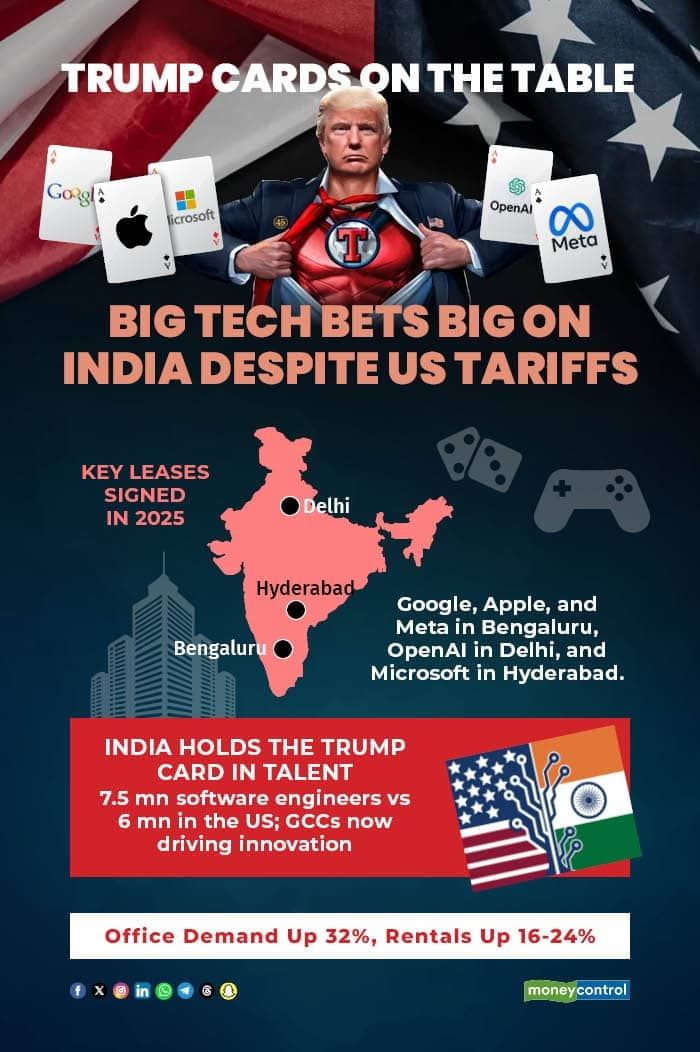

Despite rising trade tensions and tariff talk in the US, American tech giants like Google, Apple, Meta, Microsoft and OpenAI are ramping up investments in India. From major office leases in Hyderabad and Bengaluru to new engineering hubs and AI partnerships, India is quickly becoming a critical part of their global expansion plans.

"They're not able to get an adequate number of highly trained people in the US, so they come to India. They want innovation, they want to do things faster," said TV Mohandas Pai, former Infosys board member and startup investor told Moneycontrol.

India has 7.5 million software engineers compared to six million in the US, and nearly 50 percent of revenue is generated outside of the US, Pai added.

While trade and tariff policies are shifting, companies are mindful of the risks, according to global management and strategy consulting firm Zinnov. But the need to stay competitive often outweighs waiting for certainty.

“As companies take a more conservative approach globally, they must still innovate faster and deliver better-quality products at lower costs—and that requires access to the best talent,” said Namita Adavi, Partner, Zinnov.

In 2025, Big Tech’s India expansion has been highlighted by a string of high-profile office deals and investments worth billions of dollars.

India's Talent trump card

In August, OpenAI announced plans to open its first India office in New Delhi later this year.

Earlier in the month, Microsoft leased 2.65 lakh sq. ft. of prime office space in Hyderabad, with a monthly rent of about Rs 5.4 crore. In July, Apple inked a 10-year lease for office floors in Bengaluru worth over Rs 1,010 crore.

At the beginning of the year, Facebook parent Meta announced that it is opening a new office in Bengaluru and hiring for engineering and product roles in the country’s tech capital.

And in April, Google unveiled its new Bengaluru campus, Ananta, one of its largest offices globally.

Together, these landmark moves show the long-term bets Big Tech is making on India’s talent and infrastructure.

According to Zinnov, the talent base in India is not just large, but highly relevant: applied AI, model training, data engineering, and enterprise-scale deployment.

Making GCCs Great in India

Pai also pointed out that Global Capability Centres (GCCs) in India have matured rapidly, now handling core intellectual property and advanced R&D. “This is no longer about outsourcing low-end work,” he explained.

A GCC is a captive unit set up by a company to carry out information technology (IT) and related business functions. GCCs in India are set to contribute roughly 3.5 percent of India’s GDP by 2030, generating an estimated revenue of $121 billion by then.

India had more than 1,700 global capability centres (GCCs) and their export revenue rose more than 40 percent from the previous year to $65 billion in the FY24. The fast-growing sector employed over 19 million people during the period, according to a report released by IT industry body Nasscom and consulting firm Zinnov, terming India as the GCC Capital of the world.

Big techs heat up office leasing

The rush of Big Tech expansion has driven up the office leasing market.

“US companies leased close to 65 million sq. ft. between 2022-24, accounting for over 32 percent of India’s total office demand,” said Anuj Puri, Chairman of property consultant ANAROCK Group. “Bengaluru and Hyderabad alone accounted for nearly half of this demand.”

The surge has pushed up rentals as well.

“Between 2022–2025, Hyderabad saw a 24 percent increase in commercial rents and Bengaluru 16 percent,” Puri said. “Even with 25 percent new supply coming in, vacancy levels are falling and landlords still hold the advantage.”

Preferred business districts reflect a mix of connectivity, infrastructure, and talent. In Bengaluru, Outer Ring Road, Electronic City, and Whitefield dominate, while in Hyderabad, HITEC City and Gachibowli remain the most sought-after.

Cities like Pune and Chennai are not far behind – specializing in automotive software, semiconductors, and enterprise platforms. Then there’s the slow but steady rise of Tier-II hubs, wherein cities including Coimbatore, Kochi, and Ahmedabad are gaining traction as part of distributed workforce strategies, especially as companies experiment with hybrid models and seek to diversify risk.

“The story ahead is not about one city dominating—it’s about India evolving into a multi-hub GCC destination, with cities like Bengaluru and Hyderabad as the twin pillars and smaller cities plugging into the map,” Zinnov’s Adavi said.

Trumping the Competition

Some worry that Big Tech’s hiring binge could squeeze India’s IT services firms and startups, but Pai dismisses the concern.

“There will not be a talent war. The industry has a 12 percent attrition rate, which means 700,000 people move jobs every year. GCCs can absorb 300,000 of them without disruption.”

He added that India’s IT services firms have deep training and process capabilities to keep replenishing the pipeline. “This country is the only one outside China that can provide high-quality human capital at scale,” Pai said.

He added that while 95 percent of AI projects globally fail to deliver value, Indian IT firms are uniquely placed to implement and operationalise them.

The Long Game

Far from being short-term opportunism, Big Tech’s India play is a long-term strategic commitment.

“These companies are training engineers, embedding R&D, and in the process, creating the next wave of entrepreneurs,” Pai said, adding that many of Bengaluru’s most successful founders once worked at Amazon or Google.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.