BUSINESS

Rain industries Q4 CY18 review: Business in transition; accumulate on dips

BUSINESS

What explains a relatively steady show by the FMCG companies?

BUSINESS

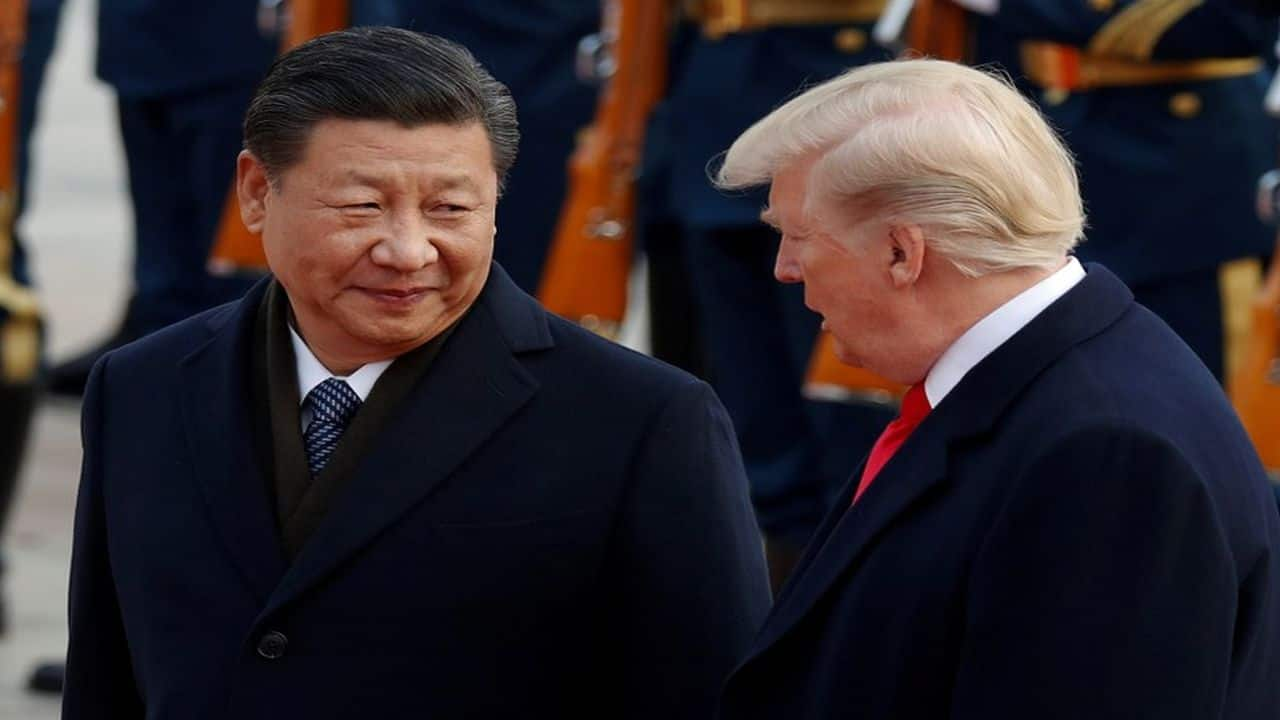

US-North Korea summit: Concrete steps on transparency in denuclearisation needs a close watch

Meet has been cut short, there appears to disappointment on a time bound denuclearization and transparency with respect to same. Asian markets, at the time of writing has turned negative and KOSPI is trading 1.8 percent lower today.

BUSINESS

Dabur: Strong execution aids in market share gains, accumulate

BUSINESS

FMCG is a bright spot in consumption; how investors can play this theme

We continue to prefer companies that focus on distribution reach, and deploy internal accruals to invest behind their brands. A sustainable way of doing the latter is deploying internal accruals such as cost savings and utilizing super normal profit from other product groups.

BUSINESS

Key risk to monitor for global & Indian markets

BUSINESS

New contract cycle and raw material sourcing holds promise for re-rating of Alufluoride

BUSINESS

Aarti Industries: Multi-year contracts makes it a partner of choice for global majors; accumulate

BUSINESS

Correction makes Graphite electrode stocks attractive; accumulate

BUSINESS

First Cut | Emami’s stake sale to alleviate key investor concern, re-rate FMCG business

BUSINESS

Ideas for Profit | Aarti Industries: Strong domestic demand, China factor aids earnings outlook; accumulate

BUSINESS

First Cut | Potential KKR- Emami deal can help re-rate the FMCG business

BUSINESS

Buy graphite electrode stocks for the long haul

BUSINESS

Britannia Q3FY19 review: Recent moderation needs to be watched; accumulate on declines

The stock is currently trading at an elevated multiple of 54x FY20 estimated earnings compared to its own history and FMCG universe.

BUSINESS

Balaji Amines Q3FY19 review: Input price volatility hits volumes; accumulate on staggered basis

On a longer term we remain positive on company’s strategy with respect to new product capacities (Greenfield project: revenue potential of Rs 450 crore in FY23), import substitution strategy along with strong technical execution capabilities. Further we take solace from the fact that demand in end markets in which company operate are stable.

BUSINESS

NOCIL Q3 review: Weak end market weighs on volume but margins to remain stable

BUSINESS

Central banks create space for growth; event risks keeps market on tenterhooks

Series of stance changes from the global central banks and RBI, along with sudued commentary on inflation creates a timely monetary policy space for growth. We expect financial market conditions would also ease out as the event risks gets mitigated. However as we go closer to deadlines 1st March (Trade truce) and (29th March) Brexit and end game plays out – volatility will remain elevated.

BUSINESS

Dabur: Enhanced growth prospects, accumulate

The stock had corrected significantly (down 25 percent from 52-week high) after the management’s Q2 commentary on rural outlook.

BUSINESS

First Cut | Britannia Q3 FY19: Steady execution but recent demand slump a concern

Q3 results indicate Britannia is reaping benefits of beefing up distribution, addressing gaps in product portfolio and implementing cost efficiency programmes.

BUSINESS

Himadri Speciality Q3 review: Volumes may pick up gradually; accumulate in a staggered manner

BUSINESS

Tata Global Q3 review: Price hike in select brands and improving global biz are key positives

Key challenges for the company remains in terms competitive intensity in the mass market. Having said that price hike taken by the company for three key domestic tea brands provides some solace.

BUSINESS

Marico Q3 review: Gross margin gains to be deployed for growth of new categories; buy on dips

For FY20, Marico has guided at 10 percent volume growth for its India business and over 18 percent EBITDA margin. In constant currency terms, the international business should continue its double-digits growth

MONEYCONTROL-RESEARCH

First cut | Tata Global Beverages Q3: Pricing pressure, lower contribution from associates hurt earnings

The consolidated net profit for Q3 was lower mainly due to a deferred tax credit of Rs 53 crore recognised in Q3 FY18.

BUSINESS

Alufluoride: A small cap with a unique proposition

the current valuation keeps us positive as the stock is trading at 3.6 times estimated earnings for FY21 (EV/EBITDA of 3.2 x for FY21), which is at a discount to the non-ferrous sector