Nitin Agrawal

Moneycontrol Research

The government of India has set an ambitious target of having all vehicles on roads to be electric by 2030. This ambitious plan envisages a transition to an EV (electric vehicles) revolution that could have huge ramifications for a large number of automotive companies.

Our earlier note highlighted that the government needs to provide support while companies will have to chip in with their efforts to make the transition to EVs smoother. As a next step, we are trying to identify the winners and losers amongst auto-component companies (especially in the small and mid-cap segment) with the eventual demise of ICE (Internal Combustion Engine) and the rise of EVs.

Industry dominated by organised players

India, a huge market for automobiles, hosts many auto-component manufacturers supplying to two segments – original equipment manufacturers (OEM) and the replacement market. OEM absorbs close to 80 percent of auto-components. The auto-component industry has close to 700 organized players whereas there are 10,000 unorganized players. However, organized players have a revenue market share of close to 85 percent.

As per ACMA (Automotive Component Manufacturers Association of India), India’s auto-component industry’s turnover was pegged at USD 39 billion in 2015-16 and contributed 2.3 percent of GDP. The industry made the capital investment in the range of USD 0.44-0.66 billion in 2015-16. These figures indicate that the auto-component industry is in need of serious attention.

Long-term disruption

We believe that the transition from internal combustion engine (ICE) to EVs would take time and there would not be any impact in the short-term. However, EVs would definitely disrupt the automobile ecosystem in the next five to ten years.

Small players to face heat

The bigger players in the affected segment would be able to adapt to the changes in technology and would bring in necessary changes required for a smooth shift to the electric powertrain. However, many smaller players, which are thriving on the back of growth in the automobile sector, would witness disruption and some would not be able to even survive.

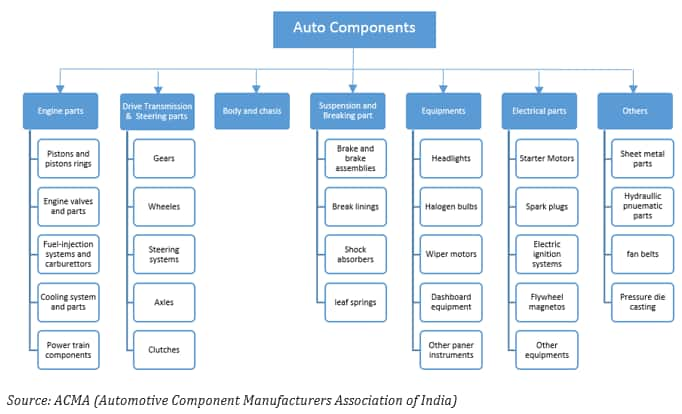

This chart indicates the structure of the auto-component industry.

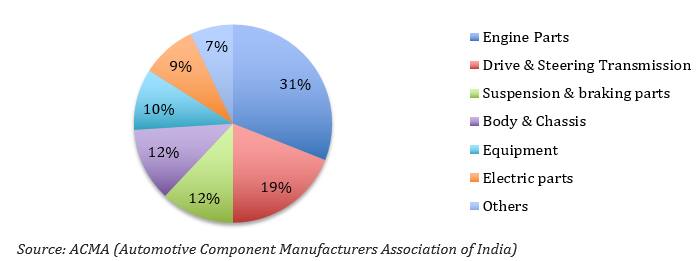

Engine parts contributes the highestIn terms of segments, the contribution of engine parts to total production is the highest followed by drive and steering transmission components. Engine parts comprise engine valves, pistons, camshafts, crankshafts, carburetors, fuel injection systems and cooling systems. Engine parts and drive transmission are the segments, which would be impacted negatively by the introduction of EVs as the focus would shift from engine management, fuel efficiency, emission control to batteries and drive motors.

The companies that will deal with battery manufacturing and related components, and other key components in EVs, would get their next leg of growth from the transition towards EVs. Additionally, there are companies, which make lighter auto parts. They would also reap benefits as EVs are supposed to be light-weight so they could get the desired power output.

Below is the list of companies from the listed space, which we have identified within auto ancillary space that would be impacted negatively by the move towards EVs. These companies are into manufacturing of engine and related parts and components related to transmission.

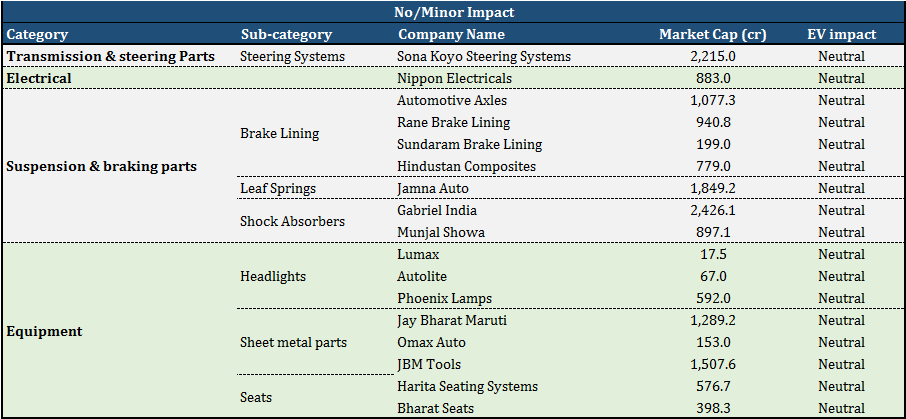

Below is the list of companies which would have a neutral/minor impact because of electrification of vehicles. These company mainly deal with the accessories or related components, suspension and brake parts and equipment.

Finally, the list of companies which would be positively impacted by the move towards EVs. These are the companies which would provide EV manufacturers with the battery and wiring harness.

Investors need to keep a hawk eye on the key developments in the space and monitor the progress these companies are making towards EVs.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.