SIPs work for debt funds, too. And, they beat bank FDs. Here’s the proof

A Moneycontrol analysis shows that 5-year SIP return calculated for MC30 debt schemes outperformed the FD rates for the respective period 60 percent of the time

1/11

Debt funds may have lost their long-term capital tax advantage and indexation benefits in the recently-passed Finance Bill amendment. But the numbers prove that debt funds score over bank fixed deposits (FD) on returns. Our back-of-the-envelope calculations show that the 5-year systematic investment plan (SIP) return calculated for MC30 debt schemes outperformed the FD rates for the respective period 60 percent of the time. We checked the data over the last 10 years. We took SBI’s 5-year FD rates for comparison (domestic term deposit rates of 3-5 years for below Rs 2 crore applicable for general public). To make the comparison more meaningful, we compared the FD rates prevalent at the time of the SIP start period. For instance, for the 5-year SIP return as of March-2023, we looked at the FD rate that was prevalent in March-2018.

2/11

SIP is a popular investment route for mutual fund investors. While most of us prefer running SIP in equity funds, we often ignore the benefits of SIP in debt MFs. Despite the fact that debt MFs are not as volatile as their equity counterparts, they go through volatile phases like falling and rising interest rates. Debt funds help in asset allocation, provide easy liquidity and help us create an emergency corpus. MC30 — the curated basket of 30 investment-worthy mutual funds schemes — has three categories of debt funds such as short-duration funds, corporate-bond funds and banking and PSU debt funds. These funds have a proven track record and are managed with a high-quality portfolio.

3/11

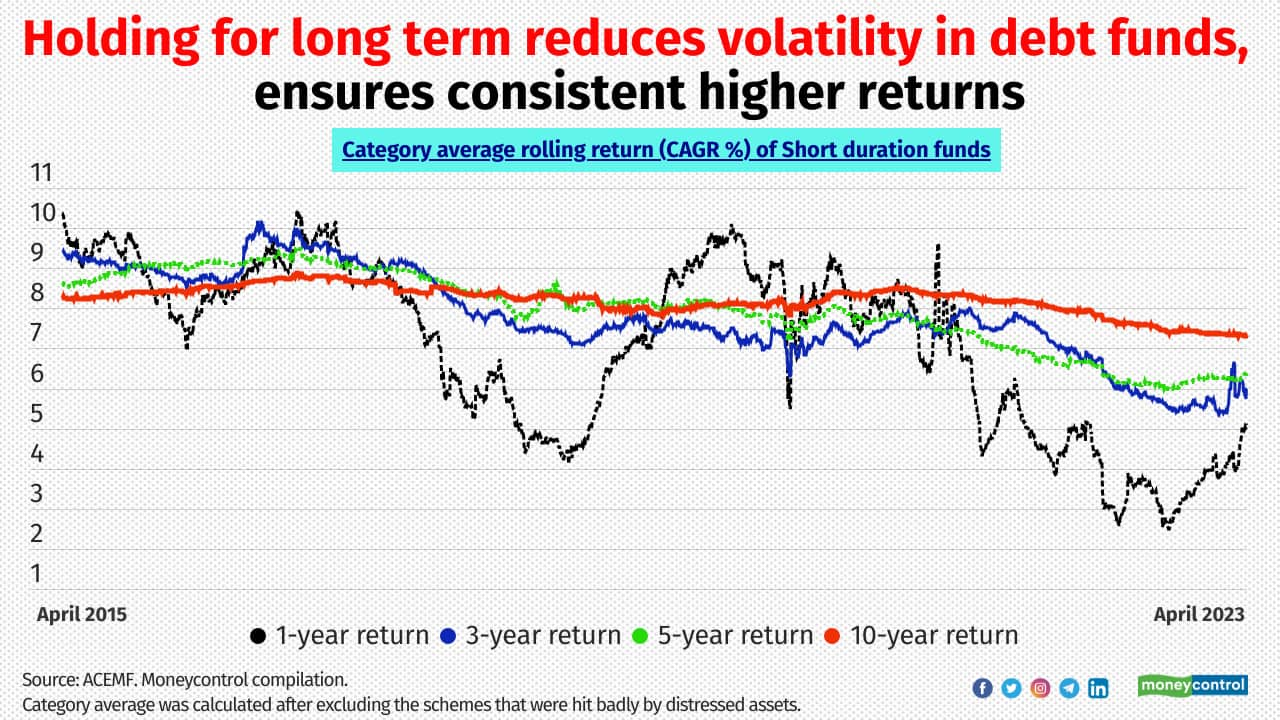

Investment held for the long term reduces not only volatility but also ensures higher consistent returns (see graph). In the above graph, average rolling returns of the short duration funds category for different timeframes were compared. So, debt funds can also be long-term wealth creators for those who want to build a fixed-income portfolio. Salaried investors can also consider investing in debt funds through SIP just like recurring deposits in the banks. To know more about MC30, click here. The charts below show the five-year SIP performance of all eight debt schemes part of the MC30 basket. Category average was calculated after excluding the schemes that were hit badly by distressed assets. Portfolio data was as of March 2023. Source: ACEMF and SBI.co.in

4/11

Bandhan Banking & PSU Debt Fund

Category: Banking & PSU Debt Funds

Average of 5-year SIP rolling return (XIRR): 7.8%

Fund managers: Gautam Kaul and Suyash Choudhary

Average Maturity (years): 2.9

Yield to Maturity (%): 7.6

Category: Banking & PSU Debt Funds

Average of 5-year SIP rolling return (XIRR): 7.8%

Fund managers: Gautam Kaul and Suyash Choudhary

Average Maturity (years): 2.9

Yield to Maturity (%): 7.6

5/11

Kotak Banking and PSU Debt Fund

Category: Banking & PSU Debt Funds

Average of 5-year SIP rolling return (XIRR): 7.8%

Fund managers: Abhishek Bisen and Deepak Agrawal

Average Maturity (years): 6.5

Yield to Maturity (%): 8

Category: Banking & PSU Debt Funds

Average of 5-year SIP rolling return (XIRR): 7.8%

Fund managers: Abhishek Bisen and Deepak Agrawal

Average Maturity (years): 6.5

Yield to Maturity (%): 8

6/11

Nippon India Banking & PSU Debt Fund

Category: Banking & PSU Debt Funds

Average of 5-year SIP rolling return (XIRR): 7.8%

Fund managers: Pranay Sinha and Vivek Sharma

Average Maturity (years): 3.2

Yield to Maturity (%): 7.5

Also see: Six fixed income products for you in this high interest rate scenario

Category: Banking & PSU Debt Funds

Average of 5-year SIP rolling return (XIRR): 7.8%

Fund managers: Pranay Sinha and Vivek Sharma

Average Maturity (years): 3.2

Yield to Maturity (%): 7.5

Also see: Six fixed income products for you in this high interest rate scenario

7/11

HDFC Corporate Bond Fund

Category: Corporate Bond Funds

Average of 5-year SIP rolling return (XIRR): 8%

Fund manager: Anupam Joshi

Average Maturity (years): 5.1

Yield to Maturity (%): 7.9

Category: Corporate Bond Funds

Average of 5-year SIP rolling return (XIRR): 8%

Fund manager: Anupam Joshi

Average Maturity (years): 5.1

Yield to Maturity (%): 7.9

8/11

Sundaram Corporate Bond Fund

Category: Corporate Bond Funds

Average of 5-year SIP rolling return (XIRR): 7.7%

Fund managers: Dwijendra Srivastava and Sandeep Agarwal

Average Maturity (years): 0.2

Yield to Maturity (%): 7.4

Category: Corporate Bond Funds

Average of 5-year SIP rolling return (XIRR): 7.7%

Fund managers: Dwijendra Srivastava and Sandeep Agarwal

Average Maturity (years): 0.2

Yield to Maturity (%): 7.4

9/11

Axis Short Term Fund

Category: Short Duration Funds

Average of 5-year SIP rolling return (XIRR): 7.4%

Fund manager: Devang Shah

Average Maturity (years): 2.8

Yield to Maturity (%): 7.8

Category: Short Duration Funds

Average of 5-year SIP rolling return (XIRR): 7.4%

Fund manager: Devang Shah

Average Maturity (years): 2.8

Yield to Maturity (%): 7.8

10/11

HDFC Short Term Debt Fund

Category: Short Duration Funds

Average of 5-year SIP rolling return (XIRR): 7.8%

Fund manager: Anil Bamboli

Average Maturity (years): 3.7

Yield to Maturity (%): 7.9

Category: Short Duration Funds

Average of 5-year SIP rolling return (XIRR): 7.8%

Fund manager: Anil Bamboli

Average Maturity (years): 3.7

Yield to Maturity (%): 7.9

11/11

ICICI Prudential Short Term Fund

Category: Short Duration Funds

Average of 5-year SIP rolling return (XIRR): 7.6%

Fund managers: Manish Banthia and Nikhil Kabra

Average Maturity (years): 4.8

Yield to Maturity (%): 8.2

Also read: A debt fund is designed to deliver better returns across rate cycles

Category: Short Duration Funds

Average of 5-year SIP rolling return (XIRR): 7.6%

Fund managers: Manish Banthia and Nikhil Kabra

Average Maturity (years): 4.8

Yield to Maturity (%): 8.2

Also read: A debt fund is designed to deliver better returns across rate cycles

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!