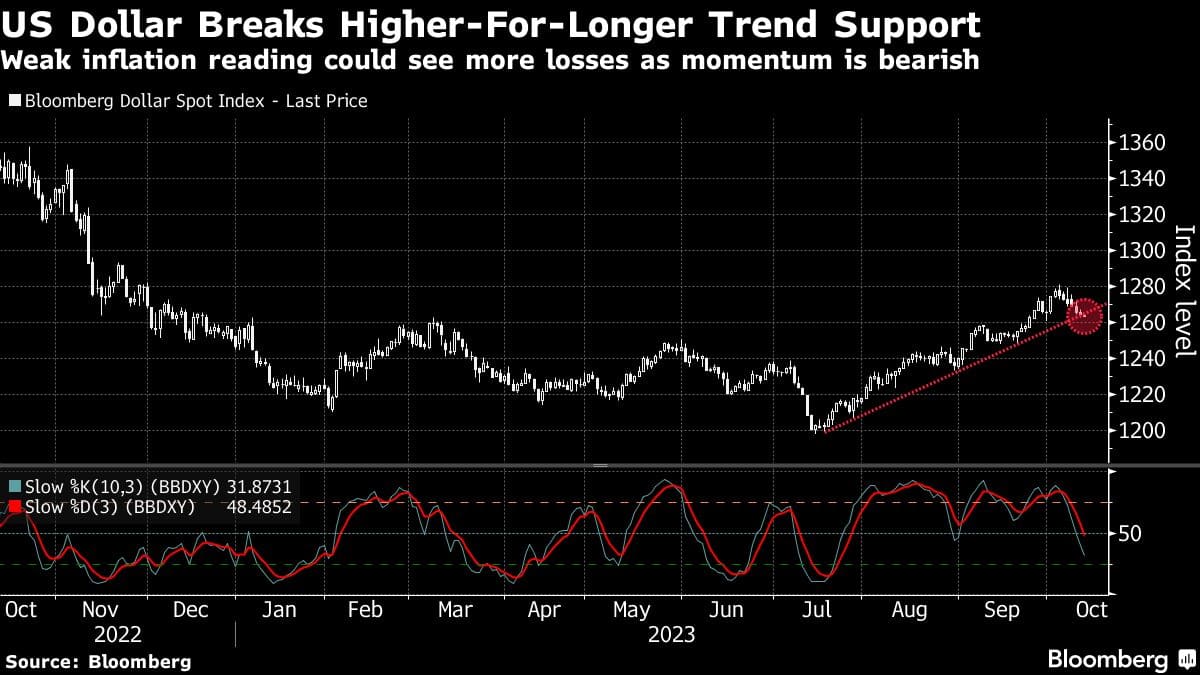

A gauge of the dollar is set for the longest run of losses in over three years, leaving analysts debating whether the greenback’s rally has finally come to an end.

The Bloomberg Dollar Spot Index fell for a seventh day after a recent chorus of commentary from Federal Reserve officials including Governor Christopher Waller suggested they may refrain from tightening further. The gauge advanced for two straight quarters and reached the strongest in almost a year last week on bets that US interest rates may remain higher for longer.

The greenback’s gains in 2023 have blindsided traders who started the year predicting that the currency would decline as US exceptionalism faded. But analysts are warning that the reprieve may be nothing more than a brief lull which will end if US inflation data due Thursday come in stronger than expected.

“It’s too early to conclude this is the start of a USD downtrend,” said Carol Kong, a strategist at Commonwealth Bank of Australia in Sydney. The upcoming US CPI data may change the narrative and push the dollar back up, she said.

While the dollar may extend its loss in the short term with a cap in Treasury yields in place, that’s unlikely to last, according to Westpac Banking Corp. Factors including mounting geopolitical risks mean that the dollar is likely to remain bid through year-end and into 2024, said Richard Franulovich, head of foreign-exchange strategy at Westpac in Sydney.

“For one thing, an outsized decline in yields would put a hike back on the table,” said Franulovich. Data indicate the US economy remains firm, payrolls are above the most bullish projections and early indications suggest core CPI may be firmer-than-expected, he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.