Anubhav Sahu

Moneycontrol research

Highlights:

-Central banks get cautious on global growth; getting neutral to accommodative

-RBI’s rate cut well in time; inflation adjusted rate differential still favorable-Brexit and Trade war – end game is on – volatility to remain elevated

Bank of England's (BoE's) earlier assessment that global slowdown and Brexit uncertainties dampen UK's near term growth outlook was all in numbers yesterday –2019 growth forecast downgraded to 1.2 percent from 1.7 percent earlier. Though it still assumes an orderly Brexit but given the elevated uncertainty, trade to the UK gets reduced as the Brexit deadline is just 49 days away. Clearly, Brexit outcome can swing the forecast either side, significantly.

The Reserve Bank of Australia (RBA) continued with similar commentary on global growth slowdown this morning with GDP downgrade to 2.5 percent (from 3.25 percent) for 2019 (June ending). In the case of Australia, slowdown is particularly moderated by weak Chinese domestic demand along with the decline in property market.

Clearly, global banks have joined the chorus underlining even more emphatically than the Federal reserve about global slowdown partly triggered by trade war and the Brexit uncertainty.

Where are we on the geopolitical risks?

On Brexit – Since May’s defeat on Brexit deal, there has been a cautiously optimistic scenario with an expectation that a better deal would be struck. May survived no-confidence motion and the negotiations with the European commission is scheduled. Focus is on bringing more clarity and acceptance for the Irish backstop.

Pls also read: Brexit in limbo

Though Article 50 can be amended which can extend the Brexit deadline from March 19, currently uncertainty continues to dampen trade and investment. However, recovery in pound sterling after an initial dip after the BoE announcement suggest currency market is penciling in a better negotiated deal.

Weighing on fragile market sentiments, Trump ruled out meeting Xi Jinping before the trade true deadline, effectively ratcheting up pressure on China to come to terms with the USA on contentious issues.

Having said that, trade talks are on course. Both sides claim progress with next round is planned for next week when Robert Lighthizer, the US trade representative, and Steven Mnuchin, the US Treasury secretary, are scheduled to visit Beijing.

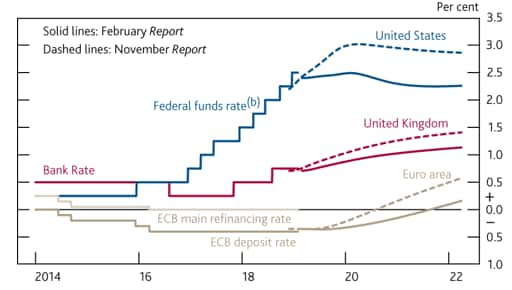

Global interest rate normalisation trajectory has moderated

In the backdrop of global slowdown and changing stance, market expectations for the global interest rate trajectory has moderated. In the case of Federal Reserve, it has already indicated that policy rate is within neutral rate range, other banks have also drawn to a neutral stance. This is important because part of the global slowdown is also attributed to steep tightening – particularly in the USA.

A monetary policy pause in developed countries and an accommodative stance in Emerging Markets (EM) could be the antidote---a reduced cost of capital--that financials markets are looking for.

Further, the US 10-year yield has clamped down to 2.64 percent – 60 bps decline from the Nov high. Term premium with the US 5-year yield sustains at 20 bps keeping the yield inversion scenario at a distance.

Chart: Market-implied paths for interest rates have declined

Sources: BoE, Bloomberg, ECB and Fed

Additionally, in terms of the fund flows, the case is incrementally positive for India. Even after adjusting for yesterday’s rate cut, inflation adjusted interest rate in India are favorable compared to the US. And in that context, RBI’s move to shift from calibrated tightening to neutral stance seems well in time. Decline in Indian 10-year yield has been marginal due to concerns about the government's fiscal slippages and accompanying large supply of government paper.

Also read: Second half of 2019 will be better for risk assets

Nevertheless, a series of stance changes from the global central banks and RBI, along with subdued commentary on inflation creates a timely monetary policy space for growth. We expect financial market conditions to also ease out as the event risks gets mitigated. However, as we go closer to deadlines -- trade truce on March 1 and Brexit on March 29 end game plays out – volatility will remain elevated.

(Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.