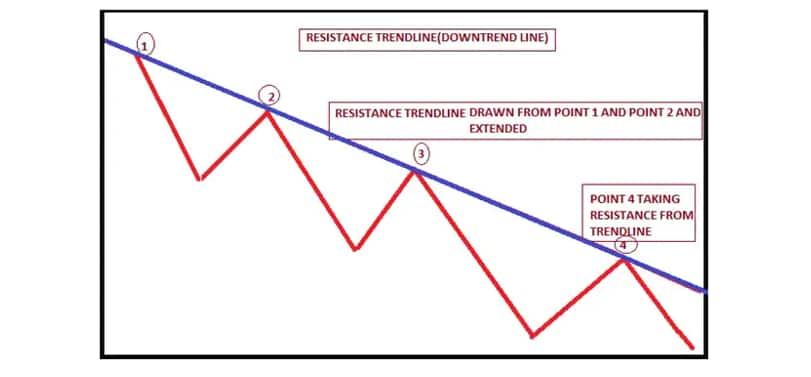

Trend lines are an important tool in technical analysis for both trend identification and confirmation. One of the basic tenets put forth by Charles Dow in the Dow Theory is that stock prices move in a trend. Trends are often measured and identified by "Trendlines".

These trend lines can help us to identify potential areas of increased supply and demand, which can cause the market to move down or up respectively. Trend lines can help traders identify buying and selling opportunities that occur within a strong trend.

Why to buy Zee Entertainment Enterprises Limited (ZEEL)?

A trend line is a straight line that connects two or more price points and then extends into the future to act as a line of support or resistance. Think of trendline as the diagonal equivalent of horizontal support and resistance.

Buy Signal:-

Recently the downward sloping trend line connecting 485-403-351 is breached from below and has given trend line breakout on the weekly chart. At the same time prices registered higher high after breaching the trend line and started retracing back towards the trend line.

The magnetic force of the trend line pulled prices towards it, forming a setup called ‘Pull Back Buy setup of trend line’ or ‘kissing the trend line’. However, this breakout is also supported by volumes and the possibility of sustainability is quite high and acceleration will come on a daily close above 192 marks.

It has also managed to close above 20 weekly simple moving average which is also supportive for prices. Looking at above-mentioned rationale one can buy this stock for higher targets.

Profit Booking:

As per one of the methods of Trend line Breakout, one can use previous swing pivot for profit booking. These levels are standing around Rs 215 and should provide immediate resistance on the higher side, moving further Rs 227 will attract more profit bookings. So one can consider profit booking near Rs 215 and higher side towards Rs 227 marks.

Stop Loss:

Entire bullish view negates on a breach of the immediate swing low and in a case of ZEEL, we will consider Rs 170 as a stop loss level closing basis.

Conclusion

We recommend buying Zee Entertainment Enterprises Limited (ZEEL) around Rs 185 with a stop loss of Rs 170 for higher targets of Rs 215/227 as indicated in above chart.

The Author is Head - Technical Research, Narnolia Financial Advisors.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.