Madhuchanda DeyMoneycontrol Research

As the financial health of state-run banks keeps deteriorating, the Reserve Bank of India has revised the Prompt Corrective Action (PCA) framework. With public sector banks again at the centre of attention with their quarterly earnings report, volatility in share prices and the government upping the ante on bad loans resolution, we explore how many of the banks are soon coming under PCA norm and how life will shape up for the sector as resolution kicks into high gear.

PCA norms allow the regulator to place certain restrictions such as halting branch expansion and stopping dividend payment. It can even cap a bank’s lending limit to one entity or sector. Other corrective action that can be imposed on banks include special audits, restructuring operations and activation of recovery plan. Banks’ promoters can be asked to bring in new management, too. The RBI can also supersede the bank’s board, under PCA.

What is PCA?

The PCA is invoked when certain risk thresholds are breached. There are three risk thresholds which are based on certain levels of asset quality (net NPA), profitability (ROA), capital (CRAR/ capital to risk weighted asset ratio). The maximum tolerance limit, sets net NPA at over 12 percent and negative return on assets for four consecutive years.

What are the types of sanctions?

There are two type of restrictions, mandatory and discretionary. Restrictions on dividend, branch expansion, directors’ compensation, are mandatory while discretionary restrictions could include curbs on lending and deposit.

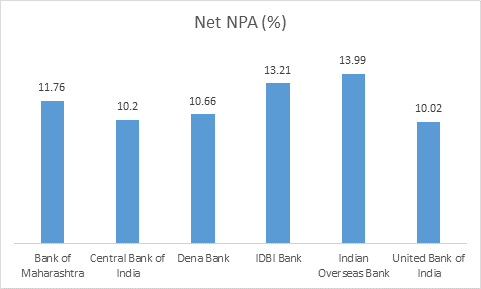

As the exhibit suggests, on the basis of reported numbers at the end of the fourth quarter of FY17, five state-owned banks have reported net NPA in excess of 10 percent.

In addition, there were four banks who reported net NPAs dangerously close to the trigger point – Allahabad Bank (8.9 percent), Corporation Bank (8.3 percent), Oriental Bank of Commerce (8.96 percent) and UCO Bank (8.9 percent). Some of the associate banks of SBI were about to breach the trigger limit, but post coming to the direct fold of SBI, the additional provision would have partially aided the situation.

It is important to note than the provision buffer of the six banks that have net NPAs in excess of 10 percent ranges anywhere in the band of 35 percent to 48 percent, thereby leaving little headroom for incremental error.

In terms of capital buffer, while none have reportedly breached the level of 9 percent thanks to the small doses of life-saving capital injected by the government, they have just about the capital to stay afloat.

Coming to the profitability parameters, the picture has been dismal for the last couple of years. It is interesting to note that in FY17 the aggregate profitability of seventeen private sector banks was Rs 40,667 crore with only one entity reporting losses (Jammu & Kashmir Bank). It was quite the contrary for public sector banks. The aggregate profitability of 21 public sector banks was Rs 473 crore in FY17 with nine entities reporting a loss.

In fact, if we look at the profitability trigger under the PCA framework (ROA in excess of 0.25 percent), for FY17, only three entities - Indian Bank, State Bank of India (standalone) and Vijaya Bank -- were above the threshold limit.

Our analysis of slightly longer term data suggests that Central Bank of India, Indian Overseas Bank and United Bank of India have breached the profitability threshold for the past four years i.e. from FY14 to FY17. Banks like Dena Bank and Oriental Bank of Commerce have breached the threshold for the past three years from FY15 onwards.

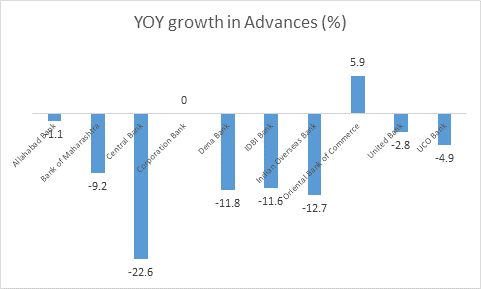

If we look at these ten public sector banks and analyse their impact on the systemic credit growth, the result speaks volumes.

The aggregate assets of these ten entities at Rs 23,80,218 crore is much less than the standalone asset book of State Bank of India. The aggregate advances of these entities are close to Rs 12,75,620 crore – 16 percent of the total bank credit. However, their share in the system’s gross NPA and net NPA is disproportionately higher at 31 percent and 33 percent, respectively.

These entities weighed down by asset quality woes are increasingly losing their relevance in incremental business. If we look at the share of these ten banks in the incremental share of system credit, the figure is negative, suggesting that they are vacating the market to the more savvy competitors.

While the aggression from the private sector is well known, who are the government banks that are incrementally improving market share in advances?

The list is clearly dominated by SBI, which has, in fact, improved its market share in FY17 over FY16. Other entities who appear to have seen a tad improvement in market share includes Andhra Bank, Bank of Baroda, Bank of India, Canara Bank, Union Bank and Vijaya Bank. These entities along with Indian Bank (on account of a better performance) and Punjab National Bank (because of the size of the balance sheet) are likely to be the survivors in the tumult that the space is witnessing. With the rest, the government will have to figure out alternative solutions -- mergers & acquisition or downsizing?

While the big-bang resolution might improve the long-term fortunes of most of the survivors amid a near-term jolt, for long-term investors State Bank of India reasonably priced at 1.6X trailing adjusted book, offers a unique combination of value, safety and growth.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.