Highlights: - Volume growth in the FMCG sector is in contrast to a slowdown in discretionary demand - Even in FMCG, competitive intensity is visible at low-priced segments - Superior growth is attributable to reach and the fading threat of Patanjali -------------------------------------------------

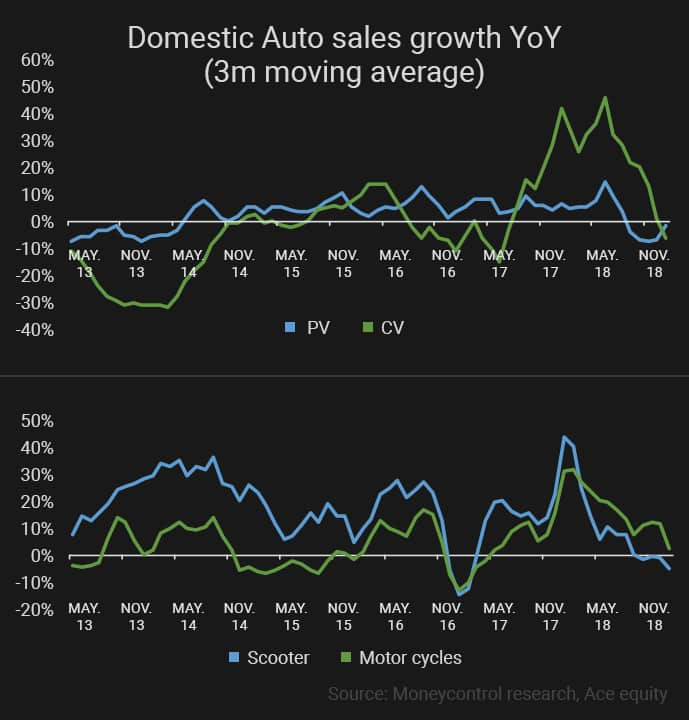

In recent months, there has been a noticeable slowdown in discretionary consumption. Automobile sales growth across categories has been lacklustre since Diwali. A macroeconomic slowdown, rural distress, sluggish rural wage growth and abysmal farm income have been blamed as the main culprits. Additionally, a change in the business dynamics of the non-banking finance companies (NBFCs) led to a moderation in credit availability for consumer purchases. But when we look at the other end of the consumption spectrum of staples, the steady volume growth appears intriguing.

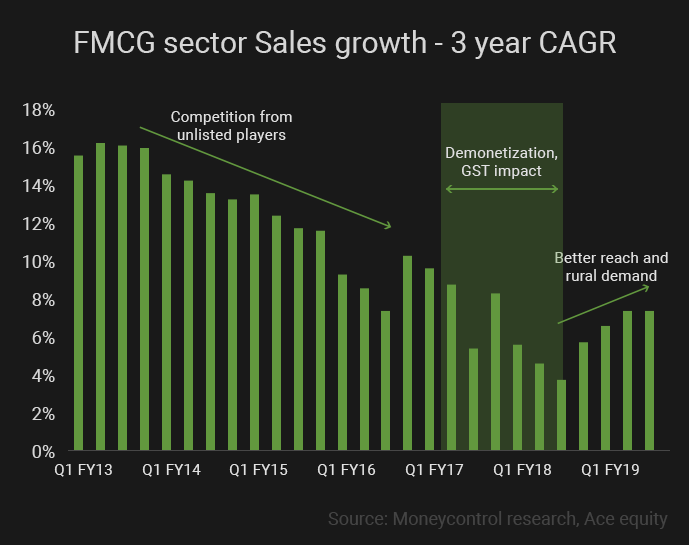

A look at Q3 FY19 results for major FMCG companies show that volume growth has been steady for most companies. The sector appears to have successfully tackled the challenges of GST implementation (Q1 FY18) and demonetisation (Q3 FY17). One reason why FMCG goods may be doing better compared to discretionary goods is that their sales are not dependent on easy availability of institutional credit.

Additionally, some of the discrepancy between demand growth numbers for four-wheelers and consumer goods such as soaps could be more fundamental — relative demand stickiness for the latter. Demand for FMCG goods, particularly staples such as food grains, is relatively inelastic.

![]()

However, look beyond robust headline volume growth and one finds weak consumer sentiments are making an appearance. Customers are trading down to cheaper products. There is growing competition in the market for low-priced variants. For instance, though Marico posted decent volume growth of nine percent (Q3 FY19) in coconut oil for its flagship brand (Parachute), sales of low-margin brands (Nihar Naturals and Oil of Malabar) were affected due to higher competitive intensity from companies such as Dabur. In oral care Dabur’s low priced Babool continues to face high competitive intensity, and Colgate’s profit margin on smaller or low-priced packs came under pressure.

Moderation in management commentaryWhile the growth numbers of FMCG companies were good, the bullishness in management commentary on outlook for growth has begun to moderate. In the September quarter, Bajaj Consumer Care highlighted a slack in wholesale pick up and Dabur underlined rural growth moderation. In the December quarter, Dabur mentioned that relative rural demand growth (versus urban), adjusting for modern trade, is about two percent which is lower than historical average of 3-4 percent. Further, Emami estimated just a tad higher relative growth in rural areas and Britannia noted demand moderation in recent months.

Still, the aggregate sales growth of the FMCG sector in recent times is impressive. This is better understood if take a longer time period. During CY13-16, there was a noticeable deceleration in the sales growth of listed FMCG companies – a key reason was heightened competitive intensity from new companies that included Patanjali Ayurved.

Read: FMCG lurches between lofty valuation, low growth and Baba Ramdev

Demonetisation and implementation of the Goods & Services Tax affected topline growth, as it adversely affected both supply and demand side temporarily. Subsequently, companies which were better placed in terms of product positioning, distribution reach and cost savings utilised the opportunity to regain lost ground.

Improving response time in Supply chain - HUL

In the last couple of years, HUL has invested on developing its naturals category (Lever Ayush). It streamlined its supply chain, helping it improve reach and response. For instance, in Q3, the company’s winter portfolio displayed better execution than peers despite a delayed and harsh season. Dabur recouped market share in health supplements and displayed stellar performance in higher priced units of its oral care brands.

Listed companies, in particular, were helped as the aggressive marketing push by Patanjali abated in the past two years. However, higher competitive intensity from unlisted companies continues in few other categories such as beverages (tea, juices) and household insecticides.

Key criteria: Investment behind brands and reachWe expect mid to high single-digit domestic volume growth to sustain for the FMCG sector as companies consolidate their direct distribution reach and grow their share of modern trade and e-commerce channels.

The government’s policy measures that are focused on rural areas should aid consumption growth. We continue to prefer companies that focus on distribution reach and deploy internal accruals to invest behind their brands. A sustainable way of doing the latter is deploying internal accruals such as cost savings and utilising super normal profit from other product groups. For instance, ITC and Marico deploy such cash profits from cigarettes and Parachute Oil, respectively, to expand revenue in other product categories. Considering all these factors, we prefer HUL, Dabur, ITC and Marico at current levels.

Follow @anubhavsaysDisclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed hereDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.