Jimmy Kimmel propelled weight-loss drugs into our popular

consciousness in March, when he quipped at the Oscars: “Everybody looks so great. When I look around this room I can’t help but wonder: Is Ozempic right for me?”

It’s hard to say. But Novo Nordisk A/S’s GLP-1 Wegovy and diabetes counterpart Ozempic, as well as other appetite-suppressing medications, don’t look so right for the global food industry. Earlier this month, the head of Walmart Inc’s US operation, John Furner, told Bloomberg News that people taking them were eating less. “We do see a slight pullback in overall basket,” he said. “Just less units, slightly less calories.”

It wasn’t just Walmart investors who balked at the comments. Food manufacturers’ stocks tumbled. PepsiCo Inc, Oreo-maker Mondelez International Inc, The Hershey Co and Kellanova — the company behind Pringles and Cheez-It — are all still trading below their year-to-date averages. Shares in Nestle SA, the world’s biggest food company, are at their lowest level in two and a half years, reflecting the weakest sales growth it’s seen for almost three years.

But the knee-jerk reaction to Furner’s comment was overdone. Investors are overestimating the scale of adoption of weight-loss drugs as well as how consumers might change their eating habits. Most importantly, they’re discounting how food companies might adapt. They could reformulate products and restructure portfolios, reducing their exposure to junk food and offering healthier alternatives.

Analysts at Morgan Stanley estimate that by 2035, about 7 percent of the US population, or 24 million people, could be treated with anti-obesity medication, amounting to a 1.3 percent reduction in calories consumed. The impact on sugary drinks, baked goods and salty snacks could be more extreme, with a 2.5 percent to 3 percent fall in consumption compared with a scenario of no widespread use of the drugs.

This looks like a treacherous headwind for the packaged-food industry, which is already struggling to lift the volume of goods sold. But it does not tell the whole story.

There are still questions about just how widespread these treatments will be. American insurance companies are already battling to deny coverage of the drugs because of their high costs, and the US Congress is debating

whether Medicare should cover them. Without insurance coverage, it’s unlikely most people would be able to shell out some $1,300 a month for Wegovy or even $900 a month for Ozempic. Analysts at Bernstein suggest only 20 percent-30 percent of people are able to stick with the regimen a year after starting them. (Most of the fear is concentrated in the US right now, but Wegovy was recently introduced in the UK — at a fraction of the US cost — and is also available in Norway, Denmark and Germany.)

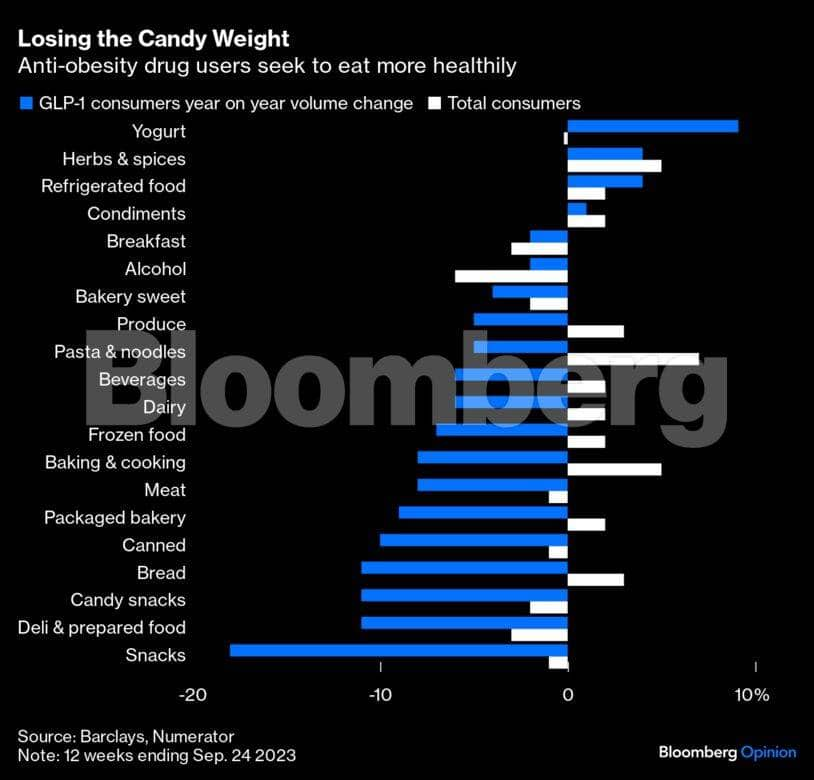

Consuming fewer calories doesn’t necessarily mean buying less either. A recent panel organized by Bernstein analysts found that those taking the drugs had a desire to eat more healthily. Yet it’s possible they actually spend more from adding pricier fresh food to their baskets. Jennifer Bartashus, analyst at Bloomberg Intelligence, points out that these health concerns aren’t new either. Companies such as Nestle, Mondelez and Hershey have been looking to make their products healthier for some time, reducing sugar and producing smaller, low-calorie packs, for example.

Foods giants so far seem unfazed. Despite its size, Nestle is less at risk than many rivals because it has been cutting back on mainstream groceries, having sold its US confectionery business to Ferrero SpA in 2018. However, about 15 percent of its sales could be affected by lower demand due to weight-loss drugs since it still sells frozen food in the US, confectionery in other parts of the world and some ice cream, although the bulk of its exposure to this category is through a joint venture. Chief Executive Officer Mark Schneider said on Thursday that it was not seeing any effect on sales so far. This echoes comments from PepsiCo, which said the impact was “negligible.”

Meanwhile, Ozempic and its ilk could even bring some opportunities. If people taking them still want to indulge, they may eat a smaller amount of chocolate, for example, but trade up to a more expensive product. This would benefit Nestle and Mondelez, which have been moving their portfolios more upmarket. Mondelez has been on a buying frenzy over the last five years, snapping up companies from premium cookie brand Tate’s Bake Shop to minimally processed, high-quality snack company Hu. And Nestle recently acquired a majority stake in Grupo CRM, a premium chocolate-maker in Brazil. About 35 percent of the Swiss company’s sales are in premium categories — three times what they were a decade ago.

Some foods may get a boost from widespread adoption of the drugs by health-conscious consumers. One of the challenges of rapid weight loss is maintaining muscle mass. Eating enough healthy protein is crucial. Analysts at Barclays point out that this could benefit French food company Danone SA, whose portfolio of enhanced protein yoghurts and yogurt drinks currently generates sales of about €500 million ($527 million). This could easily double, they predict. Nestle also sells protein supplements through its Health Science arm and is working on other products to complement the weight-loss treatments.

Snacking has been one of the fastest-growing categories in food, though, so a switch away from certain items could be a drag and lead to lots of disposals. With slower growth, these business could be appetising to private equity groups, more interested in cash generation than sales expansion. Similarly, there could be a dash by the manufacturers for healthier brands, sparking a wave of pricey M&A.

Of course there are bigger risks, such as Wegovy uptake growing faster than expected. Already, users sometimes lose their appetite for alcohol. Indigestion and nausea, side effects from the treatments, could impact demand for coffee too. And what about our obese pets — will they eventually be put on Ozempic? The latter two scenarios would be far more worrying for Nestle: Together, pet food and coffee account for about 45 percent of sales.

Fortunately, right now that sounds far-fetched. Although these drugs are a legitimate long-term concern, the food companies have enough going for them to help investors lose some of the weight of their worries.

Andrea Felsted is a Bloomberg Opinion columnist covering consumer goods and the retail industry. Leticia Miranda is a Bloomberg Opinion columnist covering consumer goods and the retail industry. Views are personal and do not represent the stand of this publication.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.