Anubhav Sahu Moneycontrol Research

Highlights: - Strong volume-led growth with rural leading from the front - Strong and sustained comeback in ayurveda/naturals’ products - More categories contributing to revenue growth is helping earnings - Keep a close watch on beverages and international business - Outlook for volume growth, should be in high single digits on a strong base -------------------------------------------------Strong volume growth trajectory and rural contribution Dabur’s domestic business (72 percent of sales) growth continues to benefit from broad-based volume growth. In the December quarter, sales were helped by 12.4 percent YoY volume growth, coming on top of a growth of 13 percent in the year ago period. Its performance was similar to that of market leader Hindustan Unilever. The effect of price change contributed 2.5 percent to sales growth, which was also higher than in earlier quarters.

FMCG sector volume tracker  Source: Company, Moneycontrol Research.

Source: Company, Moneycontrol Research.

Rural growth continues to be healthy. Rural growth in the general trade channel remains ahead of urban growth, with a gap of 3-4 percentage points. Adjusting for modern trade, rural growth is still ahead of urban markets by about 2 percent. The management expects high single-digit volume growth should continue, which can increase to double digits if the government’s rural policy measures materialise.

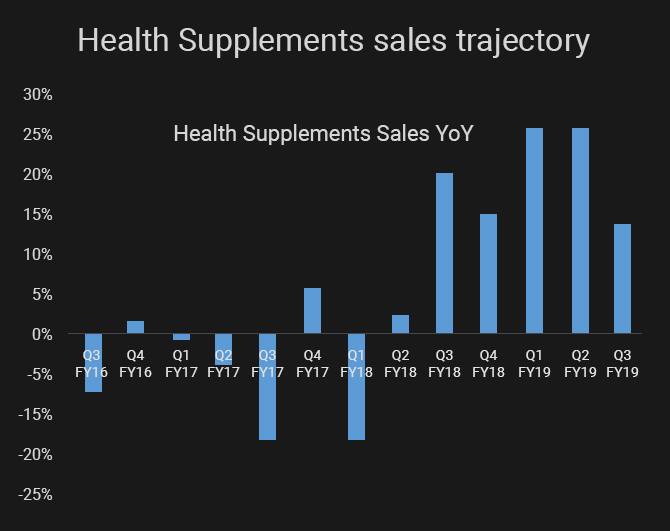

Naturals are a formidable defence Competitive intensity has decreased in some categories in the past few quarters, where Patanjali was a core challenger. In healthcare (36 percent of sales), Dabur's sales rose by 16 percent, led by double-digit growth in Chyawanprash and honey. In fact, sales of health supplements, as per our estimates, are past their historic peak level of sales suggesting a recouping of market share loss to a great extent.

Health supplement sales  Source: Company, Moneycontrol Research.

Source: Company, Moneycontrol Research.

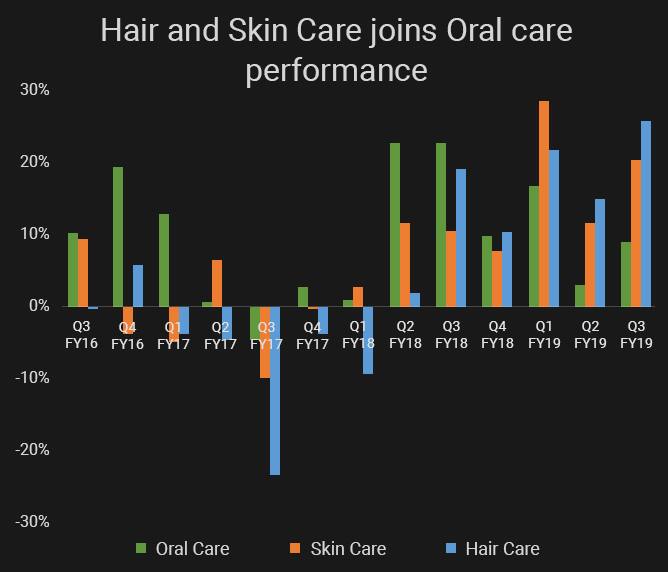

Personal care growth was driven by a number of categories Home and personal care segment (47 percent of sales) grew well by 16.3 percent YoY (Q3 FY19) aided by hair oil market share gains and a stellar showing in shampoos. Over the past few quarters, there has been a strong performance across categories and not just in oral care. The two-year CAGR of these categories – hair, skin, oral care- are in mid to high teens. Hair care stands out as a category that has made a good comeback over a longer timeframe.

Within oral care, Red Toothpaste sales (two-thirds of toothpaste category) continued to show a strong growth momentum. The last three to four years was a phase in which Patanjali Ayurved's aggressive strategy led to growth in the naturals category. Dabur gained market share from HUL and Colgate.

However, low-priced Babool continued to face high competitive intensity. Takeaways from Colgate results also suggest margin pressure for low grammage/low priced packs. Going forward, a new toothpaste launch on the naturals platform is awaited.

Hair and skin care joins oral care performance  Source: Company, Moneycontrol Research.

Source: Company, Moneycontrol Research.

Beverages division gives some cause for concern The beverages segment (foods category constitute 22 percent of sales) has been affected by high competitive intensity, which is being countered by giving trade offers and new products. Beverages grew by 11.5 percent, lower than expected, due to severe winter in Northern India and higher trade promotions by competitors. The company expects a sequential improvement but margins may get affected.

On international business and input costs The international business (28 percent of sale), with constant currency growth of 1 percent YoY, was affected by currency movement and weak performance in the MENA region. There were weak sales in Europe due to pricing issues with distributors.

Another sore point was weaker gross margins (decline of 126 bps YoY for the India business). However, management expects a sequential improvement in margins, despite higher advertising expenses as input prices have softened in the current quarter.

Stock outlook We remain constructive on the stock. The intertwined factors of distribution reach (direct reach of one million outlets) and rural exposure (around 45 percent of sales) will benefit the company. Dabur will be a key beneficiary of the government’s rural focus that is giving birth to schemes targeted at this population.

The stock had corrected significantly (down 25 percent from 52-week high) after the management’s Q2 commentary on rural outlook. Since then it has rebounded and trades in a range bound manner at a 40x of FY20 estimated earnings, on the back of an improving outlook. If we assess its prospects over a longer period, we remain positive about Dabur’s successful execution of product-wise business strategies, which help in gaining or even defending market share.

In the past few quarters, we have seen broadening of growth drivers and hence the stock can be accumulated on a staggered basis.

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.