From January 1, 2018, your debit card transactions will cost lower. In order to boost debit card usage for payments, the Reserve Bank of India (RBI) on Wednesday that it will rationalise the framework for the merchant discount rate (MDR) applicable on debit card transactions.

Although many players have welcomed the move, which will incentivise merchants to pay less on a debit card transaction, others have said this may not be enough as the interchange fee, a subset of the MDR, was the core issue for many acquirers or those who provide the payments infrastructure and set up the PoS (point of sale) terminals.

MDR is the rate charged to a merchant by a bank for providing debit and credit card services. In most cases, the charge is passed on to the customer by the merchant, saying that it eats into his margin. Interchange fee is a part of the MDR which is charged by the issuing bank (0.5-0.75 percent), acquirer (0.5-0.25 percent) which is also shared by the payment provider such as Rupay, Visa and Mastercard.

In a tweet, Amrish Rau, CEO of PayU, said: “RBI has tinkered with debit charges again. The problem is NOT MDR. Capping of Bank Interchange fees will provide big boost to digital payments.”

In a brief conversation, Rau said there is still less incentive for the merchants to set up PoS terminals and also for payments companies to convince the merchants. PayU is a payment gateway that facilitates to collect payments online.

Deepak Chandnani, Managing Director, Worldline South Asia and Middle East, who welcomed the move suggesting it will boost the use of debit cards and non-card instruments, also said: “I hope that along with this, the RBI also mandates that the split of the MDR between the issuer and the acquirer is distributed more equitably so that the acquirers can make 25+ basis points on POS transactions and 15+ basis points on asset-light transactions. Without this the eco-system for electronic payments will not get built in a holistic and sustainable way. All the key players must see economic viability for e-payments to achieve the goals we have as a nation and as an industry."

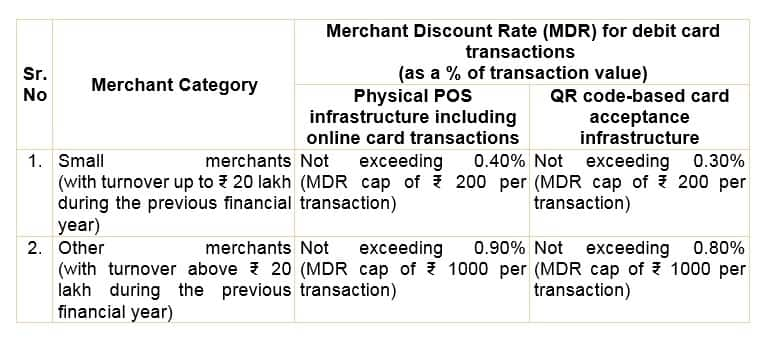

Under the new RBI norms announced on December 6, the MDR for smaller merchants would be lower. Small merchants are defined as those who had a turnover of less than Rs 20 lakh in the previous financial year.

• For small businesses, the MDR cap would stand at 0.4 percent or Rs 200 per transaction, whichever is lower.

• For other merchants, the MDR cap will be 0.9 percent or Rs 1,000 per transaction, whichever is lower.

MDR for both debit and credit cards were same till June 2012, when the RBI first reduced MDR for debit cards to boost their usage for sales. Till then, debit cards were primarily used for cash withdrawals from ATMs.

Consequently, MDR for debit cards were first fixed at 0.75 percent for transactions of amount up to Rs 2,000, while for transactions above Rs 2,000, MDR was 1 percent.

After the demonetisation drive in November last year, when currency notes of Rs 500 and Rs 1,000 denomination was withdrawn from circulation, until March 2017, MDR was further reduced for transactions up to Rs 1,000, to 0.25 percent of the transaction value. For transactions above Rs 1,000 but less than Rs 2,000, MDR was kept at 0.50 percent of the transaction value.

On Wednesday, apart from differential MDRs across categories of merchants, the RBI also introduced different rates based on the kind of infrastructure at use. For QR code based acceptance infrastructure, the MDR will be 10 basis points lower across both merchant categories.

• For small businesses, the MDR cap at QR code based infrastructure would stand at 0.3 percent or Rs 200 per transaction, whichever is lower.

• For other merchants, the MDR cap at QR code based infrastructure will be 0.8 percent or Rs 1,000 per transaction, whichever is lower.

Madhusudanan R, Founder of M2P Solutions, another digital payment solutions company, said: “The reduction of course helps as there are a few headwinds to this move and one of this is clearly that government wants large ticket transactions to come under the digital foray…The right incentives will help acquirers to invest in not just infrastructure, but also massive sustained investment required to lift the next wave of 10 million merchants to embrace digital payments. This is where the low cost QR model can really move the needle, as for the bank it doesn’t incur Capex, the merchant pays a lower rate and doesn’t have to pay rental or invest in terminal, thanks to regulation.”

A report by Kotak institutional equities said: “MDR reduction: marginally negative for acquirers. The RBI’s move to reduce merchant discount rates (MDR) for debit card transactions for smaller merchants and QR-code based transactions will likely bode well for broad-based and asset-light adoption of cashless modes of transactions in the medium-term. However, volume is unlikely to make up for the shortfall in reduction of fees in the short term and hence, the near-term impact would be marginally negative for a few players like Axis Bank, HDFC Bank, ICICI Bank and SBI (State Bank of India). Debit card fee is a small but a key area of growth for most of these.”

Debit card usage volume has tripled to 2.4 billion transactions in 2016-17 from around 800 million in 2014-15. The value of these transactions rose to Rs 3.3 lakh crore from Rs 1.2 lakh crore.

RBI data shows that debit and credit card payments at PoS terminals have increased from Rs 35,240 crore in November 2016, compared to Rs 47,980 crore in November 2017.

The UPI and BharatQR have different MDR, so it will be a challenge for card networks and the NPCI (National payments Corporation of India) to sort out where the transaction is originating and charge merchants accordingly. On the UPI, merchants are charged a merchant discount rate (MDR) of 0.25 percent for payments below Rs 1,000 and 0.65 percent for all other charges.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.