Anubhav SahuMoneycontrol Research

Early today, North Korea fired a missile over northern Japan, sparking talk of an “unprecedented” threat. The hermit kingdom’s posturing has already strained relationships with its neighbours and the United States and might require the UN Security Council’s emergency response. Global markets are hurting: S&P 500 futures, Nikkei 225 and Kospi are down in the range of 0.5-0.6 percent at the time of writing.

While some of the global indices are at crucial technical supports, a risk-off scenario at this juncture may not be ruled out and we suggest investors to watch out for this and keep portfolios hedged.

This is the third such North Korean missile projectile over Japanese territory (previous ones in 1998 and 2009) but unlike previous attempts this one is not claimed to be for a satellite launch. This is the 80th missile test undertaken by North Korea during the regime headed by Kim Jong-un but none has been as provocative. In response, the global volatility proxy, S&P 500 VIX futures is up 7 percent to ~14, still short of long-term average of about 18.

Investors lowered expectations for a tail risk but this may change now

Interestingly, in the last fortnight, options data has been conducive. Unlike the middle of August, investors have cut down their expectations for a tail risk. CBOE SKEW Index, which maps tail risk, has tapered recently, partially owing to statements from US officials that Pyongyang is showing restraint. However, the new development could add to the risk once again.

Chart: CBOE SKEW Index has tapered recently

Source: CBOE, Moneycontrol research

Investor note: CBOE SKEW Index (SKEW) measures the deviation of S&P 500 return distribution from the normal distribution and its reading vary between 100 and 150. If the reading is 100 then the perceived distribution of S&P 500 log-returns is normal. However, if the SKEW reading is higher, it means probability of outlier returns (more than 2 std. dev) is higher.

Asset classes testing important support and resistance levels

Global asset classes are testing important support and resistance levels. Gold is nearing its multi-year resistance level at about 1,340-1,350. The US 10-year treasury yield is close to June 2017 support level and USD/JPY is testing an important support line (108.5) as well. While these are clear indications of risk-off gaining ground, if tension escalates the critical support level may be broken.

Jackson Hole: Central bankers hint towards improving global growth scenario

While the global risk events keep investors edgy, takeaways from the central bankers’ symposium in Jackson Hole are largely positive. ECB president, Mario Draghi stated that even if inflation remains low, euro area economy is gaining ground. IMF’s Chief Economist Maurice Obstfeld underlined that a global synchronized recovery is underway.

Source: Moneycontrol research

However, Central bankers highlighted that protectionist measures and dilution of regulatory standards can adversely impact growth. Seen in this context, policy actions coming from US administration would be keenly watched.

India: local risk event diffuse but global events can have repercussions

Back home, yesterday, Indian markets celebrated the defusing of a potential border clash with China in Doklam. USD/INR has broken an important psychological support of 64 in its appreciation path partly emboldened by flows due to increasing yield difference between Indian and US treasuries.

Yield differentials India 10 year and UST

Source: Moneycontrol research

FII selling has also tapered a bit but this might change again as global events shape up.

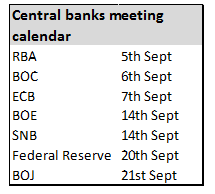

While Q1 2018 earnings are out of way, investors would focus on geopolitical risks, US legislative developments (debt ceiling debate), and monetary policy.

With overall valuation comfort in the market waning, investors have got to be choosy and take incremental exposure selectively in fundamentally strong businesses. Global events might open up interesting opportunities. Investors have got to wait patiently; in the interim, they should continue with portfolio hedging given the risk-off sentiments prevailing.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.