In 7 charts: How long-term holding mitigates interest-rate risk and ensures higher returns in debt funds

Debt funds go through volatile phases when interest rates oscillate. Consequently, returns also fluctuate. Investments held for the long term help manage rate risk and ensure consistent higher returns

1/8

Debt mutual funds play an important role in an investor’s portfolio that not only mitigate risks through asset diversification but also generate regular income. Debt funds are mostly used to meet short- and medium-term goals, like an emergency corpus or a corpus to pay for immediate expenses such as a down payment for a car loan.

They can also be part of the long-term portfolio. Long-term investments in debt funds not only reduce volatility but also ensure higher consistent returns. Our back-of-the-envelope calculations show that debt funds held for the long term are less prone to interest rate risks and deliver better returns than fixed deposits.

They can also be part of the long-term portfolio. Long-term investments in debt funds not only reduce volatility but also ensure higher consistent returns. Our back-of-the-envelope calculations show that debt funds held for the long term are less prone to interest rate risks and deliver better returns than fixed deposits.

2/8

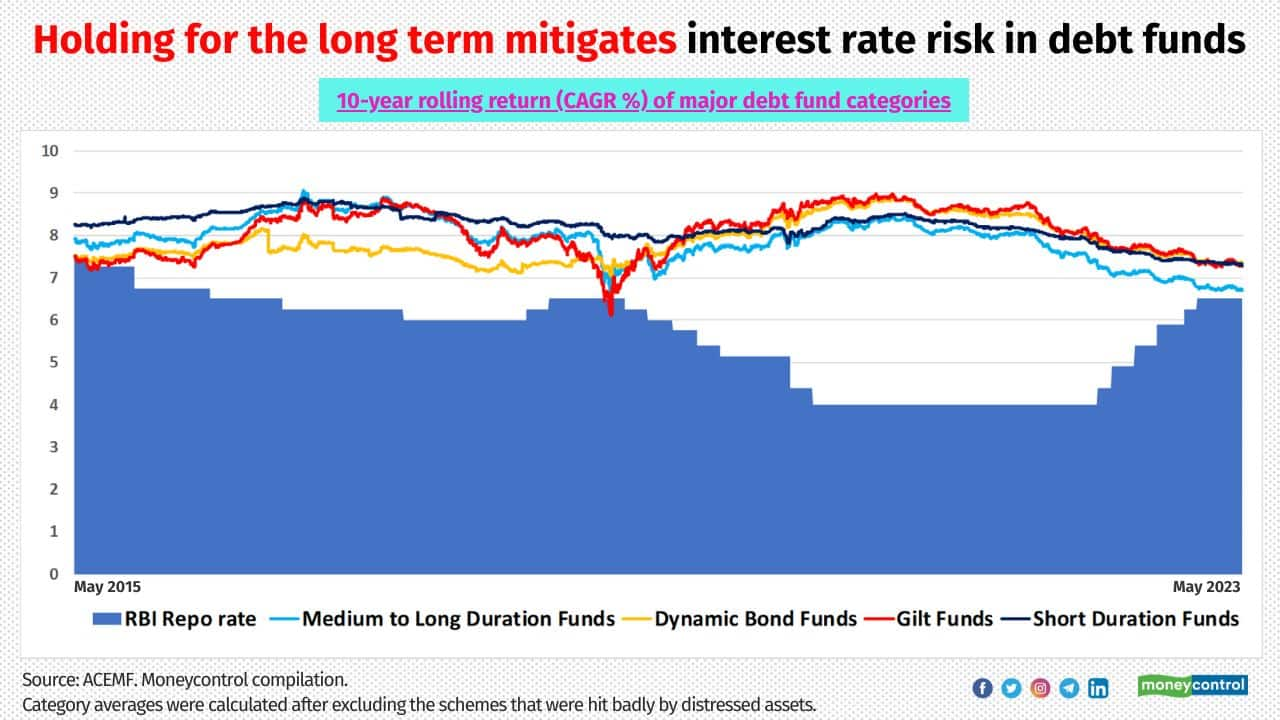

Though debt mutual funds are not as volatile as their equity counterparts, they go through volatile phases because interest rate rises or falls. Schemes investing in long tenured bonds, such as gilt funds, long-duration funds and dynamic bond funds exhibit relatively higher volatility among debt funds as they are more prone to interest rate risk.

On the other hand, accrual funds and short-term funds see lower volatility in their NAV movement as they are relatively less prone to the interest rate movement. The graph above explains that the volatility in returns is reduced if debt funds are held for the long run. A 10-year rolling return for major debt fund categories are considered. So, debt funds can also be long-term wealth creators for those who want to build a long-term fixed-income portfolio.

The salaried class can also consider investing in debt funds through SIPs, just like recurring deposits in the banks. Investors can consider the debt funds in MC30, a curated basket of investment-worthy MF schemes.

To know more about MC30, click here.

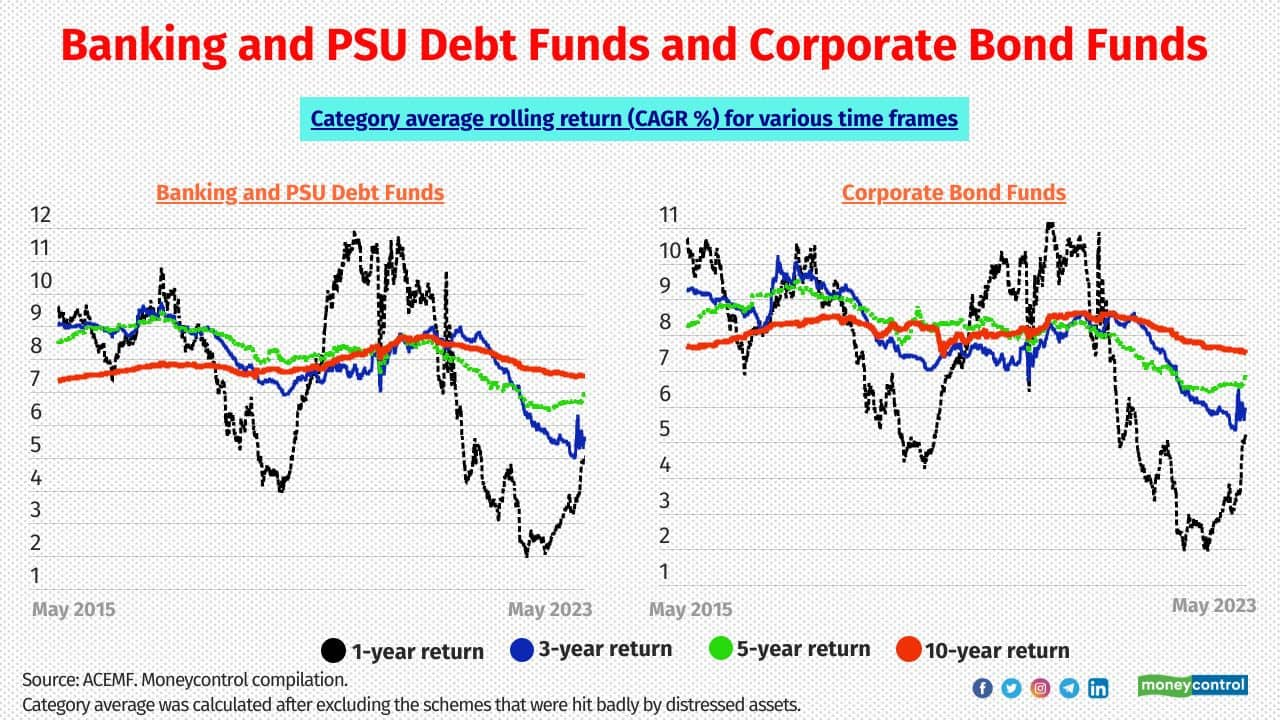

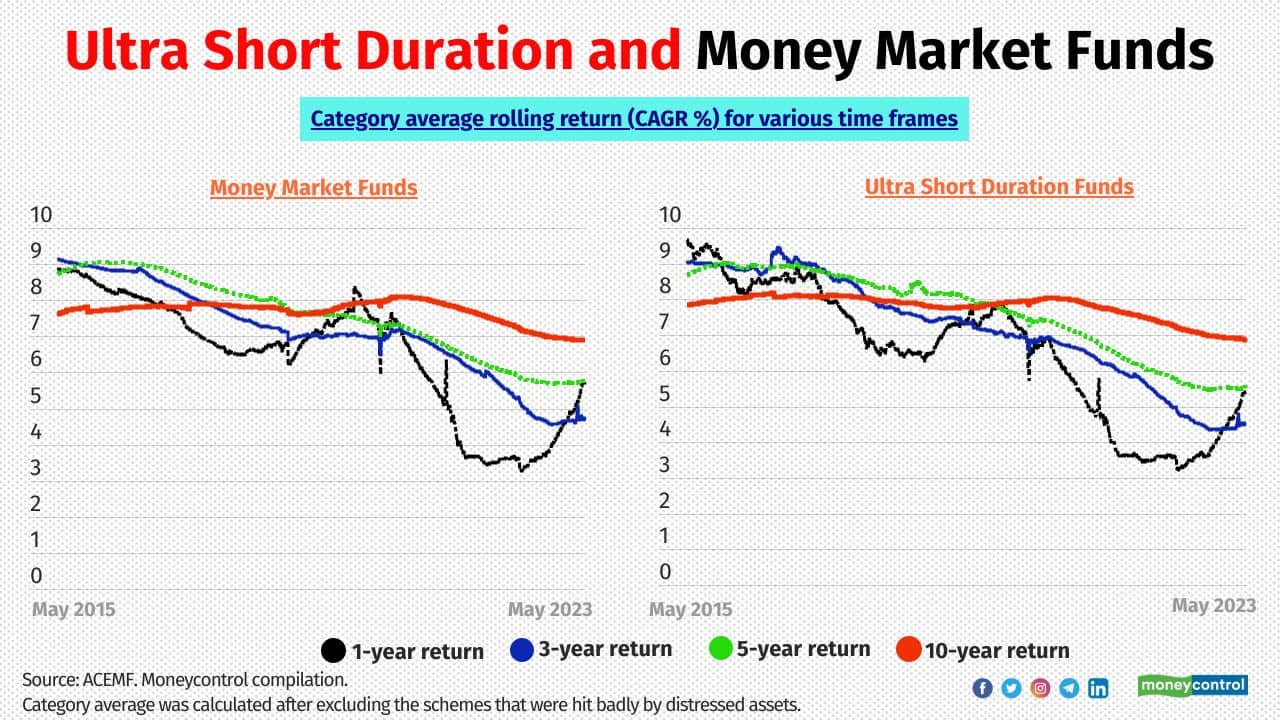

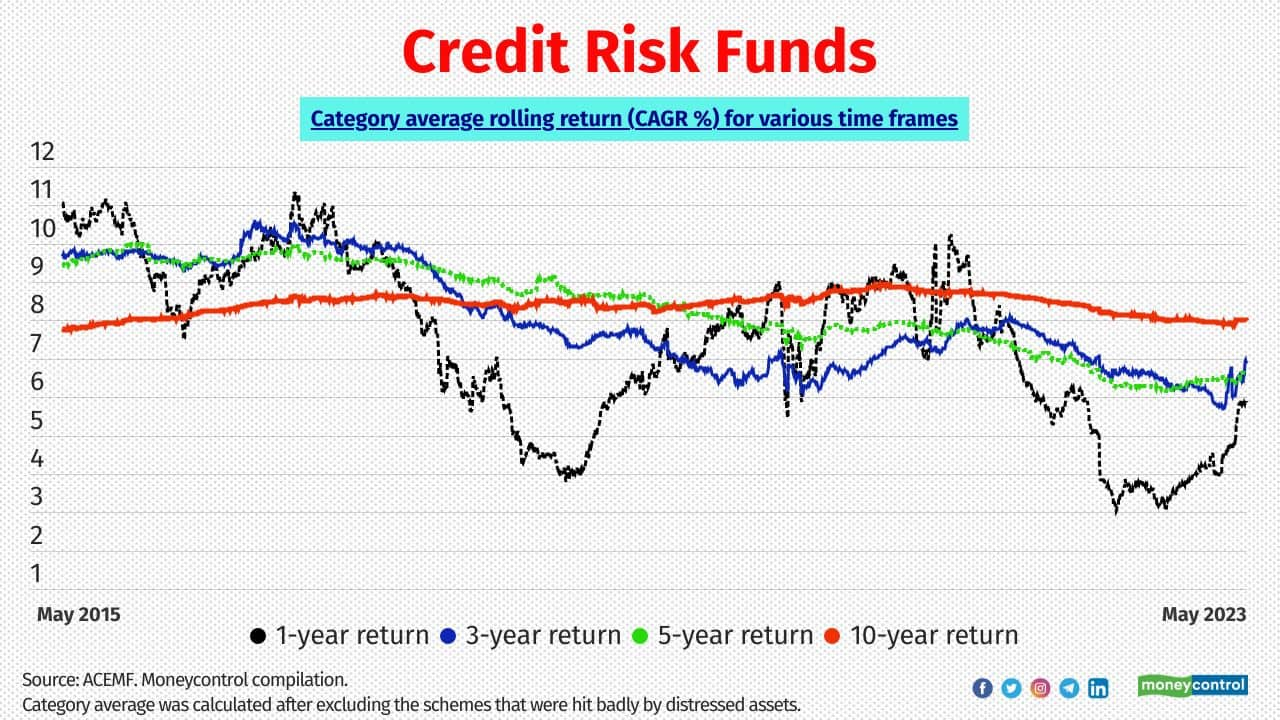

The charts below compare the rolling returns with different timeframes and exhibit how volatility is reduced if investments are held for the long term in major debt categories. The category average was calculated after excluding the schemes that were hit badly by distressed assets. Source: ACEMF.

On the other hand, accrual funds and short-term funds see lower volatility in their NAV movement as they are relatively less prone to the interest rate movement. The graph above explains that the volatility in returns is reduced if debt funds are held for the long run. A 10-year rolling return for major debt fund categories are considered. So, debt funds can also be long-term wealth creators for those who want to build a long-term fixed-income portfolio.

The salaried class can also consider investing in debt funds through SIPs, just like recurring deposits in the banks. Investors can consider the debt funds in MC30, a curated basket of investment-worthy MF schemes.

To know more about MC30, click here.

The charts below compare the rolling returns with different timeframes and exhibit how volatility is reduced if investments are held for the long term in major debt categories. The category average was calculated after excluding the schemes that were hit badly by distressed assets. Source: ACEMF.

3/8

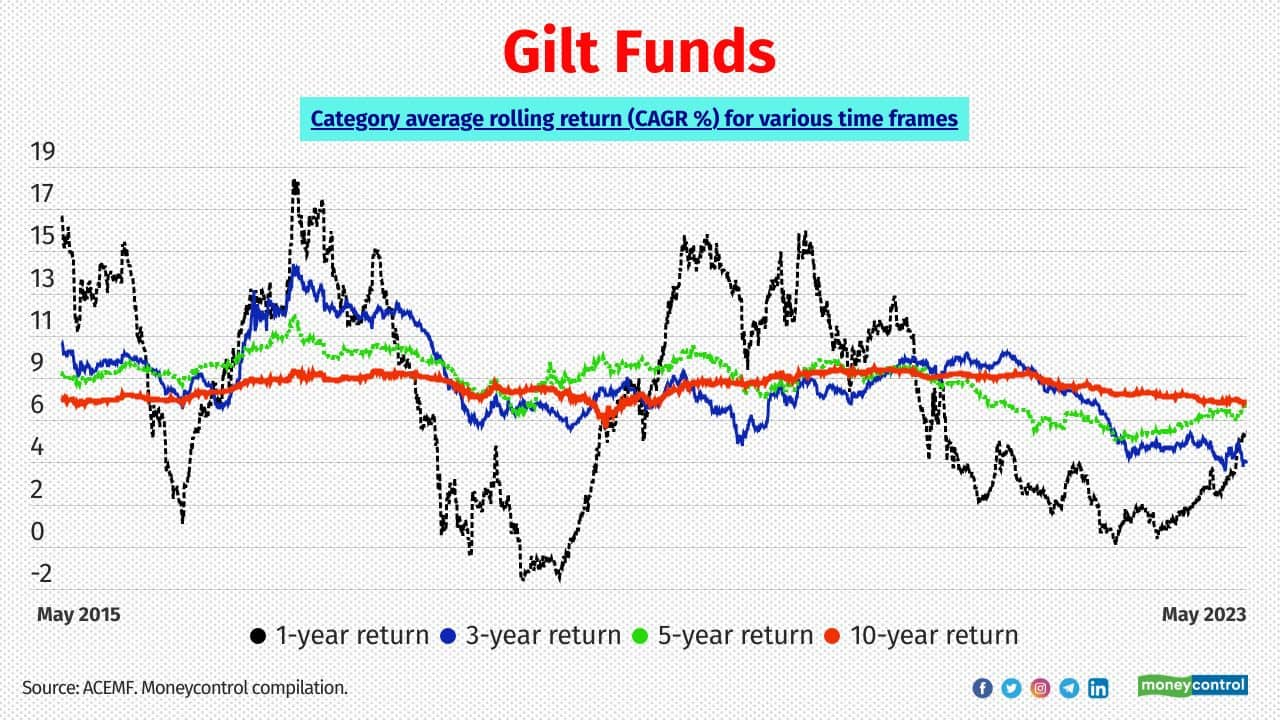

Gilt funds

Note that bonds with longer maturity are more sensitive to the interest rate movement than bonds with shorter maturity. So funds that majorly hold longer maturity papers are more prone to interest-rate risk. Gilt funds are one such. They invest in government bonds with maturity ranging between one and 40 years. They are the most volatile category among debt funds.

Note that bonds with longer maturity are more sensitive to the interest rate movement than bonds with shorter maturity. So funds that majorly hold longer maturity papers are more prone to interest-rate risk. Gilt funds are one such. They invest in government bonds with maturity ranging between one and 40 years. They are the most volatile category among debt funds.

4/8

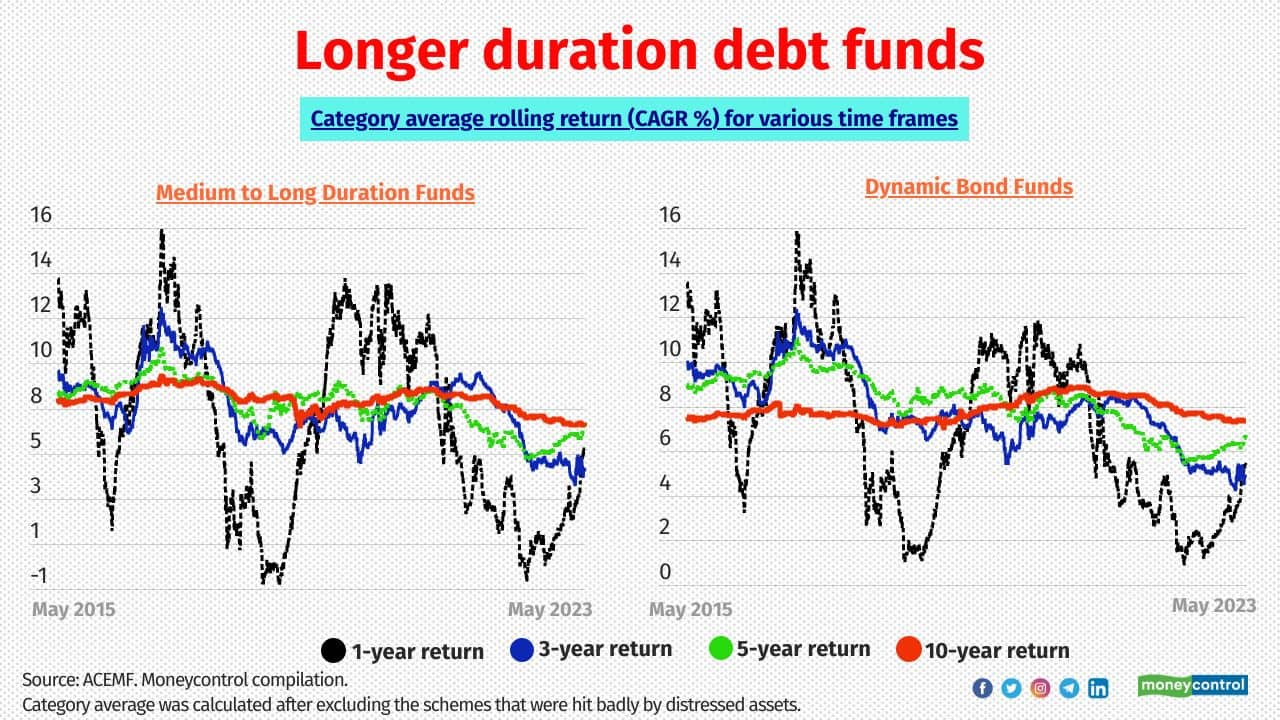

Longer duration debt funds

Longer duration funds, such as long duration, medium to long duration, medium duration and dynamic bond funds are too exposed to higher interest rate risk. Volatility in returns from these funds reduce if the investment is held for the longer term.

Longer duration funds, such as long duration, medium to long duration, medium duration and dynamic bond funds are too exposed to higher interest rate risk. Volatility in returns from these funds reduce if the investment is held for the longer term.

5/8

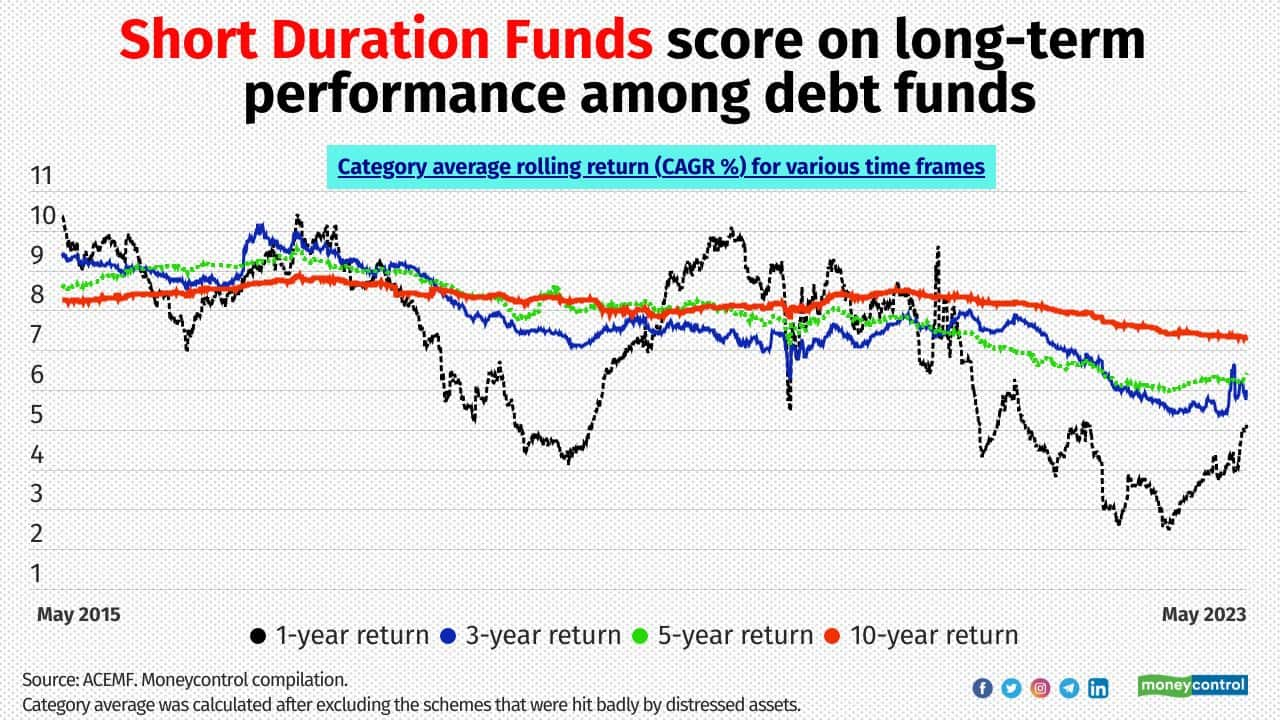

Short-duration funds

Short-duration funds invest in debt securities in such a way that the entire portfolio’s Macaulay duration remains 1-3 years. They mainly generate income from accruals and capital gains from short-duration calls.

It is worth noting here that the long-term performance of short-duration funds can be matched with the performance of the gilt funds and longer duration funds (see the exhibit 2) while taking lower risk. That is why we avoid longer duration funds such as gilt and long-duration funds and suggest funds like short duration funds in MC30.

Also see: Six fixed income products for you in this high interest rate scenario

Short-duration funds invest in debt securities in such a way that the entire portfolio’s Macaulay duration remains 1-3 years. They mainly generate income from accruals and capital gains from short-duration calls.

It is worth noting here that the long-term performance of short-duration funds can be matched with the performance of the gilt funds and longer duration funds (see the exhibit 2) while taking lower risk. That is why we avoid longer duration funds such as gilt and long-duration funds and suggest funds like short duration funds in MC30.

Also see: Six fixed income products for you in this high interest rate scenario

6/8

Banking and PSU debt funds and corporate bond funds

Banking and PSU debt funds invest at least 80 percent of their assets in instruments issued by banks, public sector undertakings (PSUs) and public financial institutions (PFIs).

Corporate bond funds invest at least 80 percent of their assets in the highest-rated (AAA and AA+) debt instruments. They mainly generate income from accruals and capital gains from moderate duration calls. They are also part of MC30.

Banking and PSU debt funds invest at least 80 percent of their assets in instruments issued by banks, public sector undertakings (PSUs) and public financial institutions (PFIs).

Corporate bond funds invest at least 80 percent of their assets in the highest-rated (AAA and AA+) debt instruments. They mainly generate income from accruals and capital gains from moderate duration calls. They are also part of MC30.

7/8

Ultra short-duration and Money Market funds

Very short-term funds, such as low duration, ultra short duration, money market and liquid funds invest in very short-term debt securities. They are exposed to less interest rate risk as these funds generate returns mostly from interest income.

Very short-term funds, such as low duration, ultra short duration, money market and liquid funds invest in very short-term debt securities. They are exposed to less interest rate risk as these funds generate returns mostly from interest income.

8/8

Credit risk funds

Credit risk funds are investing at least 65% of their money in bonds that are rated below AA+. These funds mostly prefer generating accrual income from high-yielding debt securities rather than taking duration calls.

Also read: SIPs work for debt funds, too. And, they beat bank FDs. Here’s the proof

Credit risk funds are investing at least 65% of their money in bonds that are rated below AA+. These funds mostly prefer generating accrual income from high-yielding debt securities rather than taking duration calls.

Also read: SIPs work for debt funds, too. And, they beat bank FDs. Here’s the proof

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!