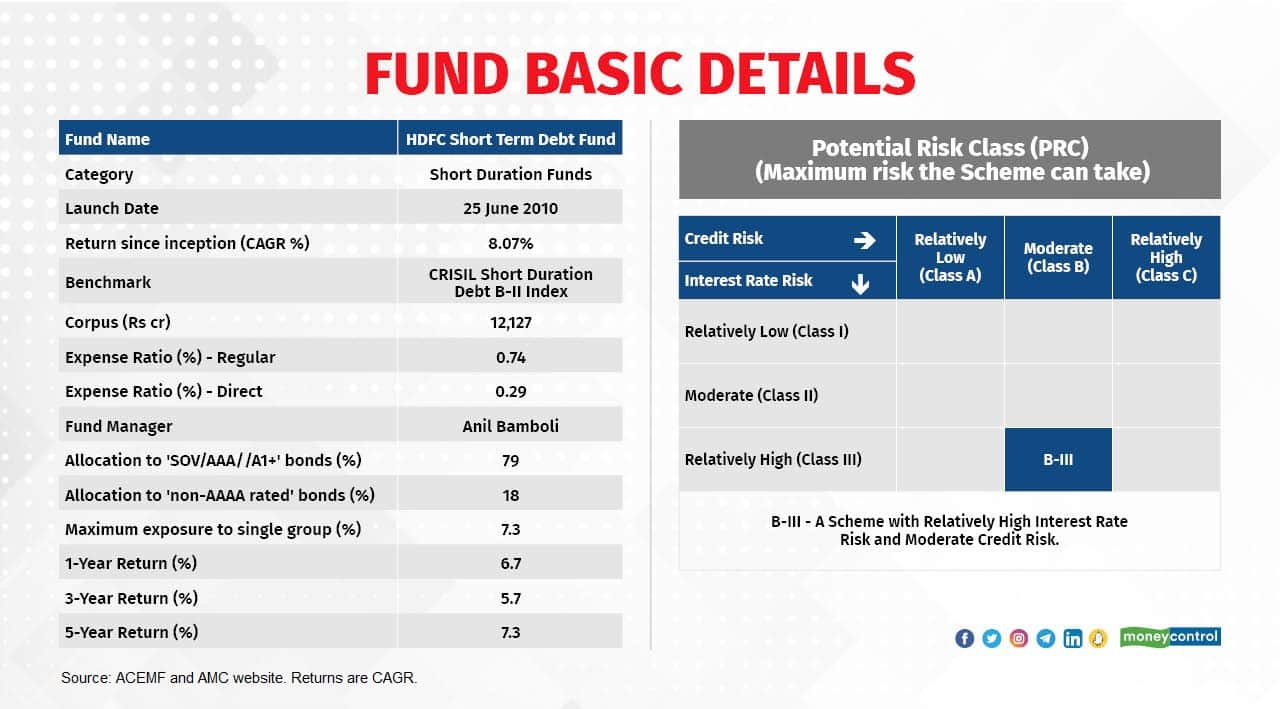

HDFC Short Term Debt Fund: An all-weather debt fund has delivered across rate cycles

Part of MC30, HDFC Short Term Debt Fund is well positioned to benefit in the current environment of high short-term yields. It’s also a good pick to get into before the interest rates start to fall

BUSINESS

One year of interest rate hikes: Debt funds emerge a winner despite headwinds

The Reserve Bank of India started raining interest rates (repo rate) in May 2022. Since then, it has hiked the repo rate 250 basis points. Accrual funds benefitted from the rate hike cycle while, duration funds have been a mixed bag. Here, we analyse how debt funds responded to the rate hikes

BUSINESS

Is your mutual fund justified for the expenses it charges you?

A recent SEBI consultation paper quotes an internal study it conducted, which showed a wide range of underperformance by mutual fund schemes versus their benchmarks. That’s what led SEBI to propose performance-linked fee. A Moneycontrol analysis made a similar finding. Just 47 percent of the schemes (regular plans) have outperformed their benchmark indices over the past 10 years

MCMINIS

How can retirees use MC30?

BUSINESS

HDFC Defence Fund NFO: Watch out for these high-risk, high-return defence stocks

The HDFC Defence Fund’s benchmark is the Nifty India Defence Index, which has 13 defence and allied sector stocks from the large, mid, small and micro-cap segments. Some of them may be part of the scheme’s portfolio

BUSINESS

Despite correction, these mid- & small-cap technology stocks got picked by mutual funds

The past year has not been good for the Information Technology (IT) sector due to the fall in the US technology sector. But many mid-cap and small-cap IT stocks are now available at reasonable valuations after corrections. That has given an opportunity to fund managers to buy some of these stocks on the cheap.

BUSINESS

Small-cap mutual funds love these sectors for higher returns

Smallcap funds mostly prefer bottom-up approach while constructing their portfolio. However, the category consolidated data showcases the sectors that are having emerging companies with promising prospects.

MCMINIS

MC30 funds for investors new to equity market

BUSINESS

Long-term wealth creation | Here are the small-cap stocks that children-oriented mutual funds love to hold

The compulsory lock-in provides leeway to children-oriented mutual funds to buy quality small-cap stocks and hold them for the long term.

MCMINIS

Why short duration funds are all weather funds

BUSINESS

Roaring multi-asset mutual funds bet on these midcap stocks. Do you own any?

Besides debt, commodities, and REITs & InvITs, multi-asset allocation mutual funds mainly invest in equities from different market capitalisation categories. They held about 13 percent of their equity portion in midcap stocks

BUSINESS

In 7 charts: How long-term holding mitigates interest-rate risk and ensures higher returns in debt funds

Debt funds go through volatile phases when interest rates oscillate. Consequently, returns also fluctuate. Investments held for the long term help manage rate risk and ensure consistent higher returns

MCMINIS

How does MC30 measure risk in a mutual fund?

BUSINESS

SIPs work for debt funds, too. And, they beat bank FDs. Here’s the proof

A Moneycontrol analysis shows that 5-year SIP return calculated for MC30 debt schemes outperformed the FD rates for the respective period 60 percent of the time

BUSINESS

In your early 50s and nearing retirement? These 2 MC30 schemes can take you there

If you are about five to seven years away from retirement, moving a portion of the investment from risky assets to aggressive hybrid funds can not only help generate returns but also guard against erosion of accumulated corpus

MCMINIS

Why has MC30 avoided these MF categories?

MC30, a curated basket of 30 investment-worthy mutual funds

BUSINESS

Market CAP below Rs 200 crore, but these nanocap multibaggers remain PMS darlings

Nanocap stocks are very risky bets. They are potential multibaggers if they are picked with care and backed by good research

BUSINESS

Why MC30 has only 2 tax-saving funds in its basket?

The 80C income tax section has many options and is thus crowded. With ELSS, it is easier to meet the required quantity of Rs 1.5 lakh for tax benefit in a financial year

BUSINESS

Six fixed income products for you in this high interest rate scenario

From corporate and bank FDs to bonds and mutual funds, high interest rates currently prevailing in the economy provide ample opportunity to earn high returns by taking nil to a little bit of risk. Still, some due diligence is required. So, choose your options wisely

BUSINESS

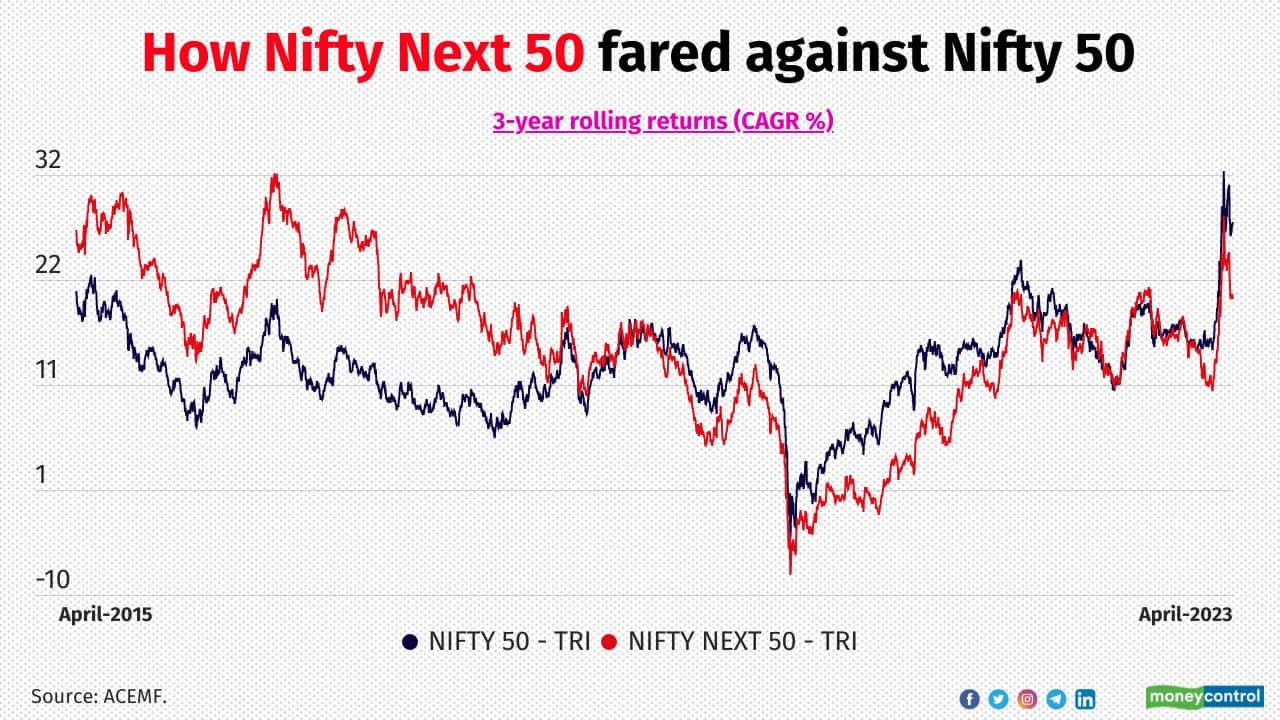

Active fund managers bet big on these largecap stocks from the beaten down Nifty Next 50 index

Many quality largecap stocks from the Nifty Next 50 index corrected significantly and are available now at reasonable valuation. Active fund managers use Nifty Next50 index to pick out tomorrow’s winners

MCMINIS

Why MC30 recommends only 3-debt categories?

Why MC30 recommends only 3-debt categories?

BUSINESS

Here are the multibagger microcap stocks held by PMS managers. Do you own any?

Microcap stocks are quite risky but potential multibaggers if they are picked with care and backed by good research

BUSINESS

MC 30 | Why five schemes go out of Moneycontrol list of top mutual funds?

From poor performance to better buys elsewhere, five mutual fund schemes move out of MC30 to give space to five new ones. But just because your scheme moves out of MC30, doesn’t mean you must always sell it. Fresh inflows can stop, though

BUSINESS

MC30 | New champions - schemes that made a fresh entry into the best MF list in 2023

PGIM India Midcap Opportunities Fund, Edelweiss Mid Cap Fund, SBI Magnum Midcap Fund, Nippon India Small Cap Fund and Sundaram Focused Fund have been added to Moneycontrol's basket of hand-picked mutual fund schemes.