Anubhav Sahu

Moneycontrol Research

Highlights:

- Beneficiary of strong domestic demand for specialty chemicals

- China disruption favourable for pharmaceutical segment

- Revenue visibility on account of multi-year contracts with chemical majors

- Robust capex programme (Rs 2,100 crore) over the next three years

-------------------------------------------------

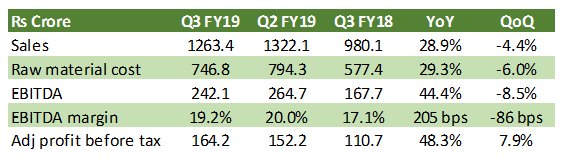

Aarti Industries, the leading aromatic chemicals manufacturer of India, posted yet another strong operational performance in Q3. The company witnessed strong revenue growth (29 percent year-on-year) led by higher domestic sales, better capacity utilisation and higher share of value added products.

Result snapshot

Source: Company

Key positives:

- Revenue growth was driven mainly by higher domestic sales growth (35 percent), implying rising domestic demand as end-customers (chemical companies) are focusing of import substitution. Domestic sales now contribute 60 percent to sales mix

- Exports have performed well, with over 21 percent sales growth

- Specialty chemicals (80 percent of sales) saw 31 percent growth led by better pricing

- Pharmaceutical division (15 percent of sales) witnessed strong growth (23 percent) as well, aided by higher share of value adds such as xanthene derivatives and opportunity from disruption in China. Sequentially, there was a sharp improvement in operating margin due to operating leverage

Key negatives:

- Adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) margin of 19.2 percent, was 205 bps higher YoY but declined sequentially. Volume growth in specialty chemicals was 4 percent, which is lower than the run rate seen in recent times (8-9 percent)

Key observations:

- On the capex front, the management continues with a cumulative plan worth Rs 2,100 crore for three years (FY19-21). This includes upfront investment towards multi-year contracts with global agrochemical companies, investment in downstream products and pharma division

- The company is also expanding its nitrochlorobenzene (NCB) capacities to 108,000 tonne (currently at 75,000 tonne), which would be commissioned in two phases. Phase I would be completed in FY20, followed by Phase II in FY21. This will cater to domestic demand and would be utilised for captive needs

- The company’s current NCB capacity utilisation stands at 90 percent. Further, its relatively new nitrotoluene plant is also witnessing higher utilisation: 53 percent in Q3 versus 50 percent in H1 FY19

- It is also setting up an R&D centre (Navi Mumbai) at a cost of Rs 75 crore

In the last one year, the company has bagged multi-year contracts from a global agrichemical company (valued at Rs 4,000 crore) and a chemical conglomerate (Rs 10,000 crore), positioning the company as a partner of choice for sourcing chemical intermediates. In contract with a global agrichemical company, Aarti would supply an agrochemical intermediate for 10 years starting H2 FY20 (earlier planned for H1 FY20). In the latter contract, the management would provide chemical intermediate for a period of 20 years, starting Q1 FY21.

OutlookThe quarterly result has been broadly as per our expectation. We continue to expect double-digit volume growth for specialty chemicals in the near term, aided by capacity expansion and higher domestic demand. Product pricing for few chemicals might witness some moderation as the company passes through benefit of lower benzene prices seen recently. However, segmental operating margin is not expected to be impacted adversely. Incidentally, working capital cost might taper down in the near term.

On the other hand, the pharma segment should continue to benefit from higher product pricing due to ongoing disruption in the API (active pharmaceutical ingredient) market of China.

After the recent decline, the stock is trading at reasonable multiples (21/17 times FY20/FY21 estimated earnings, respectively), factoring in estimated EBITDA CAGR (FY18-21) of about 24 percent.

We continue to believe that higher multiple assigned by market participants takes account of global scale of operations, wider product offerings and stable revenue visibility on account of multi-year contracts with some of the global chemical companies. Additionally, decision to hive off (by FY19-end) its loss-making home and personal care segment (5 percent of sales) also augurs well for valuation.

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!