As the saying goes – ‘Never catch a falling knife’. Humans are loss-averse, meaning that we react to losses and gains differently. The pain from selling a stock at a loss is twice as intense as the joy from equivalent gains.

Investment performance isn’t just about picking winners; it’s also about avoiding catastrophic losses.

Investing in a different stock multiple times has far lower chances of success than investing in different stocks at once, multiple times – the latter having better chances of success.

Often, investors think that acquiring a larger number of shares of a certain stock and getting the bet right (picking multi-bagger stocks) is the only chance of making a fortune — this could be true, but only if you’re lucky.

However, if you look at the mathematical probability, the chance that you would be able to do this repeatedly over a 10-year period is low.

Simply because, to win in this game, you first need a mechanism to survive for 10 years (i.e., not go bankrupt).

When the market goes through its bearish phases – for example, during the recent market correction after October 2024 – many stocks saw a 45%+ drawdown. If you had invested all your capital in any one of these stocks, your investment was almost halved.

A good method to avoid loss-making stocks would be to use the ‘Chance of Survival’ model.

At FinSharpe, we created a model to check the probability of survival of a stock. We looked at historically bankrupt companies (drawdowns of 90%).

‘No Survival Zone’ was defined as stocks dropping below 10% of their peak value.

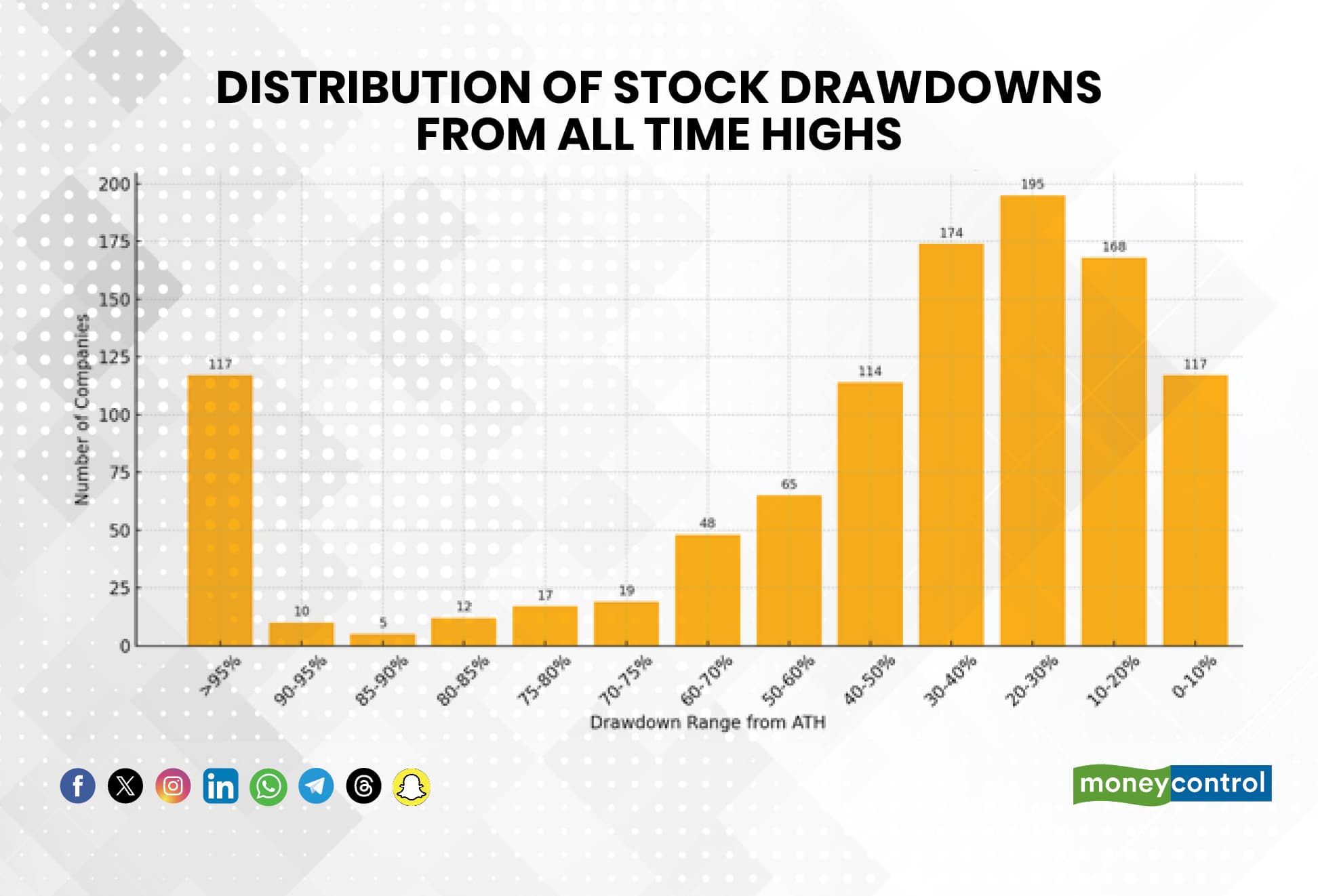

Based on the analysis of 1,084 stocks, these were some inferences:

1. 127 stocks (12%) currently fall into this critical category, reflecting a significant erosion in shareholder value.

2. If a stock falls more than 40% across any time frame, its probability of no survival is high. Monitoring drawdowns around these levels is crucial.

3. There are very few stocks that have survived a high drawdown and are trading near lifetime high levels. Turnaround stories are hard to find.

Here are some key takeaways for investors:

a) Risk Awareness: Investors must monitor drawdown trends. Stocks showing rapid deterioration may require swift reassessment.

b) Timeframe Significance: Longer-term drawdowns exhibit higher volatility and greater extremes. Even investors with a long-term horizon should adopt risk management strategies in the short term.

c) Portfolio Diversification: High drawdowns emphasise the importance of portfolio diversification to mitigate stock-specific risks and avoid investments entering the ‘No Survival’ zone. Rebalancing the portfolio from time to time proves to be a better strategy.

d) Survival Screening: Maintain vigilance on stocks nearing critical thresholds (90% drawdown from all-time high), as recovery from such levels is rare.

If a stock has fallen 90% from its lifetime high, then the chances of survival are very low – which means the stock is very unlikely to return to previous levels.

This also indicates a potential value trap, as you would really need to rely on luck to recover from such a position.

However, if you choose to rely on data, it would be wiser to take a much broader approach by investing in around 25 stocks and rebalancing the portfolio at regular intervals. This strategy has better chances of consistently beating the benchmark over the long term.

Diversification is the only free lunch when it comes to investing.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.