Highlights: - Fifth consecutive quarter of double-digit volume growth - Growth continues to be led by demand in rural areas - 1.3 times urban - Raw material price volatility needs a close watch - Recent M&As execution to seep into restructuring cost in coming quarters -------------------------------------------------

As a mark of consistent execution, Hindustan Unilever (HUL) delivered another good set of numbers led by volume growth in Q3 FY19.

Key positives - Domestic sales growth of 13 percent YoY was aided by a volume growth of 10 percent despite a high base of 11 percent in Q3 FY18.

Volume growth

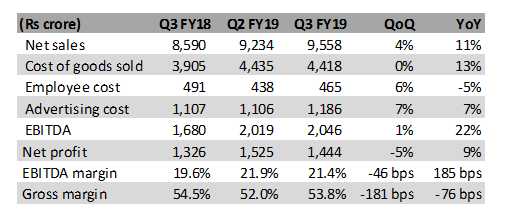

Result snapshot

- Growth continues to be led by demand in rural areas - 1.3x of urban areas in Q3

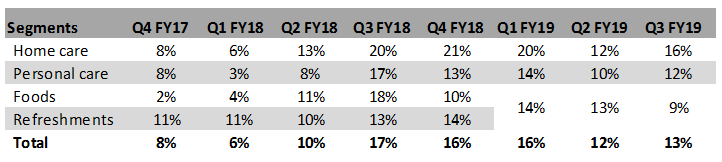

- All the three divisions posted near double digit sales growth on YoY basis, making it fifth such consecutive quarter.

Divisional performance  Source: Moneycontrol Research, Company

Source: Moneycontrol Research, Company

- Further, strong performance was witnessed in Personal care division. Here, Winter portfolio, particularly, in skin care range displayed good execution. Further, in case of home care, fabric wash performance benefitted from the premiumisation trend while household care was aided by increase in rural reach

- Operating margin improved on account of better product mix, operating leverage and cost rationalisation. Company derived EBITDA margin improvement to the tune of 140 bps YoY on comparable basis after accounting for some reclassification of categories

Key negatives At the gross margin level there was a contraction which reflects an impact of higher crude oil linked cost in the quarter gone by. Another related factor, is the pricing strategy, which is not easy to call out for the moment due to volatility in raw material prices.

Further, management guided that in coming quarters as the company move ahead on recent M&A deals, some restructuring cost would creep in as an exceptional item.

Another point one needs to keep a watch on pertains to the Naturals portfolio. Management highlighted that traction in this category is not even and North India is lagging behind South India.

Other observations Company is re-strategising purifiers business wherein it is focusing on premium business and phasing out rest.

Oral care performance seems to be improving in north and central India. This is the second consecutive quarter of performance with perceptible improvement restricted to North. While it’s difficult to say at this stage if there is any market share gain but implicitly it gives credence to Dabur’s success in South India.

Next lever of growth - execution of inorganic opportunities We are enthused by the volume led growth coming on a high base. However, in the near term, we think one needs to closely watch for pricing growth, which was a shade lower than expectations. It possibly reflects upon recent moderation in cost inflation.

Since GST implementation, company has displayed a strong agility in bringing its supply chain and product innovation into action. This has benefitted it in capturing any demand led consumption growth and avoiding any opportunity lost due to supply constraints. Additional lever which has helped the company is its investment behind brands and visibility (Advertising cost at 12.4 percent of sales). We are also encouraged by company's recent M&A deals and expect that company’s emphasis on food and refreshments business could be next strategic growth lever. Having said that there would be a gestation period of 5-6 quarters before a reasonable synergistic benefits accrue.

Now as far as the stock is concerned, after having a decent run from the October lows it has recently consolidated and hence provides an opportunity to accumulate. It currently trades close to 44x FY21e earnings after including benefits arising from the GSK Consumer Healthcare India deal recently. We expect company’s premium valuation to sustain as it factors in innovation profile, limited volatility in earnings and strong execution capability.

Follow @anubhavsaysDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!