Anubhav SahuMoneycontrol research

Graphite India, one of the leading global manufacturers of graphite electrode, posted robust quarterly numbers on the back of better realizations. As the second half of the calendar year progresses, the company has apparently put to use its spare capacity at pricing closer to spot prices which are at a record high. While it is expected to continue with the healthy operating performance as it benefits from the pricing trends, investors should keep an eye on long-term contracts to be inked during October-December in 2017.

That said, the current valuation already factors a significant improvement in realizations for the next calendar year.

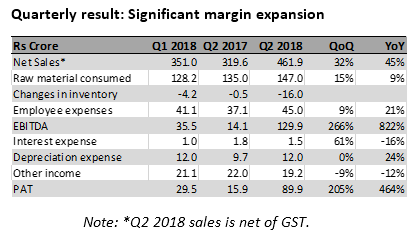

Quarterly result: Significant margin expansion

Graphite India’s Q2 FY18 numbers were upbeat with the sales growth of 45 percent YoY led by higher graphite electrode realization and volumes. It clocked a capacity utilization of 89 percent (against 75 percent in Q2 2017) implying a production volume increase of 19 percent. However, on a QoQ basis, production volumes decreased by 6 percent. EBITDA margin expanded majorly to 28.1 percent from sub 5 percent in Q2 2017 (10.1 percent in Q1 FY18). Other income witnessed a decline of 12 percent YoY. Higher realizations and margin expansion, however, helped net earnings to jump three times, sequentially.

Higher realizations

Sales reported for the second quarter of this fiscal year is net of GST and, therefore, not exactly comparable to earlier quarters which are net of excise duty paid only. Effective excise duty for Graphite India was about 7 percent in the earlier quarters. Prevalent GST rate for graphite electrodes is 18 percent. Thus, a comparable sales number for Graphite India would be about 11 percent higher implying 60 percent YoY growth. Implied graphite electrode pricing realizations come to around USD 3600/tonne for the company which is about 35 percent higher on a YoY basis (+56 percent QoQ basis).

As the graphite electrode manufacturers follow a convention of annual contracts, a bulk of the Graphite India’s contract execution is still based on contracts inked in the start of 2017.

However, reportedly limited spare capacity has been utilized for short term/on-spot contracts at the prevalent pricing which results in better realization.

Easing pricing pressure on needle coke

Sequentially, the company reported a lower capacity utilization (89 percent against 95 percent in Q1 FY18) which may have been impacted by the scarcity of its key raw material - needle coke. However, media buzz suggests that availability of needle coke is improving and that it may see some ease in pricing. One of the reasons cited is that needle coke which was earlier diverted for lithium-ion applications is partially available for graphite electrodes due to higher pricing.

Other product segments witness structural improvement

Though a bulk of the manufacturing capacity is utilized for graphite electrodes, Graphite India also offers various other carbon products like calcined petroleum coke, carbon electrode paste which are also witnessing higher realization and demand. Calcined petroleum coke, in particular, used for aluminum industry has witnessed higher pricing on account of limited supply and a rise in raw material (pet coke) price.

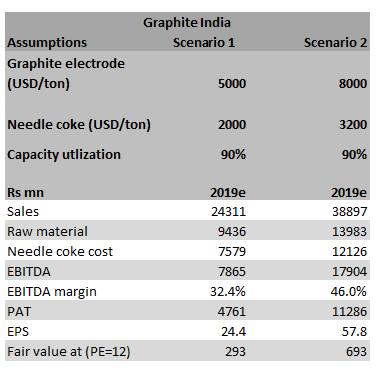

Valuation and pricing trends

The stock has undergone a sharp re-rating given the multiple drivers for the industry. Steel capacity curtailment in China and subsequently plans for steel production elsewhere through EAF (electric arc furnace method) and the consolidation of global graphite electrode manufacturing have been the key drivers.

There has been media buzz about a clamp-down in the graphite electrode manufacturing capacity in China which has cited weak pollution norms. This would lead to the closure of idle capacity. Export data of graphite electrodes from China have not slowed down so far according to data available till June).

Needle coke pricing, though expected to ease after an improved supply, would remain a key contributor to the elevated graphite electrode prices.

In this scenario, global manufacturers are resorting to short-term/quarterly contracts instead of annual ones. Long-term contracts are not expected to be inked at the spot prices of USD 10,000/tonne; however, we await management commentary from other graphite electrode manufacturers. Some of the CY 2018 deals struck globally are on volume visibility and commitment for pricing is not ascertained.

Given this context, when we revisit our scenarios, we find the stock is already pricing a healthy pick-up in realizations for the next year. While we don’t rule out scenario 2 in near term, a possibility of a sustained pricing level for graphite electrode for multiple years is capped as talks of new capacity additions (eg: HEG) have already taken weight.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.