The price of bitcoin crossed the USD 3,000 a piece mark for the first time on major global price indices. As per the CoinDesk price index, the cryptocurrency topped at USD 3,041 and is trading at levels of USD 3,002 at the time of filing this copy.

The new record comes at a time when other cryptocurrencies -- altcoins -- are seeing robust global traction and ether (having the second highest market cap among cryptocurrencies) setting a new all-time high above USD 300.

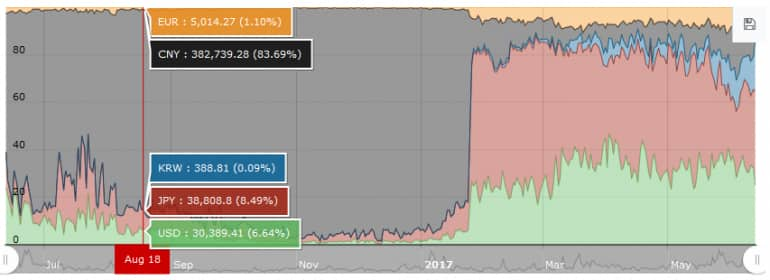

Bitcoin price chart:

Growing Acceptance

The price movement of bitcoin has largely been dependent on news. On good news, the price rallies, while bad news leads to a fall. Also, it is not just an economic currency tool but a technology as well. Hence, positive or negative development in the technology impacts the price.

As there has been growing acceptance of bitcoin in many countries, (Japan recently declared it as a currency) there has been strong demand from South Korea, Russia and India which are trying to understand and regulate it. Such positive sentiment and framing regulations around bitcoin rather than deeming it as illegal are the reasons whey there is a demand.

From the chart below, it is clear that till 2016, only China dominated the bitcoin market. Over 80 percent of trades were done over the Chinese Yuan (CNY).

With the growing acceptance and regulatory guidance from Japan (JPY) and South Korea (KRW), both these Asian countries have replaced the China as places where bitcoins are traded the most, as per the chart below.

Second, on the technological part, its development was stalled because of the Bitcoin faces 'civil war' that may split it into two, but it may be good for currency scaling debate . Now that is out of the way and SegWit has been adopted, the prices are seeing an up-move.

New kids on the 'block'chain

Compared to altcoins, bitoin has relatively underperformed this year. While the senior most digital currency has appreciated over 200 percent in 2017, the rally is still dwarfed by the likes of ether and ripple, both of which are up around 4000 percent year-to-date (YTD) and litecoin which has gone up around 700 percent (YTD).

The growing popularity of altcoins has replaced the dominance bitcoin once had on the cryptocurrency market space.

In January this year, bitcoin had a 87 percent market share which has now fallen to levels of 42 percent.

In the coming days, with growing awareness and acceptance of such blockchain based assets, the biggest change could continue to be the sharp decrease in bitcoin's dominance as altcoins capture a larger percentage of overall trading in a more diverse set of markets.

India scenario

In India, the demand for bitcoins is rising exponentially with Indians actively exploring bitcoins as an alternative investment option. Recently, the Indian government set up a committee to study virtual currencies including bitcoins and deliberate guidelines.

Commenting on the adoption of bitcoins in India, Sandeep Co-founder and Chief Operating Officer, Zebpay said, "Trade volumes at Zebpay are significant for India but still tiny compared to global trade volume of Rs 20,000 crores per day. Buoyed by positive industry growth, Zebpay has crossed 500,000 downloads and is adding 4,500 users every day."

"While it is encouraging to see growth in bitcoins adoption and scale, we are still at the tip of the iceberg vis-à-vis globally large trade volume. Nevertheless, we remain optimistic about the growth potential of bitcoin globally and in India as an emerging asset class," he adds.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!