INDIA

After Goldman Sachs and Nomura, economists warn of more cuts in FY22 GDP forecasts

Economists of other agencies like SBI and ICRA say that the impact of rising COVID cases and more localized lockdowns will have a significant impact on their GDP forecasts.

INDIA

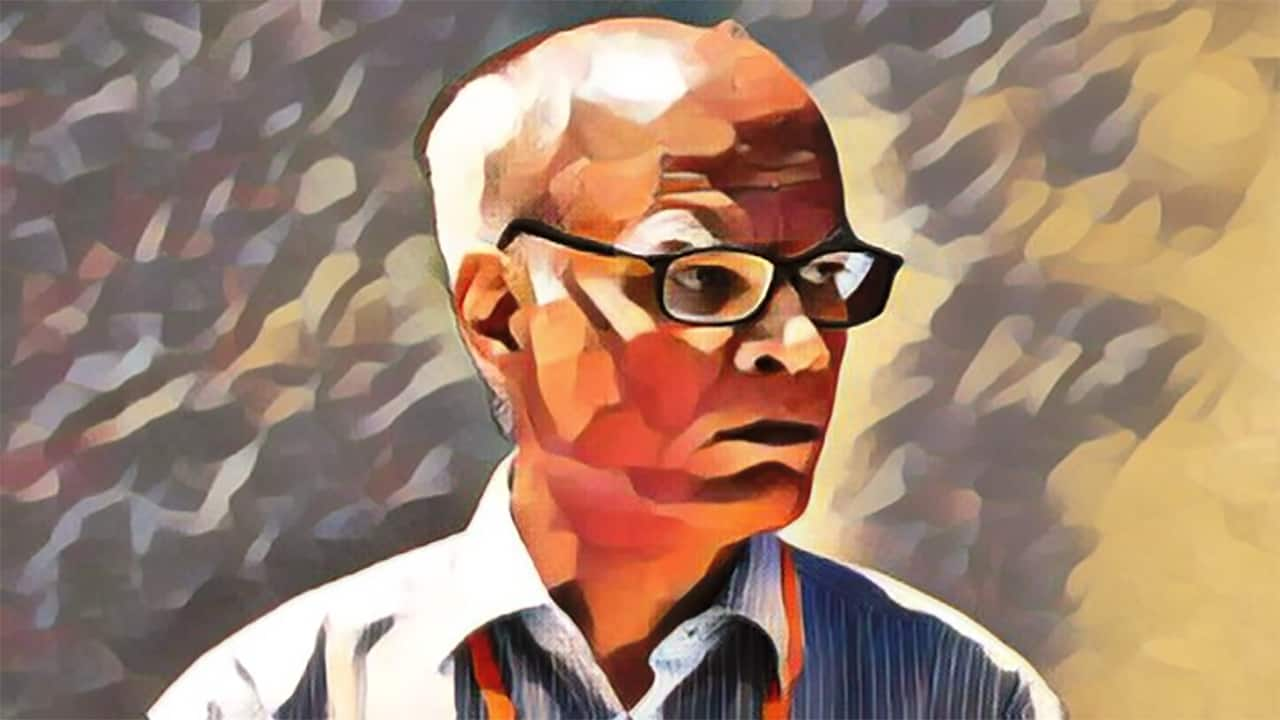

Macro Minutes Podcast | The economic impact of second Covid 'surge' will not be as large as the first one: Chief Economic Advisor

Speaking on the latest episode of “Moneycontrol Macro Minutes” podcast, Subramanian said that the government had been deliberately conservative in its forecasts for the current financial year. While not ruling out an economic intervention like last year should the need arise, Subramanian said any further measures announced would likely be on the fiscal support and capital expenditure side.

ECONOMY

2020-21 indirect tax collections beat revised estimates by 8%: CBIC Chief

Out of the total provisional indirect tax collections, custom duty collections came in at Rs 1.32 lakh crore, excise and service tax collections came at Rs 3.91 lakh crore, while the net GST collection for the centre stood at Rs 5.48 lakh crore.

BUSINESS

Direct tax collections in FY21 at Rs 9.45 lakh crore, higher than revised estimates: CBDT

Out of the total provisional net direct tax collections, around Rs 4.57 lakh crore have been garnered in corporate taxes, Rs 4.71 lakh crore in income tax, and around Rs 17,000 crore in Securities Transaction Tax. Mody said the net direct tax collections were 10 per cent lower than 2019-20.

ECONOMY

India unlikely to go along with US' global minimum corporate tax proposal

The feeling in the government is that Yellen’s statement stems from the United States’ ‘one-shot’ approach to providing stimulus in face of the Covid-19 pandemic, which is opposed to India’s response, which has been more deliberate and has focused on the credit and fiscal side of things.

ECONOMY

Data shows economy well-poised to deal with second COVID wave; but concerns remain

While data points like GST, housing and vehicle sales indicate that the economy is still on a strong path to recovery, industrial production and manufacturing sentiment numbers show that there is still a cause of concern. As COVID numbers spike again, Moneycontrol takes a look at some key high-frequency data.

ECONOMY

Major reshuffle in Finance Ministry as Tarun Bajaj shifted to Revenue Department; Bangalore Metro chief is new economic affairs secretary

Ajai Seth’s appointment as economic affairs secretary raises questions as to who will be designated as the finance secretary. Seth, Expenditure Secretary TV Somanathan and DIPAM Secretary Tuhin Kanta Pandey are all from the 1987 batch.

ECONOMY

Economy better equipped to deal with second Covid-19 wave, says Finance Ministry

"As the vaccination drive continuously upscales in India and guided by the learnings of India’s successful management of pandemic during its first wave, India is now well armed to combat any downside risk posed by the recent surge in COVID-19 cases," the Department of Economic Affairs said in its economic report for March.

ECONOMY

Oversight, competent authority and other fine details of the flip-flop on small savings rate cuts

Whose oversight was it anyway? What is the process followed by government departments in clearing crucial decisions?

BUSINESS

Government gives Monetary Policy Committee unchanged inflation target till FY26

While the official gazette notification is still awaited, this means that the Monetary Policy Committee now has the mandate to take steps under monetary policy and inflation targeting frameworks to keep consumer price index-based inflation in the 2-6 per cent range from 2021-22 till 2025-26.

ECONOMY

Govt to borrow Rs 7.24 lakh crore between April and September

For the current financial year (2020-21), the gross borrowing estimate was revised to Rs 12.8 lakh crore as against the Budget estimate of Rs 7.8 lakh crore. However, Economic Affairs Secretary Tarun Bajaj said the Centre has borrowed a record gross Rs 13.70 lakh crore in 2020-21, while net borrowing was Rs 11.43 lakh crore.

ECONOMY

EXPLAINED | The 2013 Taper Tantrum and why its spectre is being raised again

In 2013, as the world was coming out of a global financial crisis, the United States Federal Reserve said it would gradually reduce quantitative easing instituted after the Lehman Brothers bankruptcy in 2008. This would involve slowing the purchase of treasury bonds and hence reducing the money being pumped into the US economy.

ECONOMY

EXCLUSIVE | Finance Bill makes future IIFCL-NBFID merger exempt from capital gains tax

Though any decision on a possible merger will be taken by the boards of IIFCL and yet-to-be-formed NBFID, this indicates that the central government would be keen on such an amalgamation.

ECONOMY

Amended Finance Bill passed in Lok Sabha, gives 10-year tax holiday to new infra bank

Replying to the Finance Bill debate, Nirmala Sitharaman said that the central government is ready to start discussions on bringing petrol and diesel under Goods and Service Tax if the states are on-board for talks as well.

ECONOMY

Govt to hold 100% stake in NBFID at formation, reduce it to 26% later

The National Bank for Financing Infrastructure and Development (NBFID) Bill says the aim of the institution will be to support the development of long-term non-recourse infrastructure financing in India.

ECONOMY

Cabinet clears bill for new Development Finance Institution

The DFI is part of the government’s push to create jobs and boost demand through a nationwide infrastructure push. The plan also includes a capital expenditure target of Rs 5.54 lakh crore for 2021-22, compared with a revised estimate of Rs 4.39 lakh crore for 2020-21.

ECONOMY

Exclusive | Centre may give unchanged inflation targets to RBI’s Monetary Policy Committee

It is learnt that the RBI and the finance ministry are on the same page regarding keeping the targets unchanged. In fact, in late February, the RBI said in a report that it favours keeping the current inflation targeting regime unchanged, saying it has been effective in containing price-growth.

COMPANIES

Petrol, diesel under GST: Centre keen to discuss possibilities with states

While FM Nirmala Sitharaman said that there is no concrete proposal, Moneycontrol has learnt that the Centre would like to start discussions with states. Policymakers in Finance Ministry acknowledge it will be a long process to implement what they consider an 'overdue reform'

BUSINESS

India's GDP expected to grow by 11% in FY22: Crisil

Crisil expects GDP growth to average 6.3 per cent between fiscals 2022-23 and 2024-25, which would be lower than the 6.7 per cent average growth seen in the decade preceding the pandemic.

ECONOMY

India’s infra push won’t succeed without reducing NPAs in sector: Chief Economic Advisor

Krishnamurthy Subramanian’s views echo that of RBI Governor Shaktikanta Das. In July 2020, Das had said a big push for mega infrastructure projects could reignite the economy, but banks saddled with infra-related NPAs, may not be best placed to finance these projects.

BUSINESS

Explained | The Centre's Rs 2.5 lakh crore asset monetisation policy

Since 2018-19, plans to monetise the assets of the government and PSUs across the board, from key gas pipelines, power transmission lines and sports stadia to office spaces, land and apartments deemed surplus to requirements, have been taking shape. They were finally spelt out by Finance Minister Nirmala Sitharaman in her 2021-22 Union Budget

ECONOMY

Surge in COVID-19 cases poses downside risks to growth: Finance Ministry

The 'Monthly Economic Review' for February also stated that higher-than-expected subsidy outlay in 2020-21 has led to real GDP contraction projections to be larger than that of real GVA, an unusual occurrence in itself.

BUSINESS

EXCLUSIVE | Government looks to kick off FY22 privatisation programme with BPCL, Air India

The finance ministry’s Department of Investment and Public Asset Management (DIPAM), the nodal body for divestment, is confident that the privatisation of BPCL and Air India can be completed by late-first quarter or early second quarter of FY22.

BUSINESS

EXPLAINED | Why the NSO has widened India's FY21 GDP contraction forecast

One of the reasons why the government now sees a contraction of 8 percent in FY21, compared to 7.7 percent forecast earlier, is the general government's own estimated lower contribution to economic activity compared to what was forecast earlier.