HDFC Short Term Debt Fund: An all-weather debt fund has delivered across rate cycles

Part of MC30, HDFC Short Term Debt Fund is well positioned to benefit in the current environment of high short-term yields. It’s also a good pick to get into before the interest rates start to fall

1/9

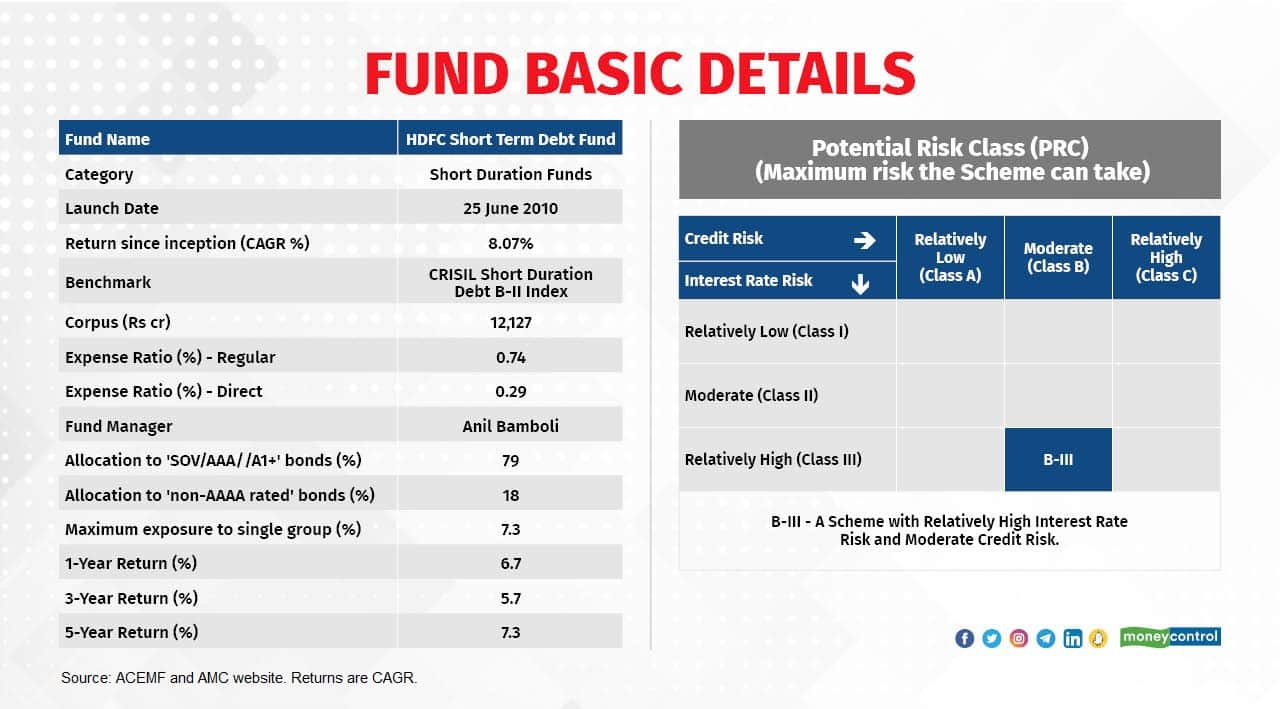

Returns from the debt mutual funds across the board have improved notably over the last 4-5 months. Accrual and short term debt funds leaped ahead and delivered better return when the RBI hiked its repo rate by 250 basis points since May 2022. (Read here: One year of interest rate hikes: How debt mutual funds emerged a winner despite headwinds). On the other hand, long duration based funds gained the most especially in the last four months thanks to declining long term yields due to the markets’ expectation of possible rate cuts going ahead. Debt funds that follow both accrual and moderate duration strategies tend to gain relatively well in such environments. And we’ve got just the fund for you. HDFC Short Term Debt Fund (HSTF) is one such fund that has done well across rate cycles. Anil Bamboli has been managing the fund since June 2010.

2/9

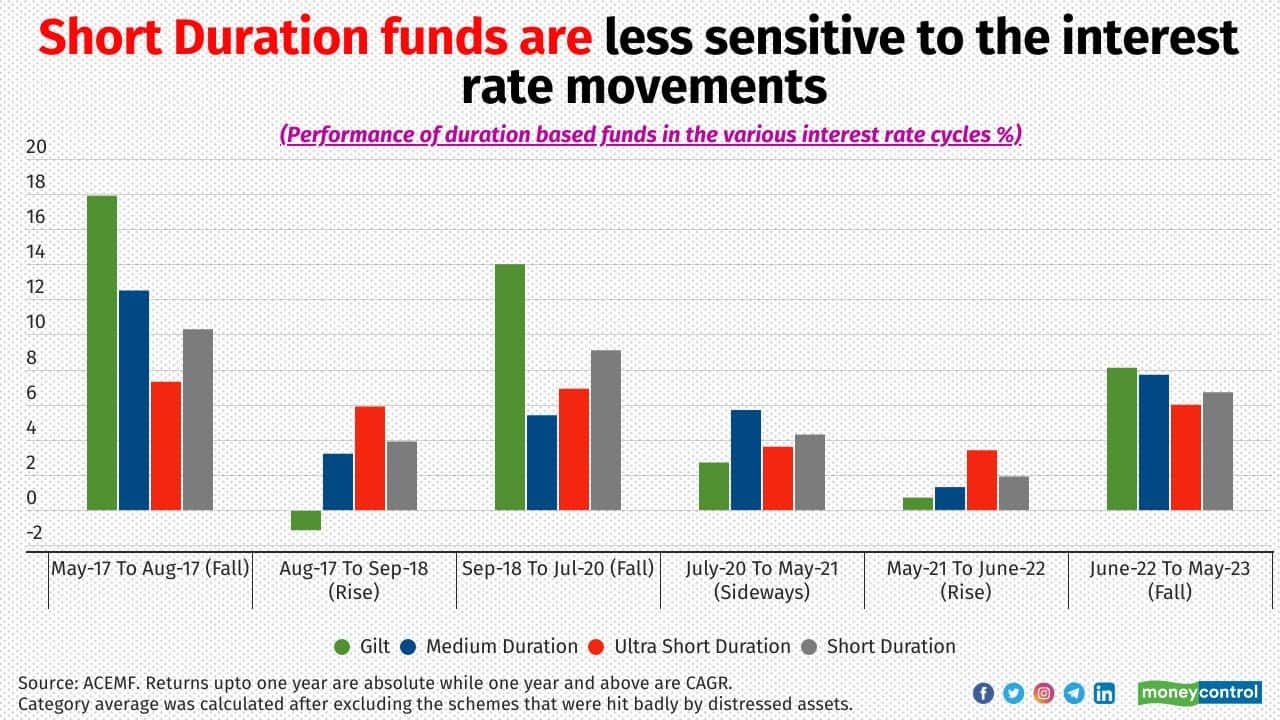

Short-duration funds invest in short term debt securities in such a way that the entire portfolio’s Macaulay duration remains 1-3 years. They are likely to deliver relatively better returns across rate cycles. Short duration funds mainly generate income from accruals and capital gains from short-duration calls. In a rising interest-rate scenario, investing in short term papers reduces volatility. Bonds with short maturity are less sensitive to the rate risk compared to the bonds with long maturity. Furthermore, the proceeds of the short-maturity papers can be redeployed in bonds with higher yields when the interest rate rises. This will improve the fund’s performance. In falling rate environment, its duration play helps to generate income from capital appreciation.

3/9

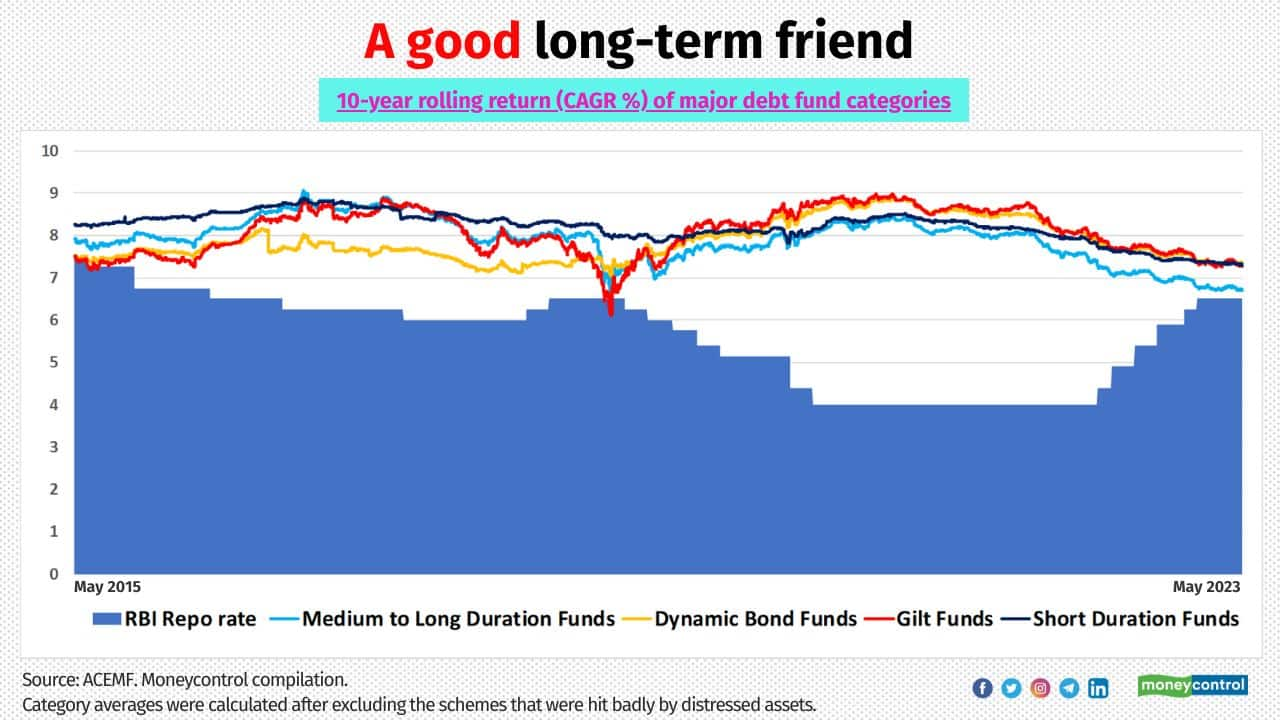

Debt funds have many benefits. It helps us plan for our emergency corpus. Debt funds can also be part of the long-term portfolio, as our Moneycontrol Personal Finance analysis shows (Read here) that debt funds held for the long term are less prone to interest rate risks and deliver better returns than fixed deposits. Among them, short duration funds category managed to deliver better return consistently than others while taking relatively lower risk. More importantly, debt funds must be included in your asset allocation (through systematic investment plan), as it helps you build wealth over the long term.

4/9

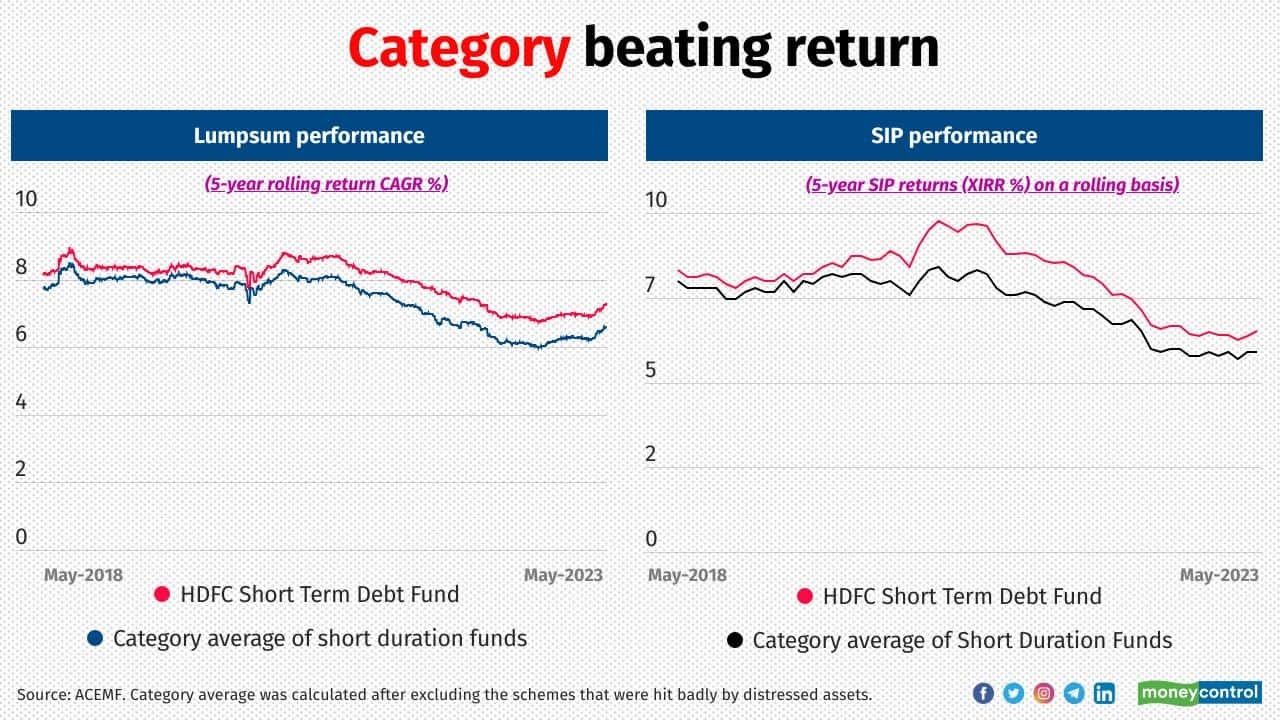

HSTF has been consistent on delivering above average return across paces. Mostly, it was either a Quartile 1 or Quartile 2 performer within the category in the past. Fund manager’s active duration strategy helped to deliver better return across periods. Performance, as measured by the 5-year rolling return calculated from the last seven years’ NAV data, shows that HSTF generated a compounded annualised growth rate (CAGR) of 7.3 percent while the category gave 6.6 percent (category average was calculated after excluding the schemes that were hit badly by distressed assets).

Also read: Six fixed income products for you in this high interest rate scenario

Also read: Six fixed income products for you in this high interest rate scenario

5/9

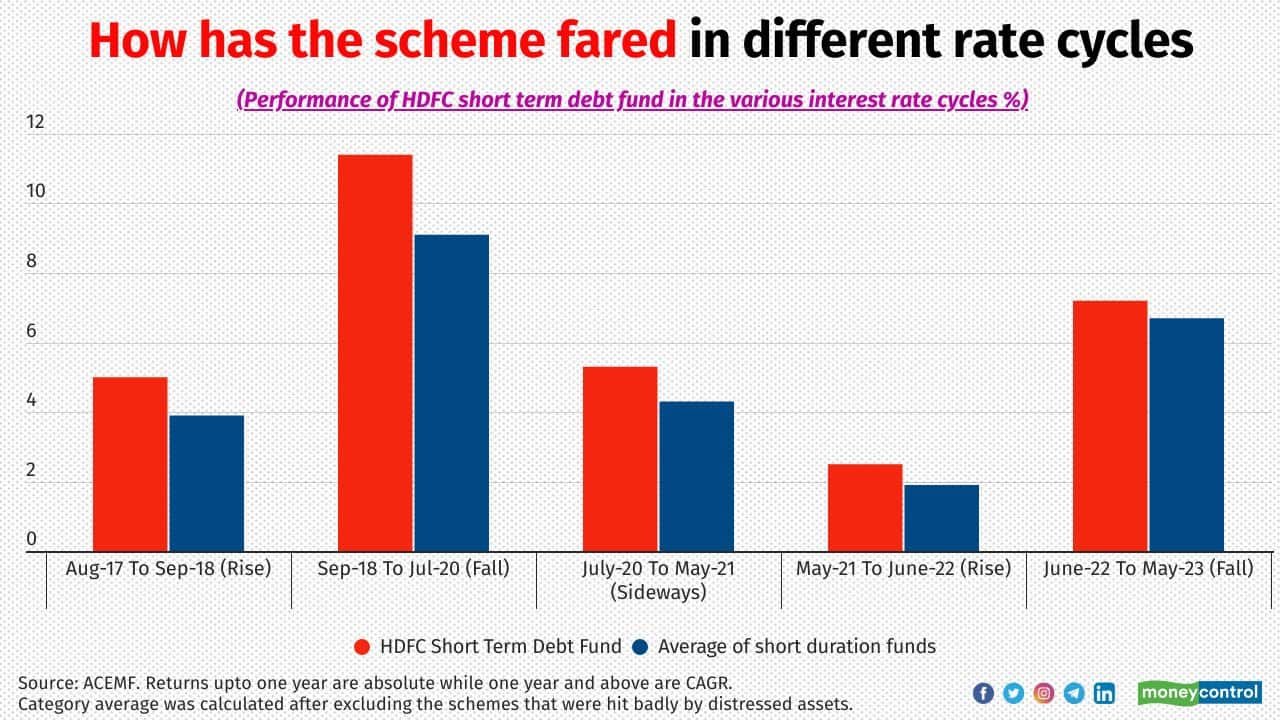

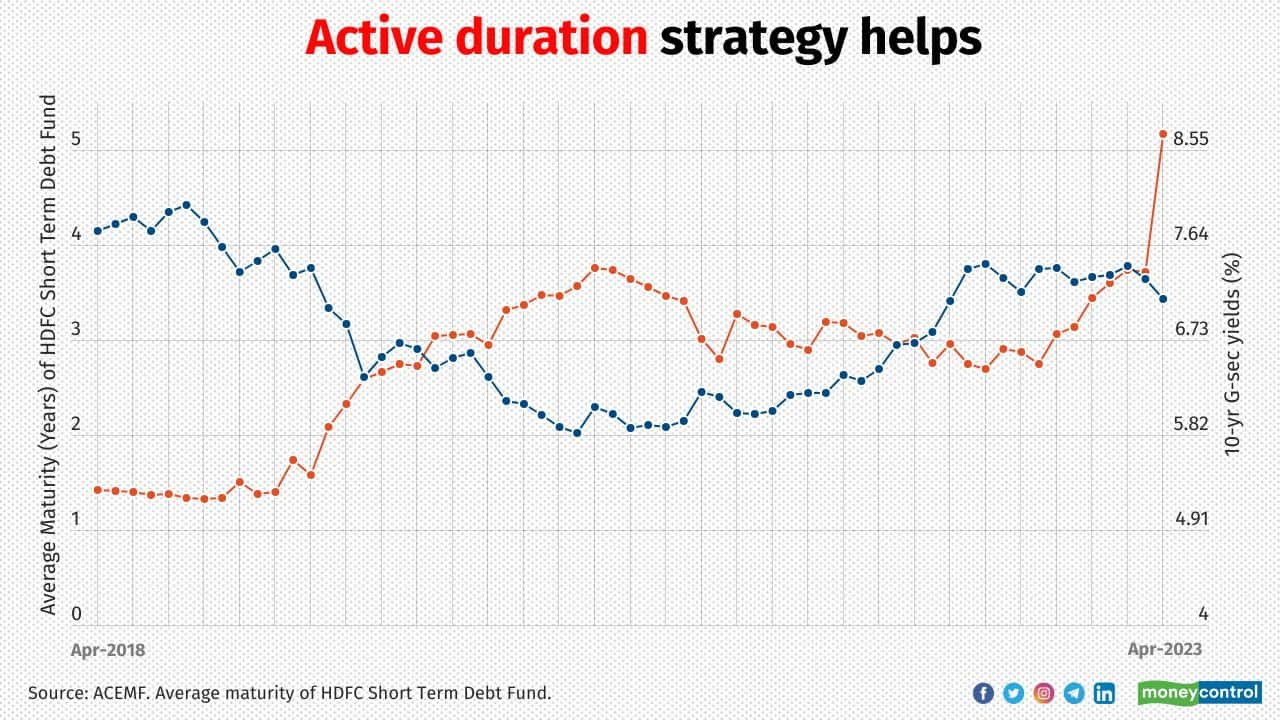

HSTF has generated a category beaten return in most of the interest rate cycles seen over the last seven years. While attributing the recent performance of the fund, Anil Bamboli, the fund manager of the fund says, “the performance was relatively weak vis-à-vis history for most funds in the short duration category in FY23. However, once the yields appeared to have priced in most of the negatives, we gradually increased the duration since October 2022 and is now closer to 2.67 years as on 15 May 2023. This strategy has worked well for the fund”.

6/9

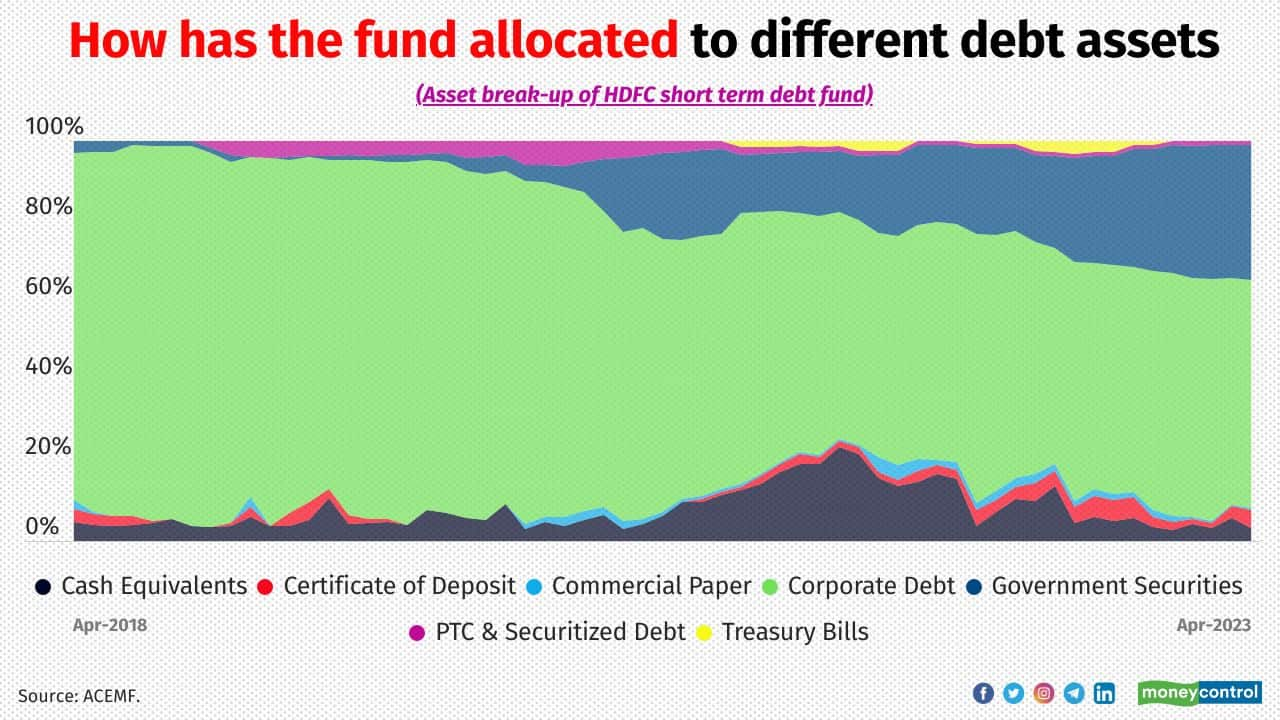

HSTF has been managed with quality portfolio. The fund manager of the fund increased G-sec exposure over the last one year due to narrow spreads. As per the latest data, the scheme has held about 34 percent and 57 percent in G-sec and corporate Debt respectively.

7/9

The Scheme continues to actively manage duration based on the medium-term view on interest rates, yield curve and spreads. Bamboli says, “Currently, we believe that most of the negatives on inflation, monetary policy tightening and growth has been factored in the current level of yields. Going forward, we expect the growth to slow down, inflation to trend lower and RBI to maintain policy status quo as the bar to restart rate hikes is quite high. In view of the aforesaid, we believe that yields can trend lower and there is reasonable case of increase in duration. Thus, as on 15th May 2023 we are maintaining duration towards the higher end of the SEBI permitted duration range (close to 2.67 years)".

8/9

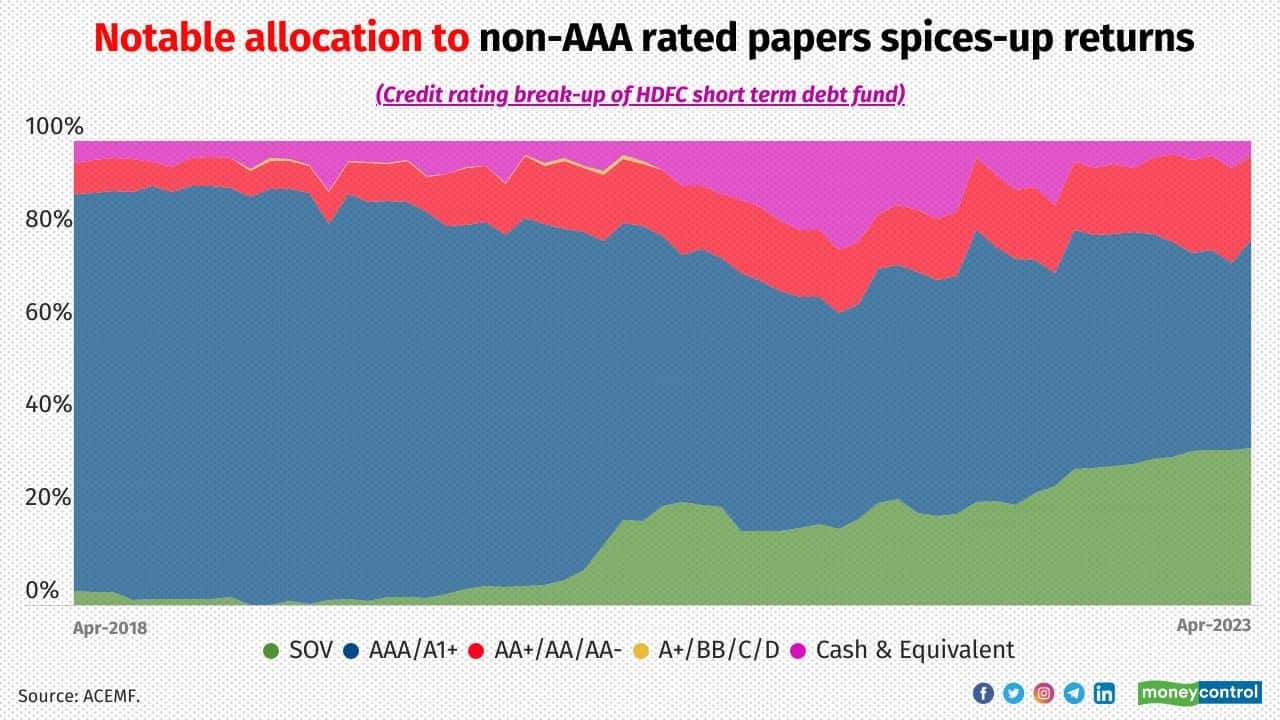

The scheme has flexibility to invest across wide range of securities like Gsec, corporate bonds and money market instrument across rating profile to take exposure in superior quality credit instruments while limiting the duration risk. “Notably, since December 2015, we have maintained over 80% of exposure in Gsec / AAA / A1+ or equivalent rated instruments Moreover, the Scheme tactically tweaks exposure to non-AAA securities keeping in view - credit spreads, duration and overall credit environment. This strategy has played out well” says Bamboli.

Despite being hit by the IL&FS crisis in 2019, the scheme recovered. Its holding in IL&FS was just 0.5 percent. And although it holds around 1.9 percent in AT-1 bonds (as of April 2023), we don’t think that’s any problem for the scheme.

Despite being hit by the IL&FS crisis in 2019, the scheme recovered. Its holding in IL&FS was just 0.5 percent. And although it holds around 1.9 percent in AT-1 bonds (as of April 2023), we don’t think that’s any problem for the scheme.

9/9

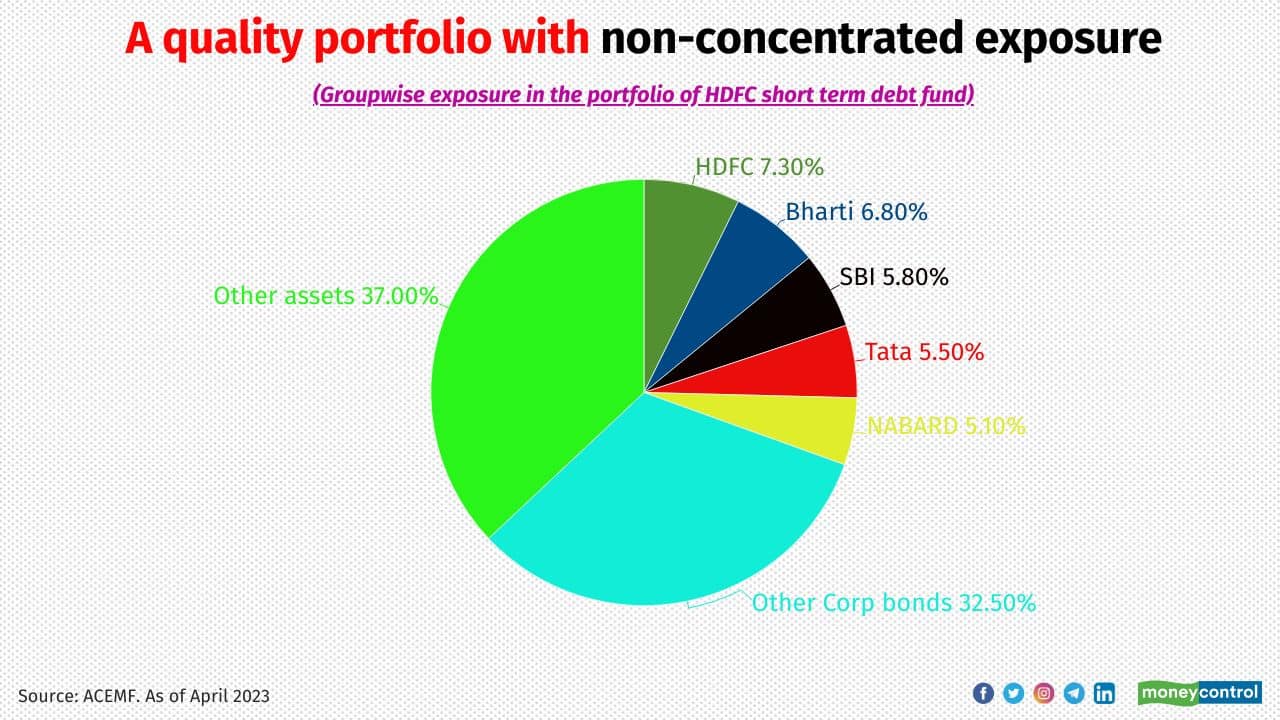

HSTF has not invested a lot in any single group. As per its latest portfolio, the maximum it has invested in a single corporate group is 7.3 percent. Market regulator Securities and Exchange Board of India (SEBI) allows up to 20 percent.

Also see: SIPs work for debt funds, too. And, they beat bank FDs. Here’s the proof

Also see: SIPs work for debt funds, too. And, they beat bank FDs. Here’s the proof

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!