Anubhav Sahu

Moneycontrol Research

Rain Industries, one of the largest manufacturers of carbon products in the world, reported stellar numbers aided by higher product pricing trends. the company’s result underlines a sequential surge in price realizations which augurs well for companies like Himadri Specialty Chemical and Goa Carbon.

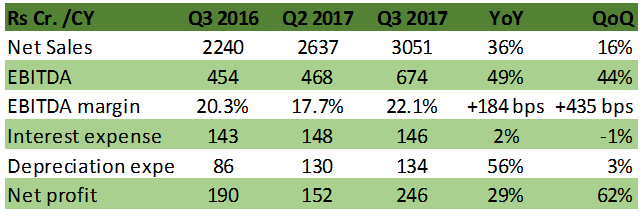

Quarterly update

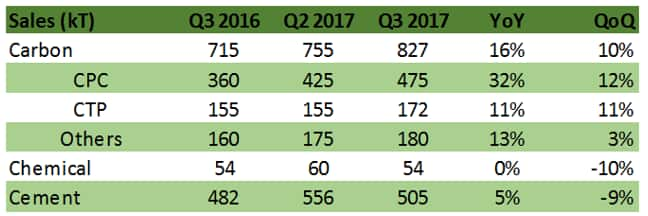

For Rain industries, net sales growth of 36 percent was mainly aided by higher realization (+29 percent YoY) and higher volumes (+10 percent) in carbon business (71 percent of the 2016 sales). Key sub segments of the carbon business – CPC (calcined petroleum coke) and CTP (coal tar pitch) witnessed improved pricing due to structural changes in supply and improving demand scenario for the end market – aluminum and graphite. This resulted in higher EBITDA margin (+435 bps QoQ, +184 bps YoY) for the company.

In case of other businesses, the chemical business (19 percent of sales) witnessed lower volumes sequentially due to decline in chemical trading business wherein the company is reducing the share of low margin trading operations. Cement business was impacted by lower realisation (-14 percent YoY) offsetting volume increase of about 5 percent.

Carbon business leads the value growth

In terms of profitability, company’s business is hugely skewed towards the carbon business (EBITDA contribution: 89 percent in 9M 2017. Both CPC and CTP benefit from the improving demand scenario for the aluminum industry.

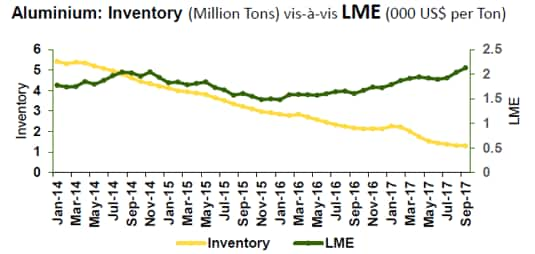

In case of CTP, it additionally benefits from gains in the demand for graphite electrodes (used for steel manufacturing). Further, supply curtailment due to plant shutdowns by Koppers, last year and the Chinese government’s effort to curb pollution suggests tight supply demand scenario.

In case of CPC, the situation is more striking because of pollution crackdown in China. China, which contributes about 55 percent of global production, has reportedly turned importer for its requirement. While China has also curtailed aluminum capacity but it has led to increased production elsewhere in the world. Further, as China’s export of CPC has reduced, it has resulted in a net gain for the CPC manufacturers.

Capacity expansion

The company currently has a capacity of 3,455 kT for CTP and CPC. In each case, it is executing capacity expansion of about 16 percent. CPC plant (370 kT) in SEZ, Vizag is expected to be commissioned by Q1 2019. For CTP, the company is undergoing debottlenecking to the tune of about 200 kT in Europe (Germany and Belgium).

Raw material risk

Procurement of green petroleum coke (for CPC) and coal tar (for CTP) are the key risks for the company. Prices of green petroleum coke have also surged recently but the supply-demand imbalance is not as grave as it was in FY11. Further, the company is partially able to counter it and can process low grade raw material (high sulphur content) with the help of recent investments in desulfurization plant.

Rain Industries is currently trading at a multiple of 11.3x 2018 earnings, which is still not expensive after having a significant run this year. At present, CPC business is running near optimum capacity but CTP business can witness volume growth. 2019 onwards company gains from new capacity expansion. Current pricing realization can sustain in the medium-term in our view on account of structural supply curtailments. These aspects make the stock an accumulation candidate for long-term.

Having said that company’s robust quarterly results have a positive takeaway for Himadri Speciality Chemical. Rain Industries sales realization for CTP business is broadly in the same range as that for Himadri and confirms that this is an industry wide trend.Follow @anubhavsays

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.