Did you know that approximately Rs 11 trillion of investors’ money is stuck in poor quality mutual fund schemes?

Shocking yet true!

The mutual fund industry has grown 5 times in the last 10 years! Its assets under management (AUM) stand at a whopping Rs 31.02 trillion!

Of these, about Rs 79.9 million is held with retail investors. So, it’s safe to say that mutual funds are the preferred investment choice for retail investors.

But unfortunately, retail investors make a critical mistake while selecting mutual funds. This mistake is why retail investors fail to make big money in mutual funds.

This mistake is why Rs 11 trillion of investor’s money is stuck in poor quality mutual fund schemes.

How investors choose a mutual fund scheme?

The Association of Mutual Funds in India (AMFI) has played a pivotal role in creating awareness about mutual funds in India. Everyone knows ‘Mutual Funds Sahi Hai’.

But there’s negligible awareness on ‘Kaunsa Mutual Fund Sahi Hai’.

Some investors choose mutual funds based on their own analysis. They use parameters like past performance, fund’s Net Asset Value, AUM, entry or exit load, etc.

Some investors rely on third party sources such as financial advisors, brokers, friends, relatives, etc.

Most investors rely on so-called ‘best mutual fund investment app’ while selecting mutual funds.

But even the smallest error in selecting a mutual fund could derail an investor’s wealth creation journey. It can also result in a poor investing experience.

Another issue with mutual fund investors is their interest in ‘direct plans’. Investors end up investing in poor quality funds just to save 1 percent in commissions. This ultimately results in huge losses. Investors prioritise cost over the quality of the scheme, which affects their overall portfolio returns.

Several people have invested in mutual funds with great discipline. But still haven’t made substantial gains over a long period.

Mutual fund scheme selection is a huge problem for investors

The biggest mistake investors make while selecting mutual fund scheme is relying on existing research and rating methods. These methods are outdated. They haven’t changed since 1980s.

The current ranking and ratings assigned to mutual fund schemes is majorly based on a fund’s past performance. But as you know, past performance does not guarantee future results.

Most platforms still evaluate a fund’s potential and performance manually. Hence ratings and rankings are not updated regularly plus they are more prone to errors.

It is impossible to manually rate and rank more than 3,000 schemes in India. Hence all available schemes are not rated or ranked creating a ‘biased’ research system.

Most people eventually end up investing in poor quality funds. This leads to slow portfolio growth and low or negative returns.

RankMF – creating a new standard of mutual fund research in India

To solve the problem of biased scheme selection, RankMF has created India’s first and only technology-driven proprietary research and rating platform.

This platform helps investors choose and invest in right mutual fund schemes to generate better returns and achieve their financial goals.

RankMF, with the help of technology and research experts, has made a proprietary research engine. This engine evaluates more than 20 million data points daily to rate and ranks all mutual fund schemes in India.

The parameters include,

1. Expense ratios

2. Standard deviation

3. Market valuations and multiples

4. Portfolio holdings and diversification

5. Cash ratio of a fund

6. Size of the fund and many more!

This helps investors in selecting the right funds based on their future potential and not just past performance.

RankMF’s research method is created using a Giga Trading Engine. It does not have any manual intervention and is completely unbiased.

There are two major outputs of this evaluation which defines the rating and ranking of a mutual fund scheme:

1) Stock Rating System – When you invest in a mutual fund you are actually buying the portfolio of stocks in the scheme. Hence, the proprietary Stock Rating System rates and ranks the return earning potential of the mutual fund scheme’s underlying portfolio.

2) The Margin of Safety Index (MosDEX) – MosDEX helps an investor invest in a mutual fund scheme at the right time and price. MosDEX indicates whether the equity scheme is expensive or cheap.

RankMF with its tech-driven research ensures that mutual fund investors are provided with unbiased research. They can explore the schemes they want to invest in and easily invest in them with the best mutual fund investment app.- RankMF

RankMF was launched in 2018. It recommended five quality equity mutual funds to their clients based on its proprietary research method.

Here is a solid proof of how RankMF’s recommendations have outperformed benchmark indices of these funds by 7.79 percent.

| RankMF Recommended Funds | NAV growth - 2 years | ||

| 20-Nov-18 | 25-Jan-21 | Return | |

| UTI Equity Fund Growth Plan - Growth | 131.26 | 201.96 | 53.86% |

| UTI MNC Fund - Growth Plan | 192.07 | 226.39 | 17.87% |

| Motilal Oswal Multicap 35 Fund - Growth | 24.38 | 30.66 | 25.76% |

| Axis Focused 25 Fund Growth | 25.65 | 37.15 | 44.83% |

| Motilal Oswal Focused 25 Fund - Growth | 20.18 | 28.97 | 43.56% |

| Average Returns of RankMF recommended Funds | 37.18% | ||

| Average Returns of Benchmark Indexes for same period(Nifty 50, Nifty 500, Nifty MNC, S&P BSE 500) | 29.39% | ||

| Outperformance of RankMF Funds | 7.79% | ||

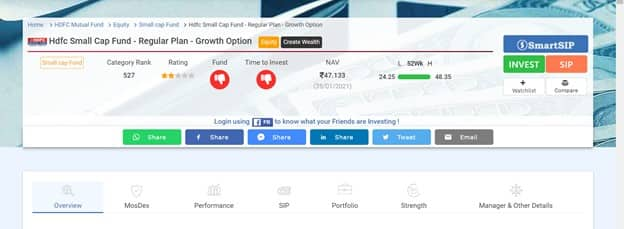

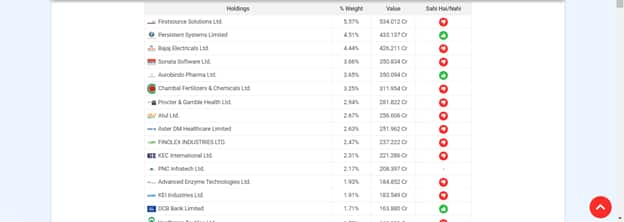

But as per RankMF proprietary research method, HDFC Small Cap fund is rated 2-Star not because it’s a small cap fund but the quality of its underlying equity holdings is really poor.

Out of HDFC small cap fund’s total equity holdings, only 3 stocks are worth investing!

This is a clear proof of how investing based on only star ratings can lead to huge losses.

Every disciplined investor deserves to create long-term wealth. But this can be done only when we stop trusting outdated research methodology.

RankMF is the only mutual fund research and investment platform where all mutual fund schemes ratings and rankings are updated on a daily basis. It uses technology-driven research methods without any manual intervention.

RankMF’s superior returns are a result of its superior research which is absolutely FREE!

Forget about paying annual subscription fees to these so-called ‘mutual fund research’ platforms and apps and instead choose RankMF – the smart investor’s first choice!

Open a FREE RankMF account today and start investing in ‘BEST’ mutual fund schemes.

This is a partnered post.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!