The Nifty 50 extended its weakness amid rangebound trading for another session on February 6, falling by four-tenths of a percent as traders remained cautious ahead of the RBI MPC (Monetary Policy Committee) meeting outcome. Street is factoring in a 25 bps rate cut. Experts expect consolidation to continue even though the overall trend remains positive. In the case of a correction, the index may fall to 23,400-23,450, followed by 23,200, which is considered crucial support. On the higher side, 23,800 is expected to be a crucial hurdle for the index, as above this level, 24,000 is the next key level to watch. Among stocks to watch will be ITC, Bharti Airtel, BSE and M&M. Catch Nandita Khemka in conversation with Raja Venkatraman, Co-Founder NeoTrader & Raj Vyas, VP Research, Teji Mandi

first published: Feb 7, 2025 08:58 am

A collection of the most-viewed Moneycontrol videos.

How SIP Top-Ups Can Boost Your Wealth | Smart Investing Made Simple

Nifty Reclaims 26,000; Nifty Bank Hits New Life High| Groww Joins RS 1 Lk Cr Club| Closing Bell Live

Nifty Headed For All-Time Highs After Friday’s Late Recovery?| Opening Bell Live

This Tenant Moved from a 100sqft Slum to a Premium Residence | The Tenant

Is it a good time to enter Bajaj Finance post Q3 business update? | Opening Bell

Nifty Reclaims 26,000; Nifty Bank Hits New Life High| Groww Joins RS 1 Lk Cr Club| Closing Bell Live

Nifty Headed For All-Time Highs After Friday’s Late Recovery?| Opening Bell Live

Live: Nifty snaps 4-day winning streak but rises 1% this week | Closing Bell

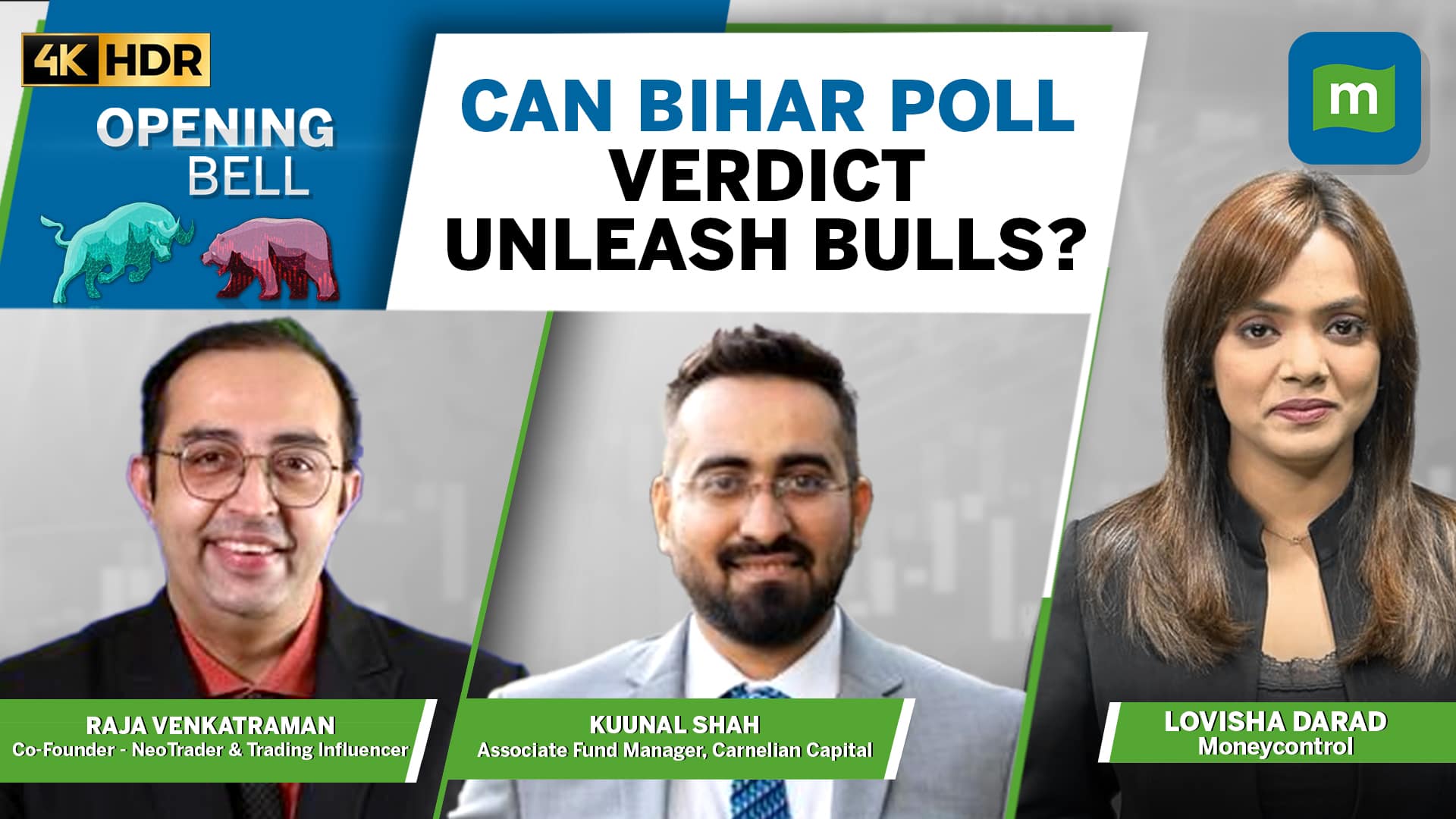

Live: Can Bihar poll outcome trigger Nifty to reclaim 26,000-mark? | Opening Bell

You are already a Moneycontrol Pro user.