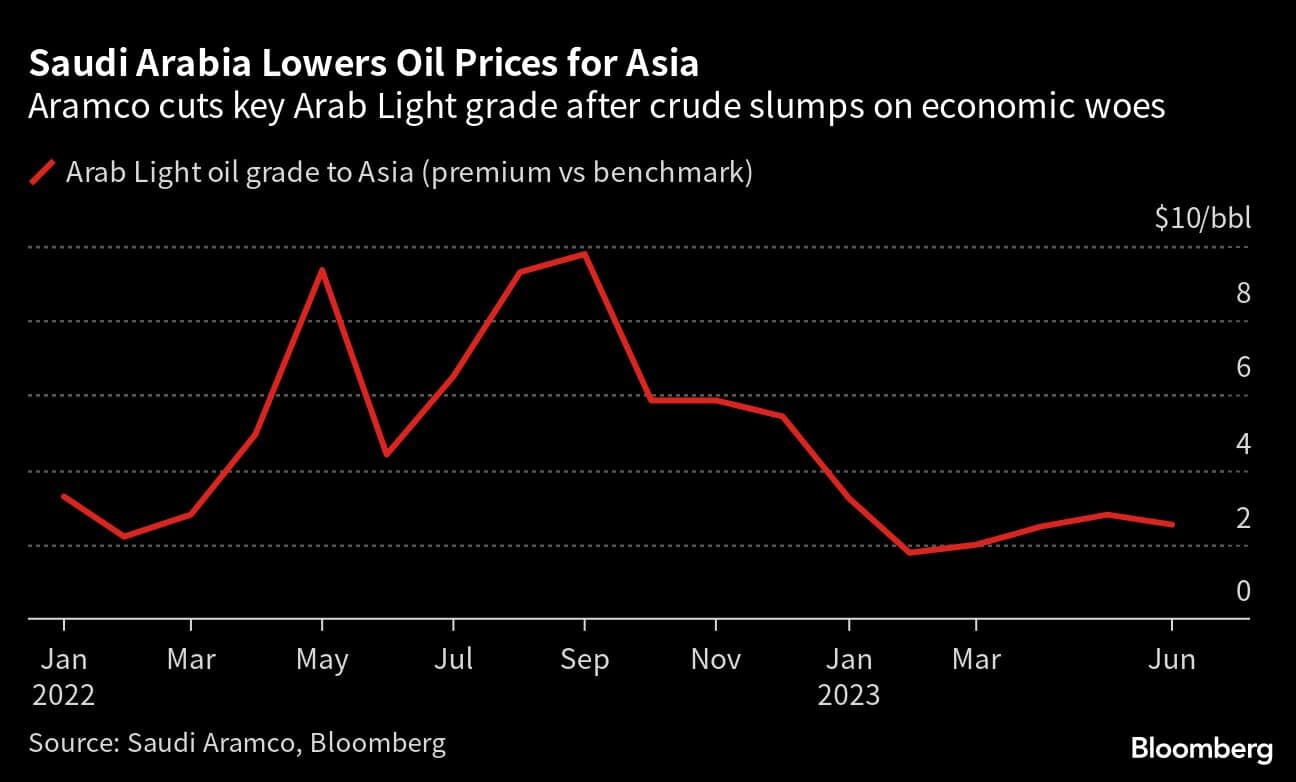

Saudi Arabia lowered oil prices for customers in its main market of Asia after futures slumped, with traders fretting about the health of the global economy.

A softening US economy and continued fragility among its banks, as well as weak manufacturing data in China, have triggered a renewed fall in Brent and WTI futures. Refining margins have also sunk.

State-controlled Saudi Aramco cut all official selling prices for Asia in June. The company’s key Arab Light grade was reduced to $2.55 a barrel above the regional benchmark, 25 cents less than the price for this month.

A Bloomberg survey of refiners and traders from last week forecasted a slightly bigger drop of 45 cents.

Aramco sells about 60% of its crude shipments to Asia, most of them under long-term contracts, pricing for which is reviewed each month. China, Japan, South Korea and India are the biggest buyers.

The company raised all prices for European customers and left most US grades unchanged.

The kingdom is the world’s largest oil exporter and leads the OPEC+ group of producers along with Russia. Several members of the 23-nation alliance, including Riyadh, decided early last month to cut production by more than 1 million barrels a day, saying it was a “precautionary measure” to stabilize the market.

Brent crude futures jumped above $87 a barrel after the announcement, but are now back to $73 and down 9% this month, signaling how bearish investors have become.

The next OPEC+ meeting is on June 3-4 and the group has decided to make it an in-person gathering rather than a virtual one. That signals the group’s resolve to stabilize oil markets and it may opt for another supply reduction, according to Helima Croft, head of commodity strategy at RBC Capital Markets LLC.

The company’s OSP decisions are often followed by other Gulf producers such as Iraq and Kuwait.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.