Hardcore bitcoin watchers may have lately come across a major issue facing the digital currency: a 'hard fork' that threatens to split it into two.

At the core is an argument that is as technical as the currency itself: put simply, the digital currency's increasing popularity is putting load on its underlying infrastructure -- the blockchain -- that is slowing down transaction speeds and is in need of an upgrade.

Developers, miners and technical experts of the cryptocurrency are locked in a heated debate -- a 'civil war' according to some reports -- on how to make the currency’s software protocol to allow it to meet the increased demand and handle more transactions.

What is a hard fork?

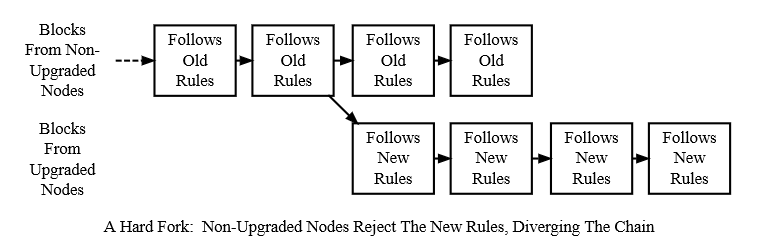

A hard fork is an event where a blockchain splits into two separate ledgers, based upon a fundamental change in rules governing the software’s protocols.

The fight has divided the bitcoin community into two camps. First is the Bitcoin Core group, which trades on exchanges under the BTC ticker and aims to solve the transaction problem by implementing Segregated Witness, or SegWit, that will increase the block size to 2 megabyte from the current 1 megabyte.

The second camp is called Bitcoin Unlimited (BU), this group wants to remove all restrictions on the block size and hence, in turn, the transaction capacity.

This seems like a fairly simple solution to the problem but goes against the philosophy of bitcoin, and undermine its decentralized nature. BU will give power to miners who can decide when to increase the block size, in turn giving them control of the bitcoin network.

If the hard fork goes through then the bitcoin blockchain will be divided into these two camps.

But global bitcoin expert Andreas Antonopoulos is of the view there is a "lot of barking" around the issue.

Speaking to Moneycontrol, he admitted that an issue with bitcoin block size exists but said it is being sensationalized and inflamed by those who want to establish some control over the decentralized network.

“A provocateur does not start from zero, they take a real issue that exists and they inflame it on purpose,” he said.

Andreas is of the opinion that a hard fork is very unlikely. “I think there's less than 10 percent chance of a hard fork anytime soon. I might be wrong of course, but I'm not worried. Honey badger will survive,” he recently said on Twitter.

“However, if that happens, which is highly unlikely to, it will probably set back the value of the currency on the exchange rate for a while, it might set us back by a year or maybe less,” he said.

“But this [hard fork] will also resolve the deadlock, by resolving the deadlock it will accelerate the development [of bitcoin software] from that point onwards. So, it is a double-edged sword but it is the natural progression of bitcoin,” he further added.

Impact on price

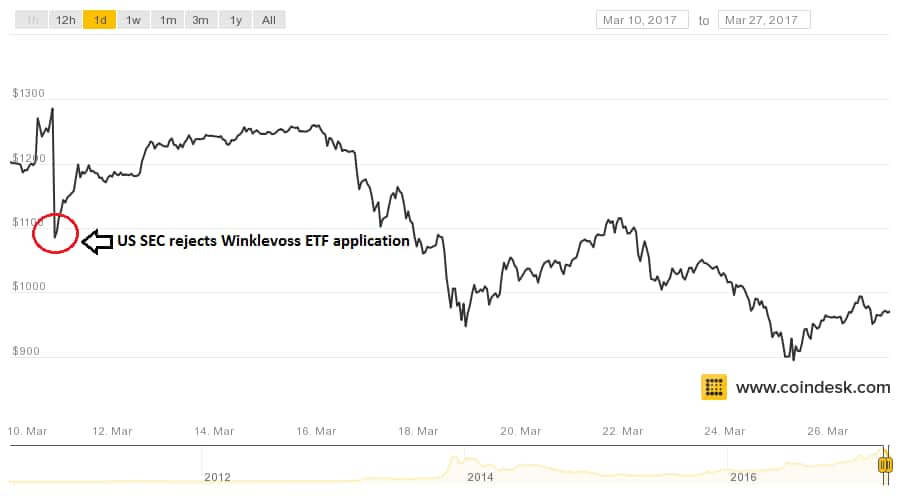

The ongoing feud has hurt the price of bitcoin on global exchanges. Prior to this bitcoin had reached levels of USD 1,300 and it longest running spell over the USD 1,000 mark.

But post the rejection of the Winklevoss ETF proposal by the US SEC, this debate has damaged the price as it brings a lot of uncertainty over the currency’s future.

The price of bitcoin has dropped the USD 1,000 mark as the community waits to see in which direction the software protocol will go.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.