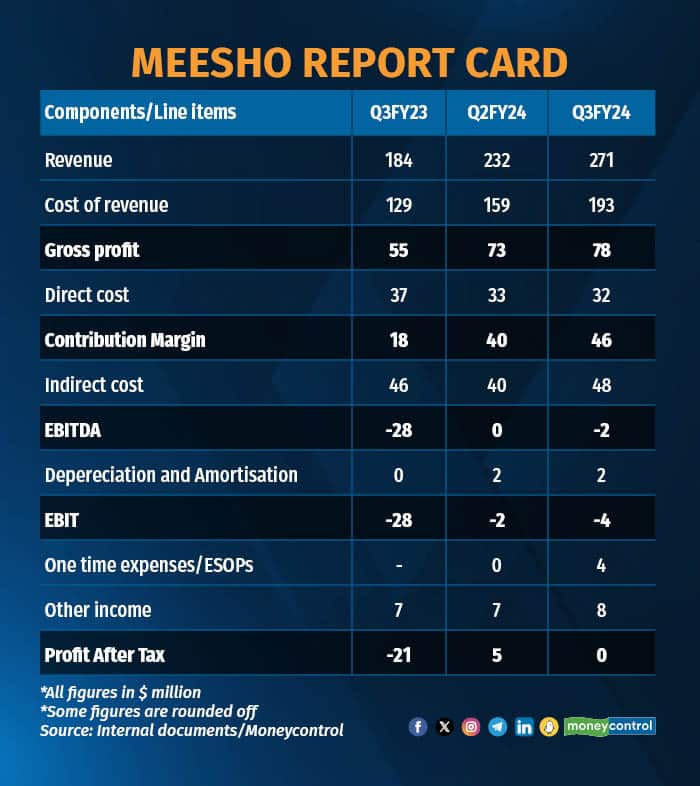

SoftBank-backed Meesho, the low price e-commerce platform, slipped into break-even in Q3FY24 after recording a profit of $5 million in Q2FY24, according to an internal set of documents that it shared with existing and potential investors.

Moneycontrol has viewed a copy of these documents.

The dip in profit was because of higher operational costs. Employee stock option (ESOP) spends also weighed on the performance during the period, the documents showed.

While breaking even is good optics for a startup that is still growing, public market investors place a higher value on the predictability in earnings. This will be crucial for Meesho, which is in the process of raising funds that will help it domicile to India from the US and eventually list on the markets here.

Meesho is also in the middle of a fundraise, a round that can potentially be as large as $500 million, as Moneycontrol reported earlier.

Q3FY24 figures were the latest available as Meesho kicked off its fundraising plans in March, before the end of the fourth quarter of the previous fiscal year.

Meesho declined to comment.

As it happens, Q3 (of the financial year) or the October-December period is typically the festive season in India. It is one of the most lucrative for e-commerce firms such as Meesho and its larger rivals- Amazon and Walmart-owned Flipkart as they roll out special offers to attract more buyers. Marketing costs usually rise during this period.

For the three months ended December, Meesho spent a total of $80 million ($48 million in indirect and $32 million in direct costs). That total came on the back of a gross profit of $78 million which translates to a negative EBITDA of $2 million for Meesho in Q3FY24. Subtracting the depreciation and amortisation (D&A) component, of another $2 million, Meesho had a negative EBIT of $4 million. Then, after accounting for one time expenses/ESOPs ($4 million) and other income ($8 million) – Meesho had a profit after tax (PAT) of 0 (zero).

Meesho has not achieve operational profitability (EBITDA positive) in any of the quarters since at least the end of 2022.

At the end of Q3FY24, Meesho had a cash balance of $400 million, the documents showed.

At the end of Q3FY24, Meesho had a cash balance of $400 million, the documents showed.ALSO READ: Meesho turned profitable in July on a PAT basis, says CFO

The break-even quarter means Meesho has not maintained a streak of profitability, which came for the first time in Q2FY24. While on a sequential basis, it may appear that Meesho has more ground to cover, on a year-on-year (YoY) basis, Meesho’s PAT went from negative $-21 million (negative $21 million) in Q3FY23 to 0 (zero) in Q3FY24, underscoring that the company is indeed improving its financial health.

Revenue boostWhile it improved its bottom line, Meesho has also seen its top line jump as more customers transacted on its platform. The company clocked a revenue of $271 million in Q3FY24, a 17 percent jump from $232 million recorded in Q2FY24. On a YoY basis, Meesho’s revenue jumped 47 percent from $184 million, according to the same set of documents. The revenue was at a high, at least since the end of FY22.

The higher revenue, buoyed by festive season demand, was because of improved gross merchandise value (GMV) as well. The company had a GMV of $1.4 billion in Q3FY24, a 17 percent jump from $1.2 billion in Q2FY24. On a YoY basis the GMV jumped from $1 billion to $1.4 billion.

At the end of Q3FY24, Meesho had a cash balance of $400 million, the documents showed. The company is looking to increase that reserve by raising more money from Tiger Global, Peak XV Partners, SoftBank and others. Meesho will use a bulk of that money to pay the relevant taxes that arise from flipping its base back to India from Delaware in the United States, ahead of a planned IPO, as reported by Moneycontrol in March.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.