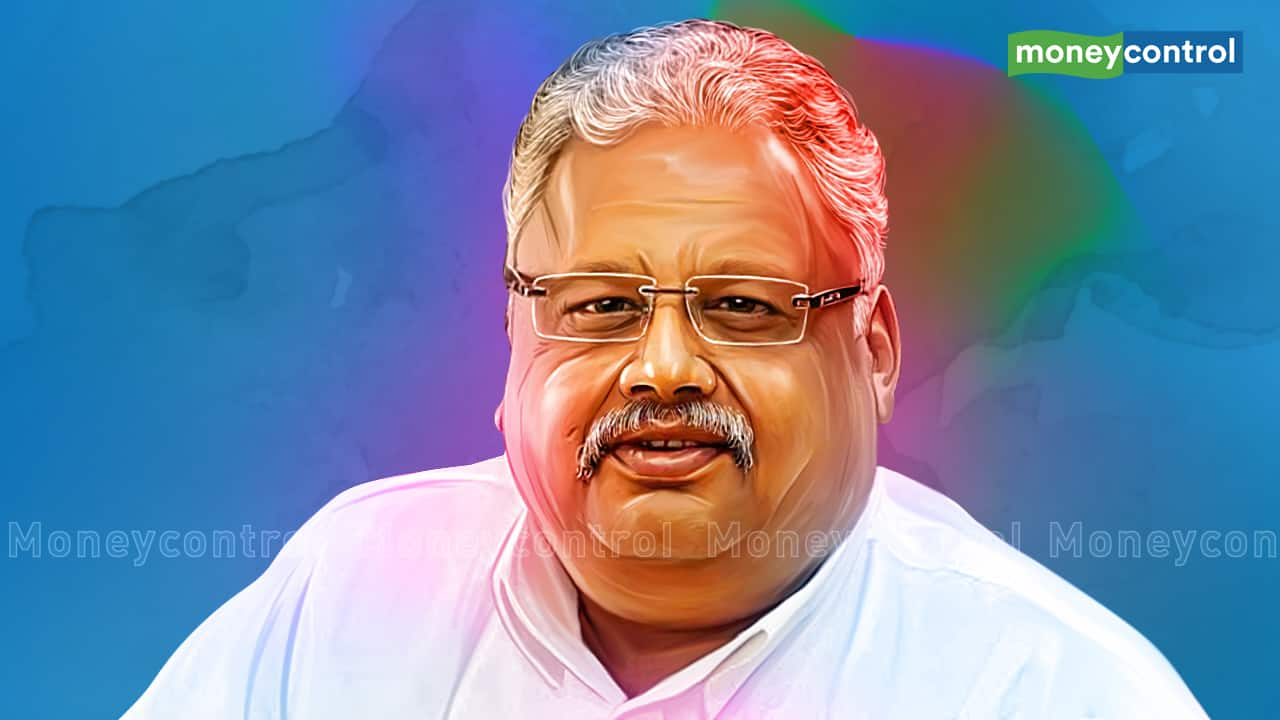

Rakesh Jhunjhunwala reiterates trust in India's long-term story

Ace investor Rakesh Jhunjhunwala said India is in a long bull market and retail investors should invest at home and not in the US for better returns.

1/6

Playing down the recent correction in the market and the concerns around inflation, India’s renowned investor Rakesh Jhunjhunwala said in an interview to CNBC-TV18, "India’s bull market will continue and the inflation in India is transitory".

2/6

Jhunjhunwala on US Fed hinting at tapering | Don't see any tightening by US Fed before 2023. Don't think Indian market has gone down only because of Fed's comments on interest rate hike.

3/6

Jhunjhunwala on sectoral picks: Bullish on banks, bullish on the so-called inefficient banks as well.

4/6

Jhunjhunwala on metals sector: Steel stocks are valued at 5x earnings and people still doubt moves in these names. Extremely bullish on metal stocks.

5/6

Jhunjhunwala on pharma sector: Indian pharma sector also has a massive home market. 40 percent of all medicines consumed in US are from the Indian pharma sector. Healthcare consumption in India will go through the roof going ahead.

6/6

Jhunjhunwala on Indian economy: Flow of money in Indian market is unimaginable. India's current per capita income warrants much higher discretionary spending. Debt in the corporate system is significantly low. We are sitting on one of the highest capex cycles India has ever seen. Structural change that has taken place in the economy is coming to the fore. Given the pace of vaccination, there might not be a third Covid wave.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!