Anubhav SahuMoneycontrol Research

A significantly lower dividend payment to the government by the RBI prompts us to look once again at the federal fiscal math. This brings us to a pertinent question: can the government’s ambitious disinvestment programme not only reach its target but also make up for lower RBI dividend? In this context, let’s have a look at the status of proceeds from disinvestment programme so far and where we are heading.

Dividend shortfall is 15 percent of non-tax revenue

Last Thursday, RBI declared that this year it would pay Rs 30,659 crore as surplus dividend to government which is less than half the amount it transferred last year. RBI’s dividend transfer of Rs 65,876 crore last year was about 86 percent of the total dividend income from the financial institutions.

In FY18, the budget estimate for the dividend income is Rs 74,901 crore. After RBI’s declaration, shortfall in this category is Rs 44,242 crore, which is 15.3 percent of the non-tax revenue budgeted. As the public sector banks are struggling with higher provisioning and weak fundamentals, a limited contribution is expected in the form of dividends.

Source: Moneycontrol Research

11% of disinvestment target achieved so far

Given this context, we look at another non-tax, non-debt means available for the government in terms of disinvestment to reduce the shortfall. Here, interestingly, government already has a higher target budgeted i.e. Rs 72,500 crore for the FY18 vs Rs 56,500 crore in the last fiscal.

Source: Moneycontrol Research

Disinvestment target includes Rs 46,500 crore from the disinvestment of the government’s equity holdings through minority stake sales (ETF sale route), buybacks, mergers, Rs 15000 crore as the strategic disinvestment (SUUTI route) and listings of insurance companies.

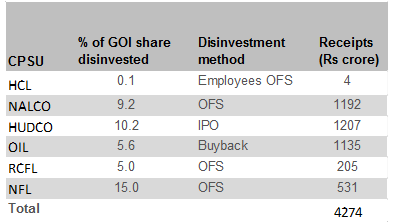

As per the data available from the department of investment and public asset management (DIPAM), divestment so far has been Rs 8,428 crore constituting 11 percent of the target. This includes proceeds of Rs 4154 crore from the disinvestment of SUUTI investment (L&T stake sale). Further, Rs 4274 crore is from the minority sale/listings.

Source: Moneycontrol research

Multipronged disinvestment programme

The government is currently working through following modes to meet th edisinvestment target.

1, Disinvestment through ETF route – Bharat 22: Earlier ETF route for stake sale was deployed through CPSE ETF, which was able to garner Rs 11, 500 crore. Partially primed by its success, Bharat 22 ETF is expected to be major conduit to sell the government’s SUUTI stake as there is 40 percent weightage for the SUUTI heavyweights (L&T, ITC and Axis Bank).

Source: Moneycontrol Research

Now, broadly looking at SUUTI sale stake at the current price, th egovernment could garner Rs 49,811 crore. As government might do it in tranches and partially through the ETF route, we are keeping an assumption of 50 percent of stake sale for this year.

2, HPCL-ONGC merger: Oil majors’ expected merger and government’s stake sale in HPCL (51 percent) amounts to Rs 33,293 crore which can further aid the government’s fiscal balance, even if it is a transfer from one pocket to the other.

3, Defence companies listing: On the back-of-the-envelope calculation suggest that these defence companies when listed can command a valuation of Rs 29, 850 crore (based on P/E 20x multiple for the industrials sector). As government plans to divest 25 percent stake, Rs 7,395 crore proceeds could be a rough estimate.

Source: Moneycontrol research

4, Insurance companies listing: The government plans to list all the five state-run general insurance companies as well. New India Assurance and GIC are already lined up to raise Rs 20,000 crore, of which about Rs 16,000 crore would go to the government.

Source: Moneycontrol research

Taking all these in to account, the government’s target for the divestment can possibly be reached, and some of the shortfall from dividend income. However, our calculation suggests a net shortfall of about Rs 16,700 crore unless the government decides to sale the entire SUUTI stake or accelerate the listing of PSUs. This could mean a slippage in fiscal deficit target, if everything else remains same, to 3.3 percent compared to 3.2 percent budgeted for 2017-18.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.