MC30 Scheme Review | A debt fund is designed to deliver better returns across rate cycles

With an increase in bond yields, thanks to the policy rate hikes by the RBI, the overall outlook for fixed-income return improves. Debt schemes with short-maturity profiles, such as ICICI Prudential Short-Term Fund, tend to benefit and are likely to deliver better returns

1/8

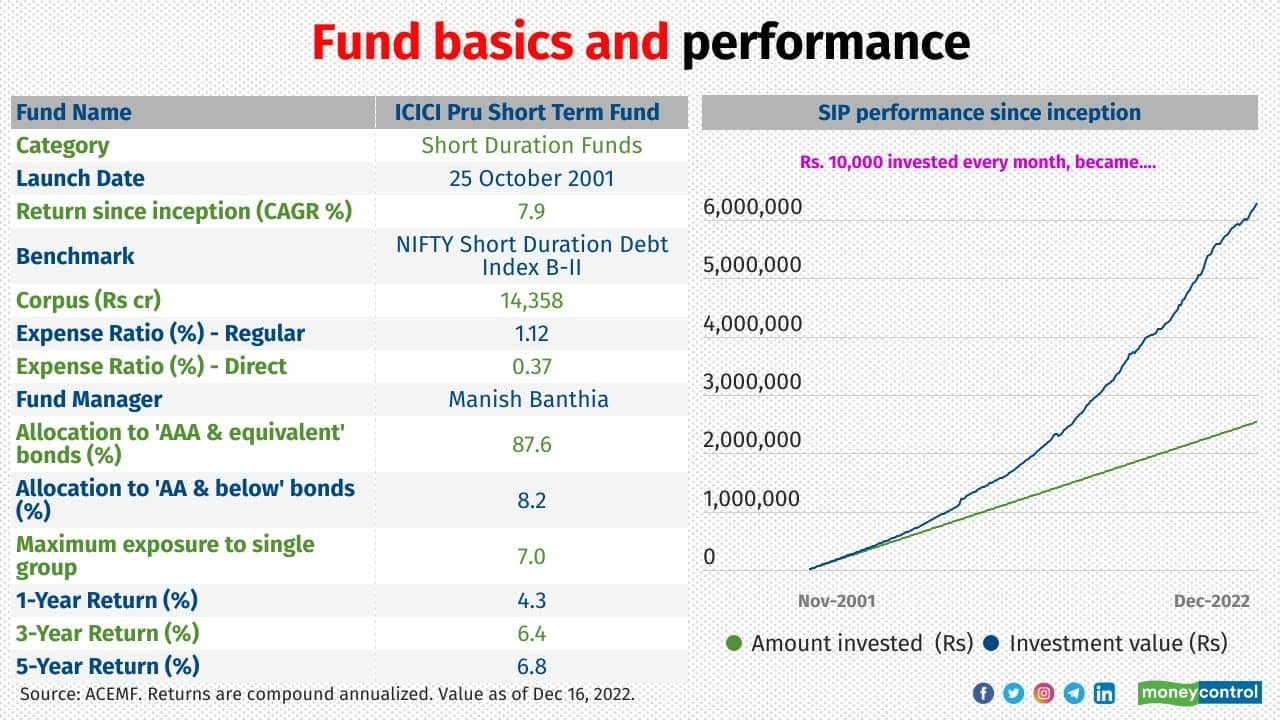

Returns from debt mutual funds were muted over the last two years. Ever since the pandemic broke out, central banks across the globe have been working hard to boost economies by cutting policy rates. This, in turn, lowered the yields, making accrual-focused funds post poor returns. While central banks were fighting for economic growth, rising inflation turned to be a nightmare, of late. This has made most of the key economies to reverse their stance and increase rates. Since May 2022, the RBI, too, has increased the repo rate by 225 basis points to 6.25 percent to contain inflation. Though rising yields have inflicted some mark-to-market losses on debt funds in the recent past, the overall outlook for fixed-income return has improved. For instance, the yield of 1 Year AAA Corporate bonds traded at 7.9 percent, as of December 16, 2022. Debt funds betting on short-term debt papers are likely to benefit from such higher yields and deliver higher returns, going ahead. ICICI Prudential Short Term Fund (ISTF) is one such. It is one of the eight debt schemes in the basket of MC30, a curated list of investment worthy mutual fund schemes.

Manish Banthia, Deputy CIO, Fixed Income, ICICI Prudential Mutual Fund, has been managing the fund since 2009.

Manish Banthia, Deputy CIO, Fixed Income, ICICI Prudential Mutual Fund, has been managing the fund since 2009.

2/8

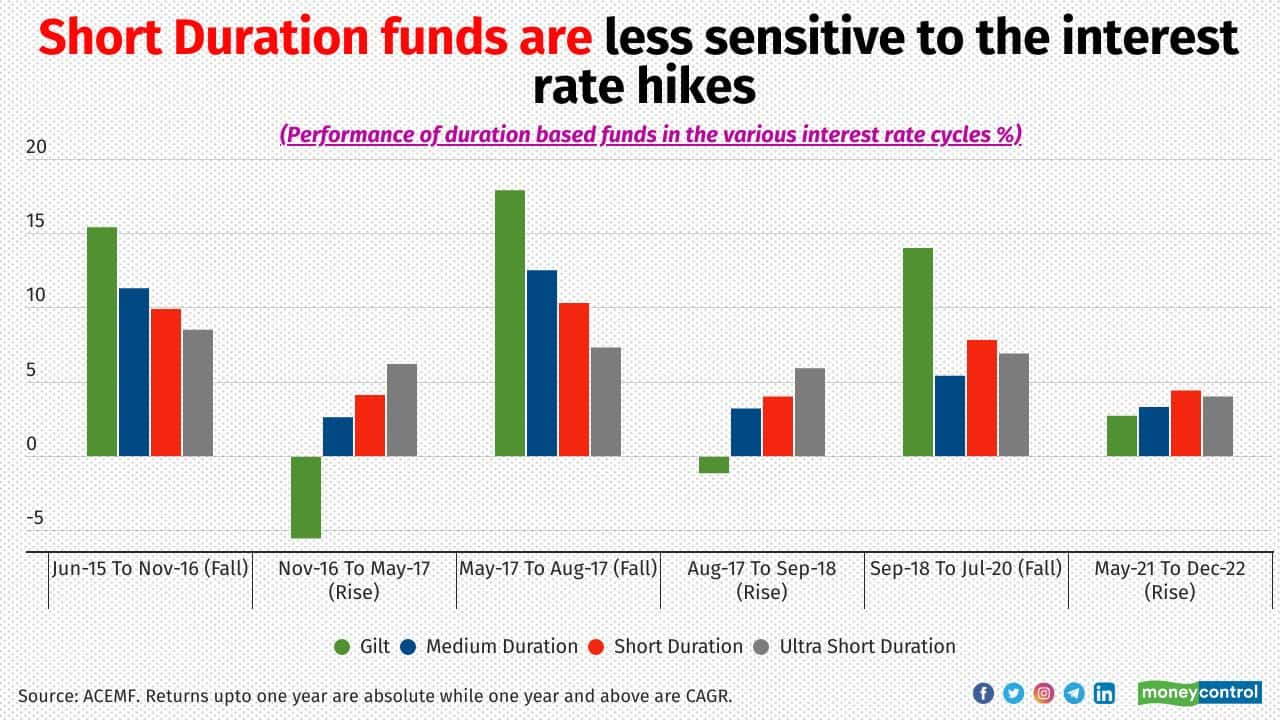

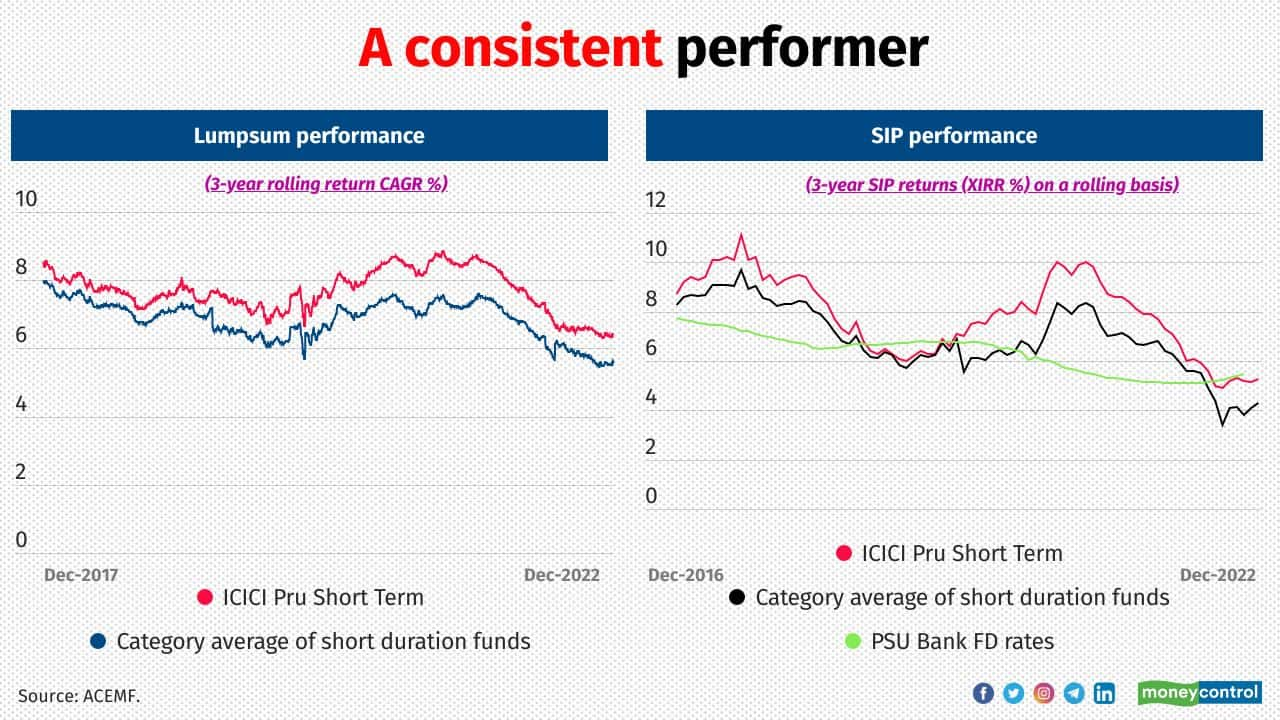

Short-duration funds invest in debt securities in such a way that the entire portfolio’s Macaulay duration (weighted average term to the maturity of the cash flows from a bond) remains 1-3 years. In a rising-rate scenario, short- duration funds are preferred bets as their short-duration strategy reduces volatility and also offers interest income. Here’s how short-term bond funds can protect you from sharp interest rate hikes. One: they return investors’ money quicker than long-term securities. It is, therefore, easier to hold them until maturity. You can avoid interest rate risks if you hold bonds till maturity. Second, in a rising interest-rate scenario, the proceeds of the short-maturity papers can be redeployed in bonds with higher yields. This will improve the fund’s performance. Actively managed short-duration funds, such as ISTF, can deliver returns that can beat bank FDs over the long run. Investors with a three-year time horizon can consider the fund.

3/8

ISTF has managed to beat the category average consistently over the long term. It has been showing an impressive track record since its launch, thanks to the fund manager’s active duration and cash-call strategy. Performance, as measured by the rolling return calculated from the last seven years’ NAV data, shows that ISTF generated a compounded annualised growth rate (CAGR) of 7.7 percent while the category gave 6.8 percent (category average was calculated after excluding the schemes that were hit badly by distressed assets). The scheme has been holding around 18-20 percent in the non-AAA rated papers. This has added extra return to the portfolio.

4/8

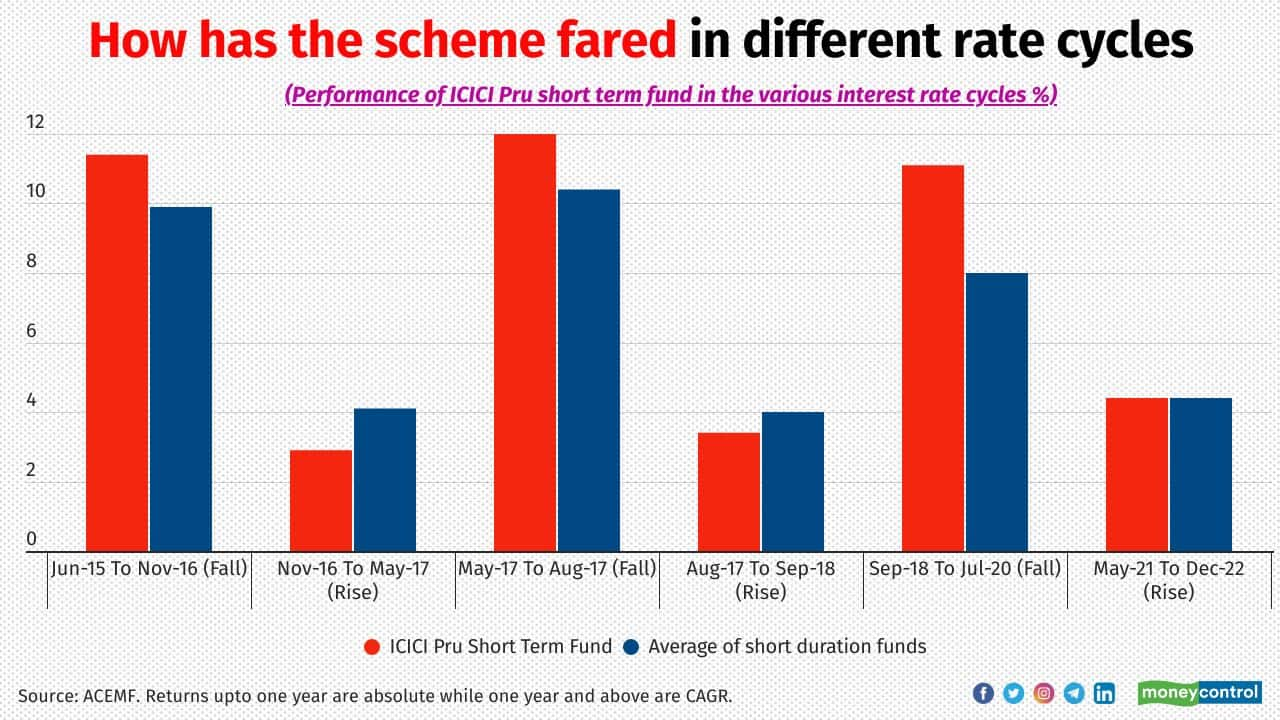

While the ISTF outperformed its peers in the falling-rate scenario with a huge margin, it posted a matching or below-average return in rising rate cycles. It was mainly due to its aggressive duration strategy than the category averages. However, it managed to deliver better returns in the current rising rate cycle. A notable allocation to floating rate bonds helped the fund manager to contain the duration risk and deliver a decent return during this period.

5/8

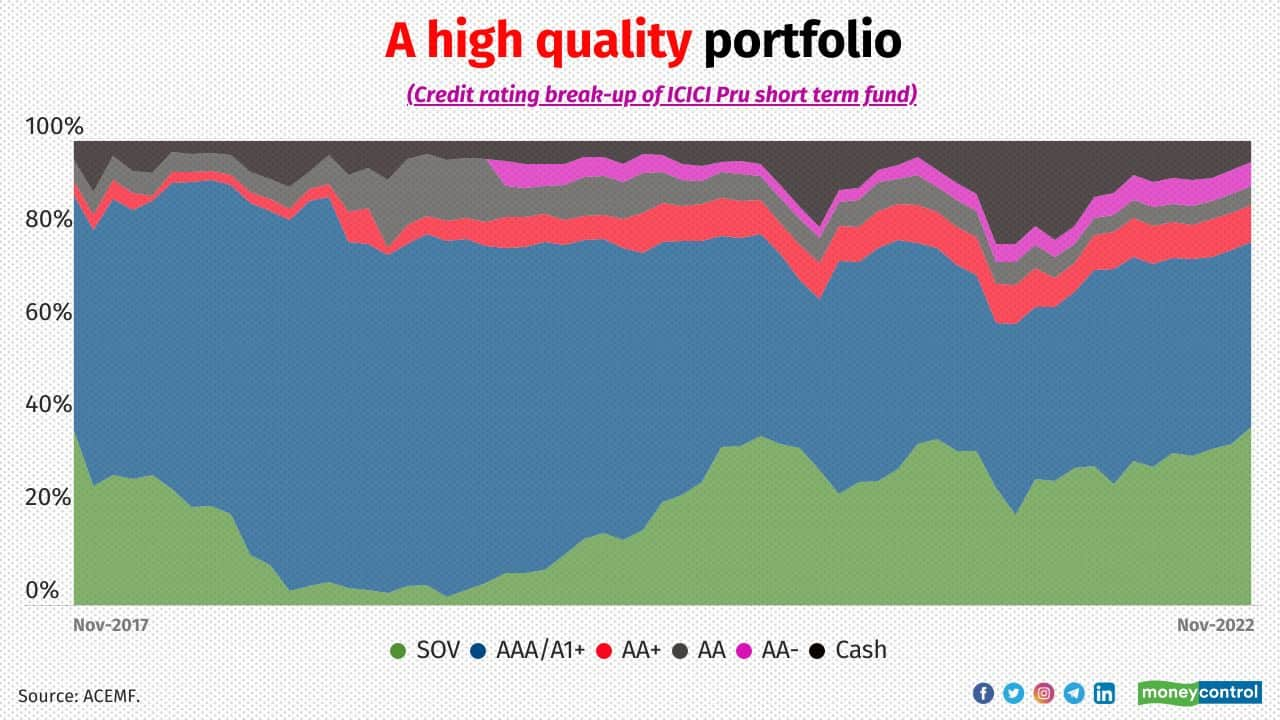

ISTF has quality corporate bonds and G-Secs. It increased allocation to government securities over the last two years. Manish Banthia, fund manager, says, “The allocation of G-Secs in the portfolio has been largely in the floating rate bonds. Their coupons are linked to market- based instruments. They are low-duration assets as these G-Sec floating rate bonds are linked to the 6-month T-bill. Their interest rates are reset every six months”. It generated higher yields than all of these segments without taking any additional duration, adds Banthia.

6/8

The fund has a high-quality portfolio as most of the corporate bonds held are issued by market leaders in their respective segments. The scheme has been allocating 18-20 percent in the non-AAA rated papers, which adds extra returns. Banthia is of the view that the credit category looks positive as the overall corporate leverage in India is quite low at this point of time. Some of the non-AAA rated bond issuers that the scheme holds currently include Tata Motors Finance, TMF Holdings and Godrej Industries. Exposure to AT1 bonds too was brought down to around 2 percent.

7/8

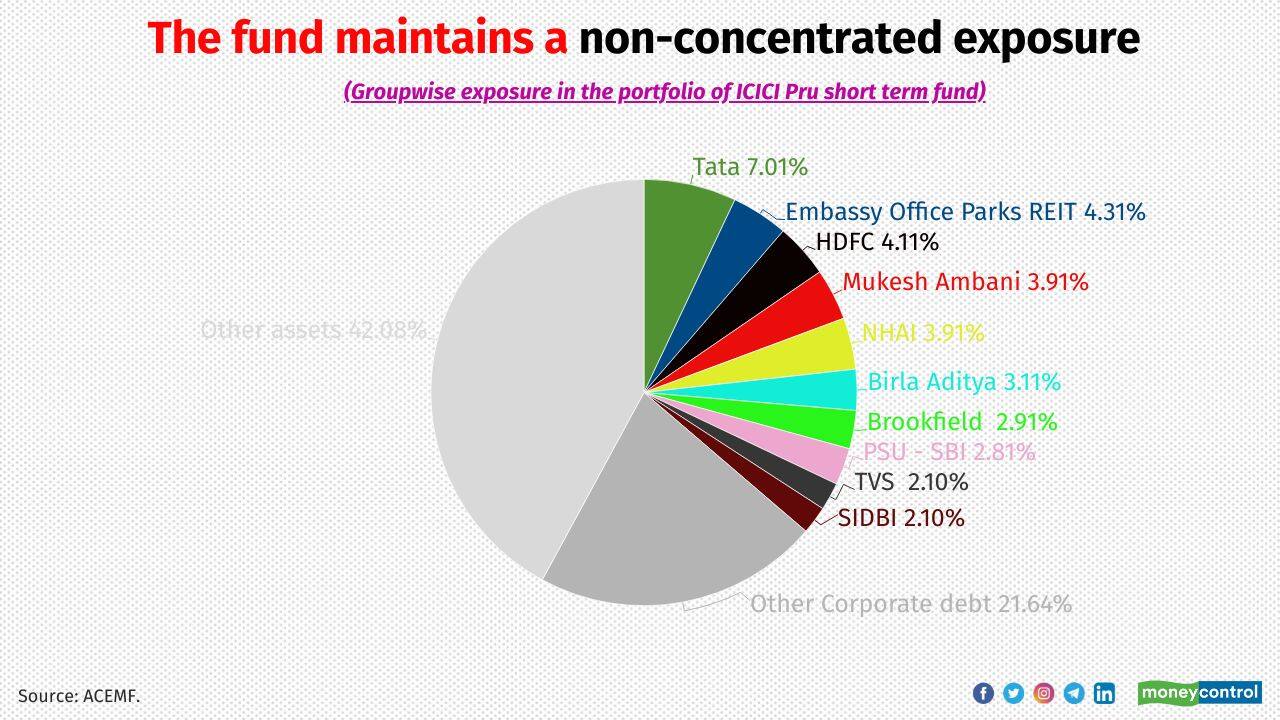

ISTF has not invested a lot in any single group. As per its latest portfolio, the maximum it has invested in a single corporate group is seven percent. Market regulator Securities and Exchange Board of India (SEBI) allows up to 20 percent.

8/8

The fund has maintained its portfolio Macaulay Duration between 1.5 years and three years over the last three years. As per the latest portfolio, the average maturity of the scheme was at 5.4 years. Investors should ideally have a time frame of minimum three years to pocket healthy risk-adjusted returns on a post-tax basis

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!