Six fixed income products for you in this high interest rate scenario

From corporate and bank FDs to bonds and mutual funds, high interest rates currently prevailing in the economy provide ample opportunity to earn high returns by taking nil to a little bit of risk. Still, some due diligence is required. So, choose your options wisely

1/8

After a cumulative rate hike of 250 basis points (bps) over the last 11 months, the Reserve Bank of India (RBI) has decided to hold the repo rate at 6.5 percent in its last two policy meetings held in February and April. The RBI has been on the verge of containing inflation while boosting economic growth. Experts believe that the central bank is likely to opt for lower interest rate hikes if inflation shows signs of abating. However, there is not much clarity on the future movements of interest rate

2/8

Over the last one year, yields at the short end of the yield curve rose significantly, thanks to consecutive rate hikes and limited liquidity in the banking system. Though the rising yields have improved the returns from fixed deposits (FDs) and accrual-focussed funds such as liquid funds, it inflicted some mark-to-market (MTM) losses on duration-based funds. Experts believe that the nature of the yield curve remains flat, and hence, the risk-reward seems tilted towards the middle part of the yield curve – the 2027-2030 segment. Considering the present high and uncertain interest rate environment, we list out the fixed income investment products that could deliver better returns in the three to seven-year time-frame.

3/8

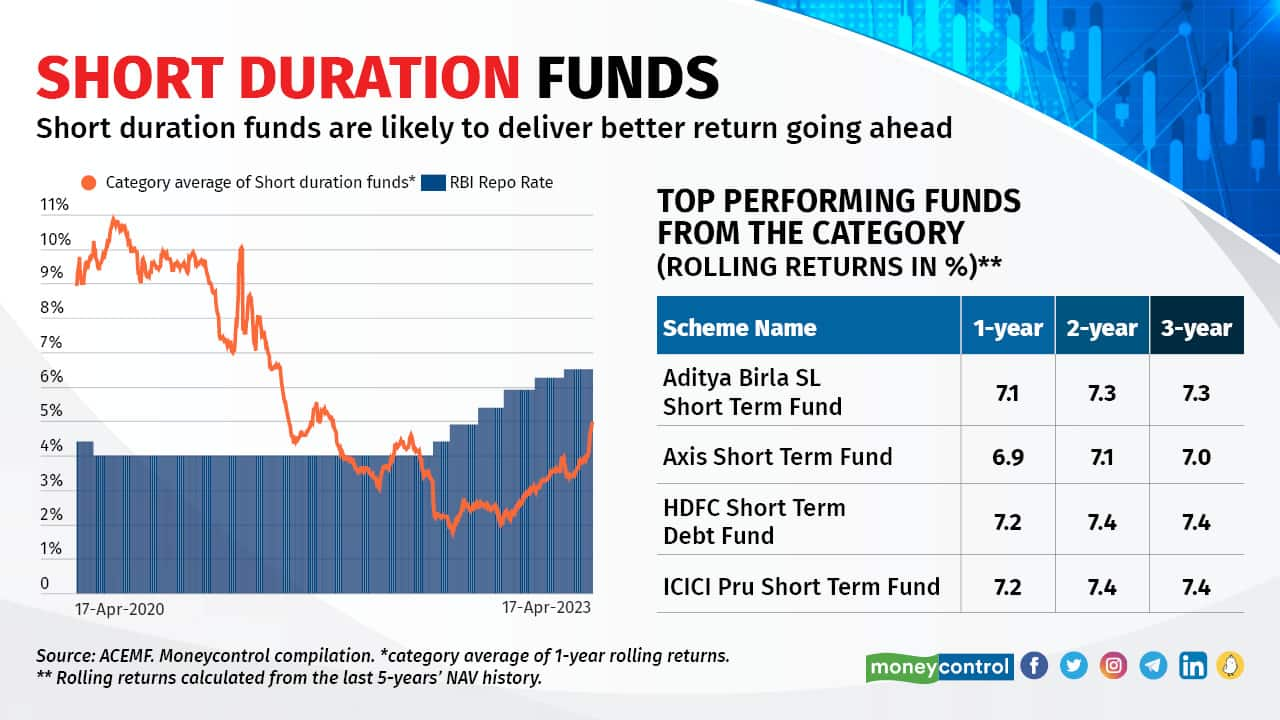

Many believe that debt funds have become unattractive and are at par with FDs as the Finance Bill 2023 removed the long-term capital gains benefit and indexation benefit that debt funds enjoyed (for units purchased after April 1, 2023). This is not the case. (see here How?) Historical data shows that debt funds outperformed bank FDs over the long run and delivered inflation-beating returns. Within debt funds, short duration funds (SDFs) can be considered at this juncture for investment periods of, say, three-five years. SDFs invest mostly in bonds with short to medium maturity. SDFs invest in bonds with maturities of one to three years. Bonds with short maturity are relatively less sensitive to interest rate movements than those with long maturity. SDFs are the preferred choice in a rising and higher-rate environment as the proceeds of the short maturity papers can be redeployed in bonds with higher yields. This should improve the fund’s performance. The returns from SDFs are seen improving over the last five to six months (see the chart) and are likely to generate returns of 7-8 percent per annum over the next one year or so.

4/8

Conservative investors have been investing in bank FDs. The FD market now offers many more options as there are small finance banks (SFBs) and new-age banks with their own FD products. The appeal of assured returns makes many opt for FDs. After the hike in policy interest rates by the RBI, banks and non-banking finance companies (NBFCs) have announced increase in interest rates.

5/8

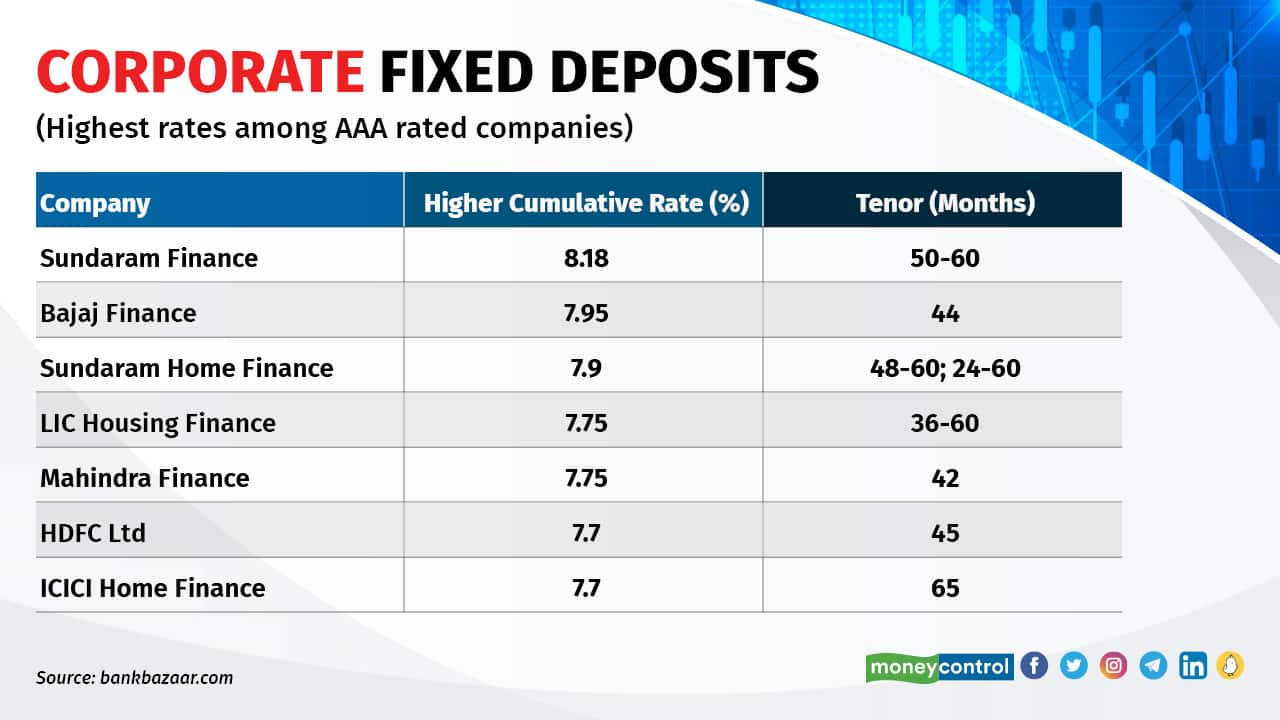

Corporate FDs are offered by NBFCs and companies that are considered financially stable and have good credit rating. These companies offer interest rates higher than banks, making Corporate FDs an attractive option for investors looking to earn higher returns on their savings. Do not invest in FDs with very high interest rates as this is also an indication of high credit risk. It is worth noting that bank FDs are considered to be less risky than Corporate FDs as they are insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC) up to Rs 5 lakh per bank account. Corporate FDs, on the other hand, are not insured by the government.

6/8

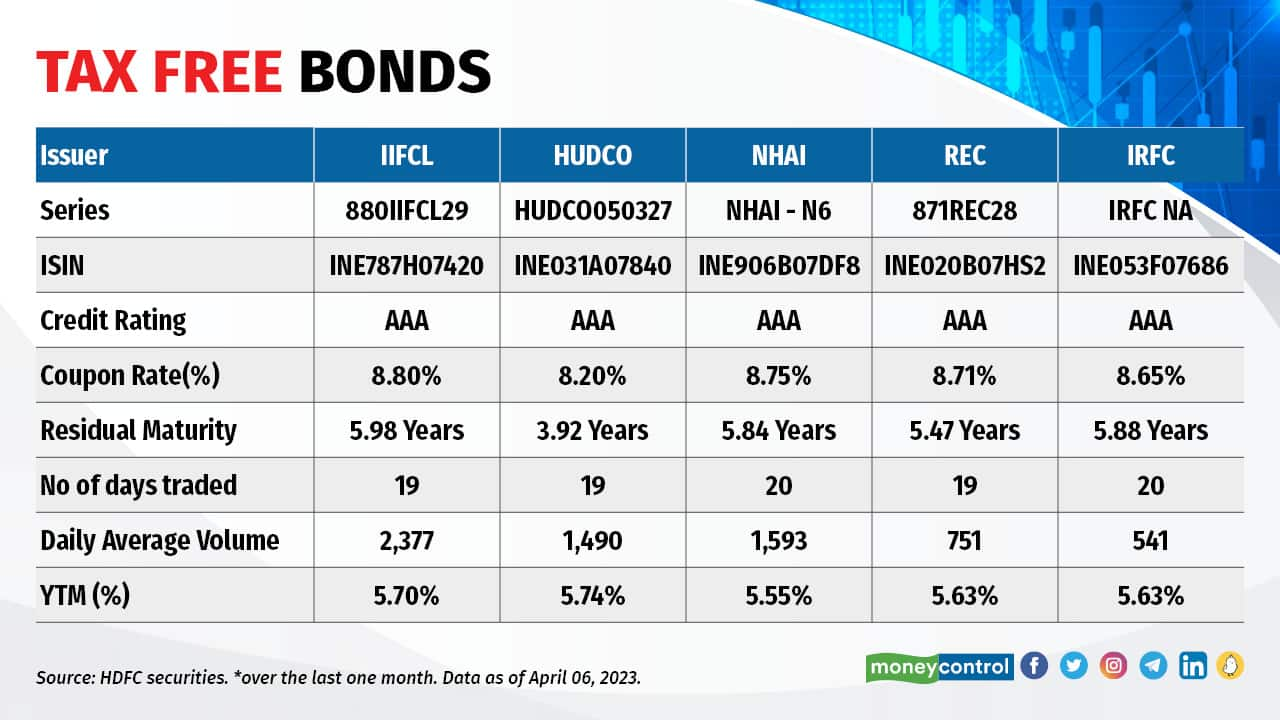

Tax-free bonds were issued by state-run infrastructure finance companies in the period between FY12 and FY16. These bonds were listed on the bourses and are now traded in the cash segment of BSE and NSE. Investors can buy these bonds — through their demat accounts — from the secondary market. These bonds pay interest annually, which is tax-free. Large investors prefer these bonds for short term investments. With 5.6 percent Yield-to-Maturity (YTM), tax-free bonds are still an attractive buy for investors in higher income-tax slabs. For those in the 39 percent tax slab, that results in a pre-tax yield of 9.2 percent. Select bonds with higher liquidity and higher YTM in the secondary market that match your time horizon.

7/8

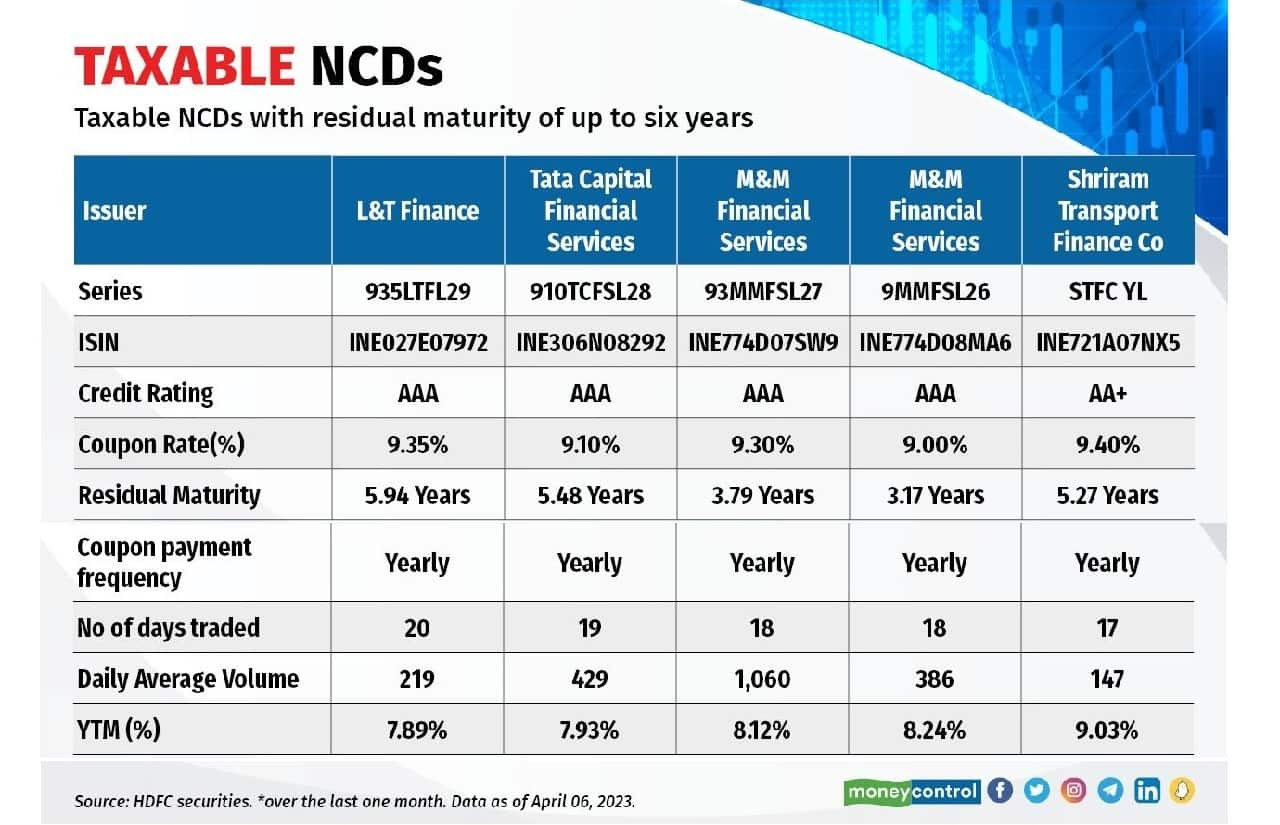

Non-convertible debentures (NCDs) are fixed income instruments issued by corporates to raise long-term funds through public issues. These are issued for a specific tenure of, say, one to seven years, and pay interest periodically or at maturity. Many NCDs that were issued to retail investors (whose face value is mostly Rs 1,000) are listed on the exchanges and traded like equity shares. A few of them are traded with reasonable liquidity and near fair value. Investors with a medium risk profile, looking for options other than bank and corporate FDs, may consider buying these NCDs. Note that these NCDs are prone to credit and interest-rate risks. So, one should consider NCDs with higher rating, better YTM, and ample liquidity on the exchanges.

8/8

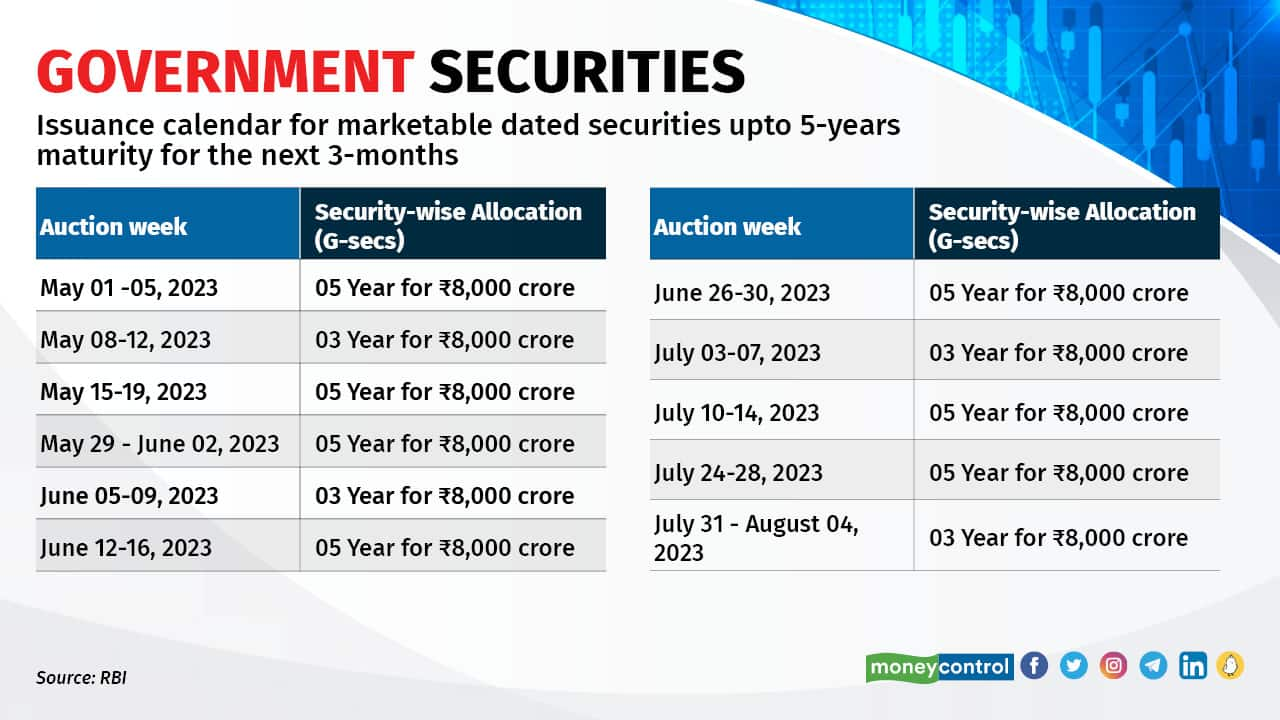

Government Securities (G-Secs) are debt instruments issued by the RBI on behalf of the Central Government. State governments also raise money by issuing such instruments, which are called State Development Loans (SDLs). Treasury bills (T-Bills) are short-term instruments with maturities of three, six and 12 months, while dated G-Secs have maturity periods of one to 40 years. Since the Government of India backs these bonds, they are virtually credit-risk-free investments. However, these bonds are exposed to interest rate risks, which can be avoided if held till maturity. Retail investors can buy these bonds either offline or online. Retail investors can buy G-Secs at primary issuance using RBI’s Retail Direct platform, that is, when a bond is first issued by the government. Or, they can participate in the secondary market, which is called the Negotiated Dealing System Order Matching (NDS OM). The other ways to invest directly in G-Secs is through trading and demat accounts, which can be opened at any bank or NBFC in India. Retail investors can buy government bonds from stockbrokers and online bond trading platforms. Investors can place bids online on the goBID web portal or the NSE goBID mobile application. The RBI has recently announced issuance calendar for marketable dated securities for the next six months. Investors can consider buying those G-Secs matching their time-frames. In an auction held on April 13, 2023, the RBI has set the yields for three-year maturity paper at 6.99 percent. Investors can also consider gilt mutual fund schemes, which are a more convenient way to invest in G-Secs.

Also see: Debt markets race ahead of RBI and signal a rate hike. How should you handle your debt portfolio?

Also see: Debt markets race ahead of RBI and signal a rate hike. How should you handle your debt portfolio?

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!