Nifty 50 crossed the 22,700 level making a new lifetime high last week. This market rally was broad-based, however, at current levels most of the stocks are trading at the higher end of their price bands.

The 200 Day Moving Average (200 DMA) is a widely tracked indicator that is useful while analysing the trend of a particular asset. It is a long-term moving average.

FinSharpe analysed the components of the Nifty 500 for a period of 10+ years to check how many stocks were trading above the 200 DMA at any given time.

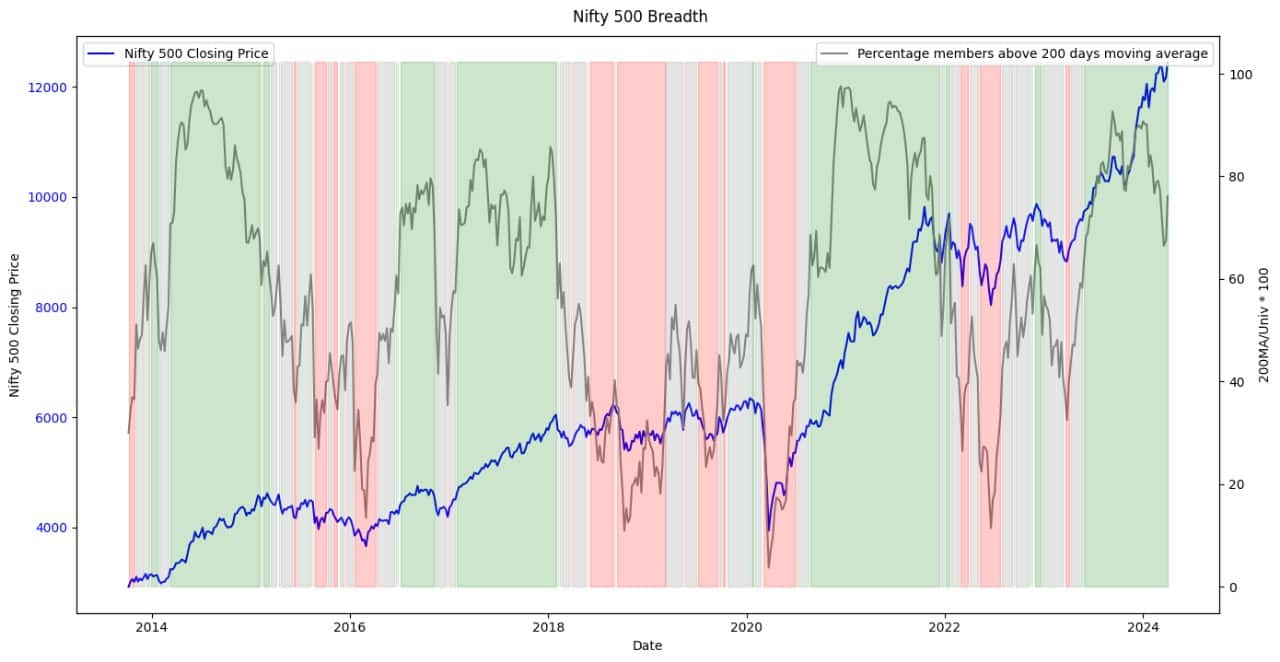

The chart below shows the percentage of stocks in Nifty 500 that are trading above their 200 DMA.

If more than 60% of the stocks are trading above their 200 DMA then it is highlighted by the colour green.

If less than 40% of the stocks are trading above their 200 DMA then it is highlighted by the colour red.

The remaining cases are highlighted by the colour grey.

Here are some observations based on the data above :

1. Whenever more than 80% of the Nifty 500 stocks were trading above their 200 DMA, the market corrected in the subsequent months.

2. Whenever less than 30% of the Nifty 500 stocks were trading above their 200 DMA, the market picked up in the subsequent months.

3. Generally, when the market breadth is is picking up it is an overall bullish sign. A declining market breadth shows a consolidation or bearish period.

When the market is picking up but the breadth is not increasing (more stocks are not participating in the rally), it is very likely that an active portfolio would underperform the benchmark.

Ideally when the overall market breadth is at a higher valuation, retail investors are better off investing in Index funds or ETFs.

Rohan Borawake is Co-Founder & CEO, Sabir Jana is Co-Founder and Head of Quantitative Research, at FinSharpe Investment Advisors. Views are personal, and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!