HDFC Defence Fund NFO: Watch out for these high-risk, high-return defence stocks

The HDFC Defence Fund’s benchmark is the Nifty India Defence Index, which has 13 defence and allied sector stocks from the large, mid, small and micro-cap segments. Some of them may be part of the scheme’s portfolio

1/15

The first mutual fund based on the defence theme has been announced. HDFC Mutual Fund has launched the HDFC Defence Fund, which will invest in stocks of defence and allied sector companies. Defence is an evergreen sector globally as many countries augment their defence capabilities. “Self-reliance in defence led by strong R&D focus and enhancement of manufacturing capabilities creates an opportunity for Indian companies to serve the domestic market as well as tap the large export potential,” said fund manager Abhishek Poddar. “This could offer a multi-decadal investment opportunity.” HDFC Defence Fund will invest at least 80 percent of its net assets in stocks classified by the Association of Mutual Funds in India as defence, including aerospace & defence, explosives, shipbuilding and allied services or stocks of companies that are members of the Society of Indian Defence Manufacturers and obtain at least 10 percent of revenue from the defence segment. The fund follows the Nifty India Defence Index (Total Return Index) as its benchmark.

2/15

The Nifty India Defence Index, developed by NSE Indices, had 13 stocks as of April 28, 2023, of which 10 were from the small and microcap universe. Some of these stocks will likely be part of the HDFC Defence Fund portfolio. With limited investment opportunities in the large-cap space, the fund will likely manage a mid- and small-cap heavy portfolio.

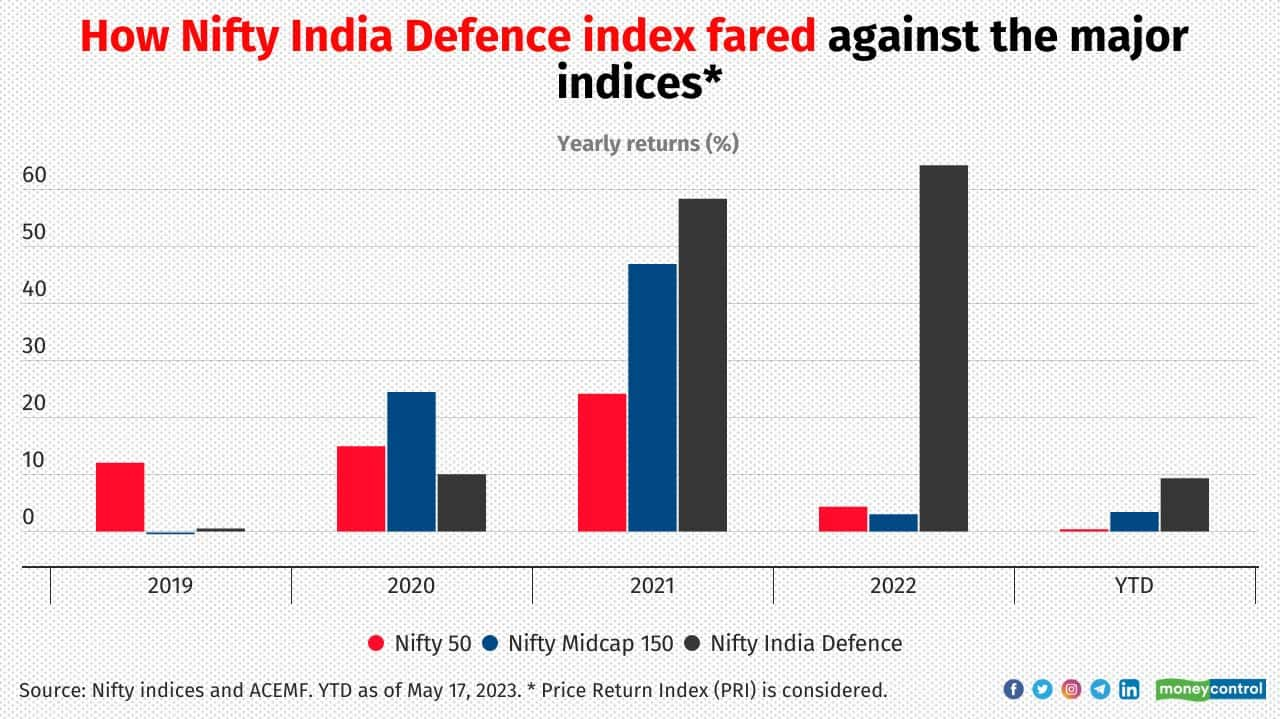

As far as the performance is concerned, the Nifty India Defence Price Return Index (PRI) generated a compounded annual growth of 20 percent over the past five years, while the Nifty 50 PRI and the Nifty Midcap 150 PRI clocked 11.2 and 12.7 percent, respectively.

Here is the list of 13 stocks that are part of the Nifty India Defence Index and the number of actively managed equity schemes that hold them. MF portfolio data was as of April 28. Sources: Nifty indices, HDFC MF, Society of Indian Defence Manufacturers and ACEMF.

As far as the performance is concerned, the Nifty India Defence Price Return Index (PRI) generated a compounded annual growth of 20 percent over the past five years, while the Nifty 50 PRI and the Nifty Midcap 150 PRI clocked 11.2 and 12.7 percent, respectively.

Here is the list of 13 stocks that are part of the Nifty India Defence Index and the number of actively managed equity schemes that hold them. MF portfolio data was as of April 28. Sources: Nifty indices, HDFC MF, Society of Indian Defence Manufacturers and ACEMF.

3/15

Astra Microwave Products

Market-cap type: Small-cap

Active equity schemes holding the stock: Nil

Products & services (Source: SIDM): Radar, sub-systems and systems, space on-board and ground sub-systems, missile electronics and sub-systems.

Market-cap type: Small-cap

Active equity schemes holding the stock: Nil

Products & services (Source: SIDM): Radar, sub-systems and systems, space on-board and ground sub-systems, missile electronics and sub-systems.

4/15

Bharat Dynamics

Market-cap type: Small-cap

Active equity schemes holding the stock: 30

Products & services (Source: SIDM): Guided missiles, underwater weapons, airborne and allied defence equipment including refurbishment/life extension of vintage missiles and product life cycle support.

Market-cap type: Small-cap

Active equity schemes holding the stock: 30

Products & services (Source: SIDM): Guided missiles, underwater weapons, airborne and allied defence equipment including refurbishment/life extension of vintage missiles and product life cycle support.

5/15

Bharat Electronics

Market-cap type: Large-cap

Active equity schemes holding the stock: 164

Products & services (Source: SIDM): Defence electronics, communication products, radars, naval systems, weapon systems, tank electronics, electro optics.

Also see: 14 new midcap stocks picked up by PMS managers, lately

Market-cap type: Large-cap

Active equity schemes holding the stock: 164

Products & services (Source: SIDM): Defence electronics, communication products, radars, naval systems, weapon systems, tank electronics, electro optics.

Also see: 14 new midcap stocks picked up by PMS managers, lately

6/15

Cochin Shipyard

Market-cap type: Small-cap

Active equity schemes holding the stock: 1

Products & services (Source: SIDM): Ships

Market-cap type: Small-cap

Active equity schemes holding the stock: 1

Products & services (Source: SIDM): Ships

7/15

DCX Systems

Market-cap type: Small-cap

Active equity schemes holding the stock: 2

Products & services (Source: company website): Systems integration, manufacturing of cables and wire harness assemblies; services for aerospace, land & naval defence systems, satellites and civil aviation.

Market-cap type: Small-cap

Active equity schemes holding the stock: 2

Products & services (Source: company website): Systems integration, manufacturing of cables and wire harness assemblies; services for aerospace, land & naval defence systems, satellites and civil aviation.

8/15

Data Patterns (India)

Market-cap type: Small-cap

Active equity schemes holding the stock: 25

Products & services (Source: SIDM): Electronics solutions for indigenously developed defence products.

Also Read: Small-cap mutual funds love these sectors for higher returns

Market-cap type: Small-cap

Active equity schemes holding the stock: 25

Products & services (Source: SIDM): Electronics solutions for indigenously developed defence products.

Also Read: Small-cap mutual funds love these sectors for higher returns

9/15

Garden Reach Shipbuilders & Engineers

Market-cap type: Small-cap

Active equity schemes holding the stock: 4

Products & services (Source: SIDM): Frigates, anti-submarine warfare corvettes, missile corvettes, landing ship tanks, landing craft utility, survey vessels, fleet replenishment tankers, fast patrol vessels, hovercrafts, fast interceptor boats.

Market-cap type: Small-cap

Active equity schemes holding the stock: 4

Products & services (Source: SIDM): Frigates, anti-submarine warfare corvettes, missile corvettes, landing ship tanks, landing craft utility, survey vessels, fleet replenishment tankers, fast patrol vessels, hovercrafts, fast interceptor boats.

10/15

Hindustan Aeronautics

Market-cap type: Large-cap

Active equity schemes holding the stock: 115

Products & services (Source: company website): Aircraft, helicopters, power plants, avionics, systems and accessories, and associated services

Market-cap type: Large-cap

Active equity schemes holding the stock: 115

Products & services (Source: company website): Aircraft, helicopters, power plants, avionics, systems and accessories, and associated services

11/15

MTAR Technologies

Market-cap type: Small-cap

Active equity schemes holding the stock: 50

Products & services (Source: SIDM): Aerial platforms other than UAS, aerospace MRO, arms and ammunition, artillery guns and systems, auxiliary machinery, components and ancillaries

Market-cap type: Small-cap

Active equity schemes holding the stock: 50

Products & services (Source: SIDM): Aerial platforms other than UAS, aerospace MRO, arms and ammunition, artillery guns and systems, auxiliary machinery, components and ancillaries

12/15

Mazagon Dock Shipbuilders

Market-cap type: Small-cap

Active equity schemes holding the stock: Nil

Products & services (Source: company website): Warships and submarines, offshore platforms and associated support vessels for offshore oil drilling.

Market-cap type: Small-cap

Active equity schemes holding the stock: Nil

Products & services (Source: company website): Warships and submarines, offshore platforms and associated support vessels for offshore oil drilling.

13/15

Mishra Dhatu Nigam

Market-cap type: Small-cap

Active equity schemes holding the stock: 9

Products & services (Source: company website): Specialised metals, metal alloys.

Market-cap type: Small-cap

Active equity schemes holding the stock: 9

Products & services (Source: company website): Specialised metals, metal alloys.

14/15

Paras Defence and Space Technologies

Market-cap type: Small-cap

Active equity schemes holding the stock: 2

Products & services (Source: SIDM): Defence & space optics, defence electronics, heavy engineering, medical equipment, RF systems, command and control systems, rockets/missiles, land and armoured vehicles, naval systems.

Market-cap type: Small-cap

Active equity schemes holding the stock: 2

Products & services (Source: SIDM): Defence & space optics, defence electronics, heavy engineering, medical equipment, RF systems, command and control systems, rockets/missiles, land and armoured vehicles, naval systems.

15/15

Solar Industries India

Market-cap type: Mid-cap

Active equity schemes holding the stock: 33

Products & services (Source: company website): Products for defence and military applications.

Also read: Despite correction, these mid- & small-cap technology stocks got picked by mutual funds

Market-cap type: Mid-cap

Active equity schemes holding the stock: 33

Products & services (Source: company website): Products for defence and military applications.

Also read: Despite correction, these mid- & small-cap technology stocks got picked by mutual funds

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!