The funds in the small cap category, which had delivered stellar returns in the year 2017, were the worst hit in the one-month period ending February 9.

According to the returns data on mutual fund tracking firm Value Research, the small-cap funds category was badly hit, giving negative 7.13 percent average returns.

In comparison, S&P BSE Small Cap Index plunged 7.49 percent during the period under review.

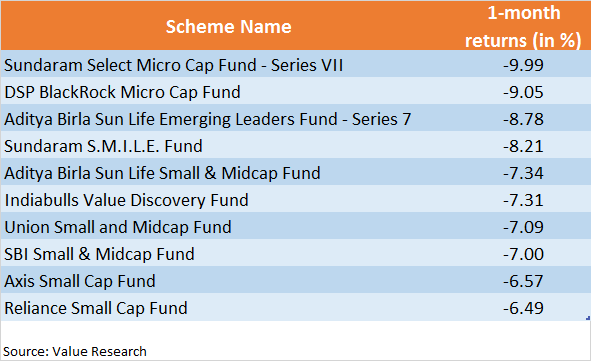

All 40 schemes in the small cap category delivered negative returns in one month period ending Feb 9. The worst hit schemes was Sundaram Select Micro Cap Fund with nearly 10 percent negative average returns.

Mutual fund managers attributed the fall in returns to stretched valuations of small cap stocks.

"Small caps had run up very sharply in the last couple of years. So, valuations were too stretched. Most of us had predicted correction in the market in wake of the stretched valuations," said a fund manager from a bank sponsored fund house.

Fund houses were facing dearth of investment option in the small cap category as valuations were stretched .

Mutual fund advisers suggest that if risk appetite and investment horizon allows, one can invest in small cap space anytime, but should have an investment horizon of close to 10 years.

MF experts suggest investors who had invested only in small caps must relook at their portfolio.

Mumbai-based mutual fund adviser Kunal Bajaj said,"If you have a portfolio which is concentrated in small and mid caps alone, then it is a good time to re-look and say..I am missing allocation across a few other sectors in the industry."

"But if you are looking at investing in funds which are top performing and have given a 60 percent return in last one year and you expect that going forward, then that’s not going to be the case," he added.

In 2017, four out of the 10 top wealth creator funds were small cap funds which had delivered returns in the range of 55-81 percent.

In the last few months, two schemes--DSP BlackRock Micro Cap and SBI Small & Midcap Funds have stopped fresh investments. They felt that with a large corpus, it would be a struggle to find good investment avenues within the narrow universe of small cap.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.