Madhuchanda DeyMoneycontrol Research

At a time when mid- and small-cap companies with earnings disappointment are also quoting at a premium to their large cap counterparts, it is difficult to imagine a listed entity that exists in a promising industry, while having a steady and consistent track record of profitability, healthy balance sheet, a history of steady dividend payments and quotes at an attractive valuation.

Our research led us to one such unique listed entity – Samkrg Pistons and Rings. The company manufactures and markets a wide array of engineered pistons, piston pins, piston rings & circlips for the automotive markets.

Growth drivers

The auto ancillary sector not only caters to a vibrant domestic automobile market but also has a robust exports market to service. Samkrg Pistons supplies to an impressive clientele which includes auto OEMs (original equipment manufacturers) like Honda, Bajaj, TVS, Piaggio, Kirloskar, Tata Motors, Force, Greaves, LML etc.

In the exports market, the company's clients include names like Bendix, Motoco, Yamaha, Knorr-Bremse, to name a few.

Samkrg Pistons also has a significant presence in the aftermarkets (market for spare parts), both in India as well as in fifteen overseas locations.

Close to 19 percent of the total turnover of the company gets generated from the exports market.

With each new generation of engines, designed to reduce emissions and extend durability warranty and with the imperative to meet with Domestic & international emission norms (BS IV to BS VI), the company is constantly improving its technology to meet these challenges.

Samkrg works closely with its consultants from Japan and Germany to provide the market with superior quality products at a competitive pricing. The company incurs substantial expenditure on R&D in order to have the requisite technological edge.

The background

Promoted by SD M Rao (promoter stake at 67 percent) this Hyderabad based company has its mother plant located close to the city and other two manufacturing units are close to Vishakapatnam - India's biggest sea port city. All the three units are strategically located close to the airport and sea port.

Superior financials

The healthy mix of business in India and abroad ensures that Samkrg maintains its profitability in economic downturns.

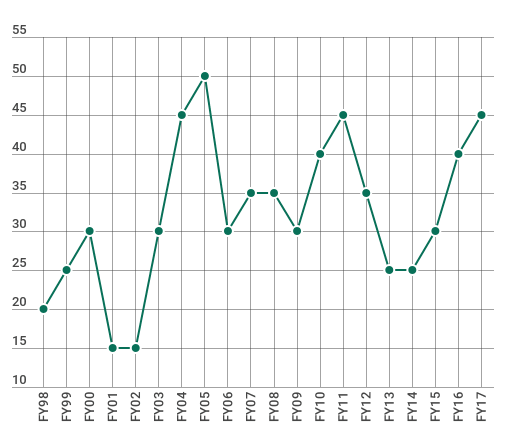

Samkrg boasts of a very steady financial performance. It has no long-term debt in its books and has grown its revenue in a profitable manner since inception. In the past ten years, revenue has grown at a CAGR (compounded annual growth rate) of 11.7 percent and profitability has also followed a similar trajectory growing by 11.2 percent. It is noteworthy that the company has consistently generated positive cash flows for the past twenty years.

Samkrg has been also meticulously rewarding its shareholders. It has never skipped dividend in the past nineteen years.

This Rs 240 crore market capitalisation entity is listed only in BSE. As the financial snapshot appears to suggest, despite having very healthy return ratios and a history of consistent performance, the valuation of the stock at 12.4 times trailing earnings and 11,2X projected earnings for FY19 remains undemanding. The market hasn’t yet rewarded the company for being a steady performer.

This Rs 240 crore market capitalisation entity is listed only in BSE. As the financial snapshot appears to suggest, despite having very healthy return ratios and a history of consistent performance, the valuation of the stock at 12.4 times trailing earnings and 11,2X projected earnings for FY19 remains undemanding. The market hasn’t yet rewarded the company for being a steady performer.

If we look at the peer group of this company, while larger companies like Federal-Mogul Goetze reports operating margins of similar trajectory, its valuation has more than captured the optimism. Other smaller competitors like IP Rings and Menon Pistons have performed much worse compared to Samkrg, but command a valuation premium.

If we look at the peer group of this company, while larger companies like Federal-Mogul Goetze reports operating margins of similar trajectory, its valuation has more than captured the optimism. Other smaller competitors like IP Rings and Menon Pistons have performed much worse compared to Samkrg, but command a valuation premium.

Considering the stable financials, superior quality of balance sheet, healthy return ratios and an attractive valuation, Samkrg Pistons and Rings appears to be the right candidate at the right price.

Considering the stable financials, superior quality of balance sheet, healthy return ratios and an attractive valuation, Samkrg Pistons and Rings appears to be the right candidate at the right price.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!