Madhuchanda DeyMoneycontrol Research

The eagerly awaited Kotak Mahindra Bank’s press meet got over and instead of big bang announcements pertaining to likely acquisitions of Axis Bank or Mahindra Financial, Uday Kotak delivered what he termed “811” banking.

811 is a digital banking platform which is available on Google Play Store and will soon be available on Apple’s App store. By downloading the app, a customer can open a so-called “banking account in 2 minutes” by providing Aadhaar and PAN numbers and enjoy full-fledged banking services.

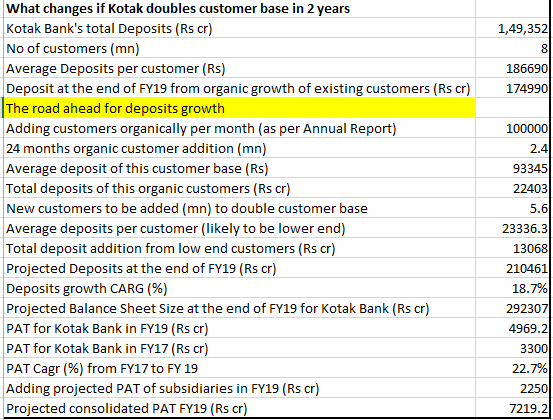

The ambitious banker has set a goal of doubling customer base in 18 months. Moneycontrol did some back-of-the-envelope calculation to figure out if the tall targets on customer acquisition will make any incremental difference to the consensus projection of Kotak Bank’s numbers for FY19.

As per the management, the bank has a current customer base of little over 8 million. Since Kotak has been a rather urban-centric bank, the arithmetic average deposits per customer works out to Rs 1,86,690 and by end of FY19, the existing customer base will take the total deposits to Rs 1,74,990 crore from the present base of Rs 1,49,352 crore.

The bank in its annual report has mentioned that post the merger of ING Vysya it is adding close to 1 lakh customers per month. While this is a healthy number, each incremental addition, comes with lower average ticket size. If we assume incremental customers to have average annual deposits of Rs 93,345, it will add Rs 22,403 crore of incremental deposits in FY19. However, as per our understanding, Kotak is looking to add 8 million customers and not 2.4 million which is the current run rate. It will certainly bank on this 811 platform for this fast organic growth in its customer base.

However, to grow at a faster clip, it predictably will have to settle for customers with a thinner wallet size. Although due to much reduced cost of acquisition, profitability per customer might stand protected. We assume the average deposit per annum of this incremental 5.6 million at Rs 23,336 resulting in an addition of Rs 13,608 crore of deposits in FY19.

To sum up, we arrive at a deposit figure of standalone Kotak Bank for FY19 at Rs 2,10,461 crore – not at variance with what the Street was expecting from the bank prior to today’s announcement. So while 811 will be a big leap for Kotak in the digital world, it wouldn’t be a similar leap for the financials.

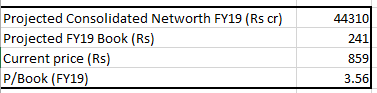

The bank is expected to report a very healthy consolidated profit growth of 24 percent and at the current market price is available for a reasonable valuation of 3.6X FY19 book.

However, make no mistakes, Kotak has not abandoned its inorganic dreams. In the press meet, Kotak mentioned the bank's wealth creation journey – “an investment of Rs 1,00,000 made in Kotak Group in November 1985 is worth around Rs 1400 crore today – a compounded growth of 40 percent over the past 32 years”. It is hard to believe that such journey in the future will be without big-bang acquisitions. Investors may be in for a pleasant surprise from this astute banker.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.