In the wee hours of Monday evening, December 9, the Government of India surprised financial markets by appointing Sanjay Malhotra as the 26th Governor of Reserve Bank of India. It was a surprise as it was widely expected that the current Governor, Shaktikanta Das, would get another extension.

Das’s term gets over today, but there was no news about Government appointing a committee to look at new candidates. Hence it was expected that Das would most likely continue. The media is going to be buzzing over the next few days on Das’s term and what to expect in Malhotra’s tenure. This article will discuss Das’s tenure.

Baptism by fireShaktikanta Das was appointed the Governor of RBI in the most trying circumstances. Then RBI Governor Urjit Patel resigned suddenly on 10 December 2018, 10 months before the end of his 3-year term. There were conflicts between the Government and the RBI over sharing the central bank reserves with the Government. With the Supreme Court judgement on electoral bonds, we also learnt that there were disagreements with the Government on the bonds too. But no one foresaw an abrupt resignation.

Amidst these simmering tensions, the educational background of Das was severely contested. He was a retired IAS officer with an educational background in history. He had served in economic roles such as Revenue Secretary and Economic Affairs Secretary, but these were seen mainly as bureaucratic roles. Since 1991 reforms, the Government of India had preferred to appoint Governors who were either specialist economists (C. Rangarajan, Bimal Jalan, Raghuram Rajan and Urjit Patel) or IAS officers with an economics background (Y.V. Reddy and D. Subbarao).

Though RBI Act (1934) does not specify educational qualifications for RBI Governor, it was still widely believed (and rightly so) that an economics background is a basic prerequisite for the Governor’s job. Das was also seen as a face of demonetization of 2016 where he was inducted into the central role to manage the crisis, ahead of then RBI Governor Urjit Patel. This also did not help as demonetization had impacted economy adversely and undermined RBI’s autonomy.

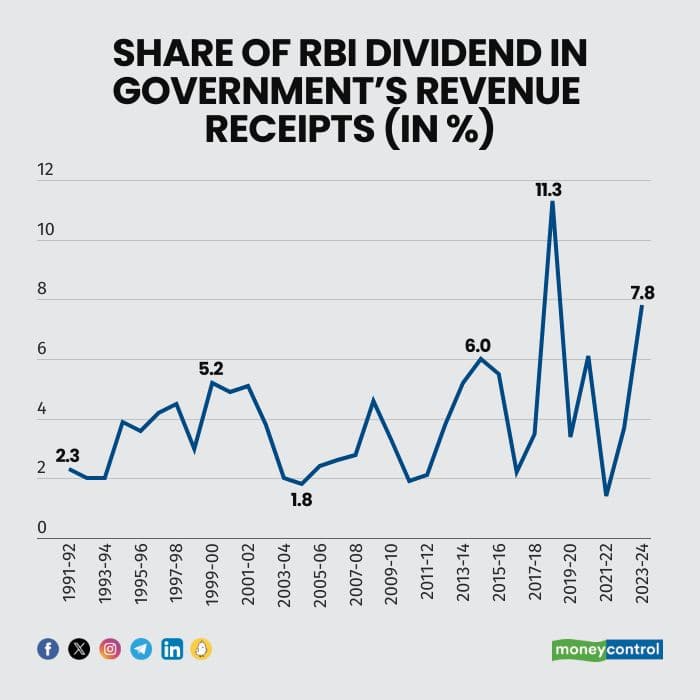

Seamless transition as head of the monetary authorityEnter Shaktikanta Das, and it was amazing how he settled into the role as a fish takes to water. The differences with the Government disappeared overnight as if they never existed! The discussions over RBI autonomy have more or less disappeared under his tenure. To sort out the contentious RBI reserves issue, a Committee was established under former Governor Bimal Jalan. Jalan Committee gave a framework for keeping reserves which means the issue has been broadly depoliticized. Questions are often raised over dividends being higher during Das’s term as we can see in the below graph but RBI is simply following recommendations of Jalan Committee.

Apart from dividends, the most important metric for central bank leadership is inflation. When Das came in, RBI had already adopted inflation target of 4 percent with a band of +/-2 percentage points. The average inflation under Das’s tenure has been 5.4 percent. The period was full of turmoil with local weather shocks and global shocks such as pandemic and geopolitical shocks that led to high food and fuel inflation in the period. The food inflation in particular has led to higher headline inflation as well.

Das’s tenure would be remembered for the way RBI handled the pandemic. The central banks worldwide were under huge pressure due to the pandemic. The lockdowns led to plunging growth and high inflation. On top of this, there were concerns over financial stability. In these trying times, Das’s background as a bureaucrat helped RBI navigate through the crisis admirably. Bureaucrats manage crises all the time and his calmness during the crisis gave a lot of comfort to both the RBI and the markets.

Another notable aspect of Das’s Governorship was his ability to learn things rather quickly. As argued above, central banking is seen as a job for economists given the complexity and interconnections of the subject. Over the years, central banks have become transparent and are expected to communicate with the financial markets and the financial media. As an economist, it is easier to at least understand the subject and one can gradually learn to communicate as well. In Das’s case, he was fine with communications due to his background but had to learn economics and financial markets quickly. He did not have any prior time to prepare given the sudden exit of Governor Patel. But then he could quickly grasp things and looked in control fairly early.

Let’s not forget the role of RBI’s staffersApart from his own personality, Das benefited immensely from the support he was given by RBI staff. The RBI over the 90 years of his history has built its own legacy of expertise. While individuals with strong economic credentials do add value, even a generalist can do relatively well given the overall structure of RBI. The inflation management had moved from being government centric to one done by Monetary Policy Committee where Governor was assisted by the erudite committee members. Likewise, other roles of RBI such as financial stability, exchange rate management, development of markets etc. are all led by competent staff members. As a Governor, you just have to trust the advice given by the experts. Das handled this task also well. After being given an initial three year term, he was reappointed for another three year term marking him as the second longest serving Governor of RBI after Benegal Rama Rau (1949-57).

RBI is both an institution and an organisationTo sum up, Das had a rollercoaster tenure. Both his entry and exit as RBI Governor were highly unexpected. He managed RBI leadership rather well against all odds. He was also supported ably by the RBI staff to conduct his role without much problems. Economists differentiate between institutions and organisations, saying that institutions are rules of the game and organisations as followers of rules. We call RBI as both an institution and organisation as it has established the rules and is also a follower of them. The credit for Das’s tenure also goes to RBI as an institution and organisation.

Over to Sanjay Malhotra who is also the Revenue Secretary like Das. He will surely look to Das’s journey to chalk out his own path.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.