Project commissioning and a substantial addition to Jio subscription were the highlights of the quarterly performance of Reliance Industries, although the broad numbers didn’t disappoint either.

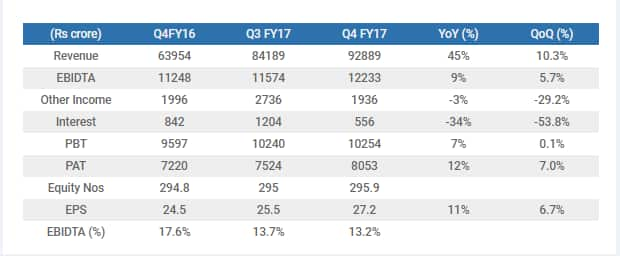

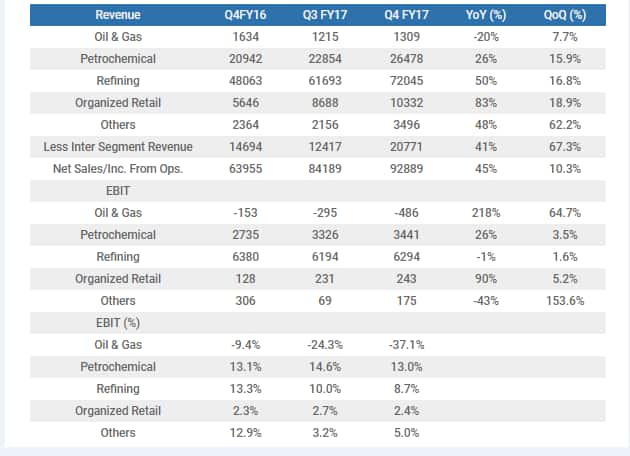

For the consolidated numbers for the fourth quarter of FY17 – the 45 percent growth in revenue was driven by 50 percent and 26 percent growth in refining and petrochemicals respectively; whereas organised retail also posted a strong show, growing by 83 percent. Despite a tad subdued margin performance, substantial savings in interest expenses drove the 12 percent growth in profit.

For the key segment of refining - the Gross Refining Margin (GRM) stood at USD 11.5 per barrel against USD 10.8 per barrel in the previous quarter. RIL’s GRM outperformed Singapore complex margins by USD 5.1 per barrel. The lower sequential margin was on account of lower gasoline and naphtha cracks.

For the petrochemicals segment, the strong topline growth was aided by an increase in prices across all products, which was partially offset by lower volumes. The stable margin performance was supported by product prices.

Oil and gas continued with a subdued performance. The decline in revenue was led by lower upstream production and lower domestic gas price realisation. Volumes were lower on account of a slowdown in development activity and natural decline. Consequently, the segment margin was negative.

Retail posted a stellar show – quarterly revenue crossing the 10,000 mark. The increase in turnover was led by growth across all consumption baskets. The margin performance was also stable. Reliance Retail added 63 stores across various store concepts. At the end of the year, it operated 3,616 stores across 702 cities with an area of over 13.5 million square feet.

The update on Jio was a key takeaway of the earnings. Jio had 108.9 million subscribers on the network. While it isn’t revenue accretive at the moment, the key factor to watch out for in Jio is the capacity that’s in place. Jio has the world’s largest greenfield 4G LTE wireless broadband network, with over 100,000 mobile towers, and will add another 100,000 towers to the network in the coming months.

The business hasn’t yet started meaningful revenue contribution as it launched with a nominal, one-time enrolment fee of Rs 99. It has been followed up with Jio Dhan Dhana Dhan - at Rs 309 for three months and an unlimited plan at Rs 509 for high data users. However, any future tariff plan will only add to revenue and help achieve break-even of this business.

Reliance Industries had embarked upon USD 20 billion core capex which is seeing fruition. One of the major core projects, based on the USD 1.5bn ethane imports from the US - has been commissioned. The highly competitive ethane imports will replace the existing expensive propane feedstock to RIL’s crackers, would result in meaningful savings.

The company also updated that it has commenced commercial production from its Coal Bed Methane (CBM). The production from RIL’s Sohagpur CBM fields will gradually ramp-up in the next 15-18 months making RIL among the largest unconventional natural gas producers in India.

RIL also mentioned installation of Para-Xylene, Cracker and downstream projects (MEG, Linear Low density and Low density Polyethylene) as well as Gasification.

The traction in telecom revenue and the commissioning of the core projects will be the key drivers of incremental performance going forward. These fundamental drivers alongside a decent valuation of 12.8X FY18 price to earnings lends substantial margin of safety for investors.

Disclosure: Reliance Industries, the parent firm of Jio, owns Network 18 that publishes Moneycontrol.com.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.