So far, 2025 has been a very volatile year for the Indian stock market, starting with a global trade war and the on-going war that India is fighting against terrorism. How should investors sail through these volatile times? The India VIX, often referred to as the ‘fear gauge’ measures the markets expectation of volatility over the next 30 days. As of May 9, 2025, the India VIX has increased by approximately 50% since the beginning of the year.

This volatile market regime is a true test for an investors long-term investing patience.

In this article we will look at an investment strategy that investors could follow. The Multi Asset Investment approach.

The modern portfolio theory emphasises that a well-diversified portfolio of non-correlated assets can reduce overall risk. The idea is that losses in one asset may be offset by gains in another.

If you invest in multiple assets strategically, the overall risk of any asset considerably reduces as the overall portfolio reaps the benefits of the cyclical nature of different asset classes.

The Nifty 50, for instance, surged over 12% in Q1 only to give up nearly half of those gains during a volatile April. Meanwhile, commodities like gold hit all-time highs, and bond markets showed signs of nervousness.

FinSharpe conducted research on a Multi Asset investment strategy for retail investor that invests in Domestic Equity, International Equity, Debt & Gold.

The Equity component helps in maximising returns, Gold offers a safety net during a market turbulence and Debt adds a level of consistency to the portfolio returns.

Investors could consider 4 ETFs to create a simple multi-asset portfolio.

Equity: Nifty 50/Nifty 500 Index ETF, Nasdaq 100 Index ETF

Commodities: Gold ETF

Debt: Bharat Bond ETF/Liquid ETF

Key highlights:

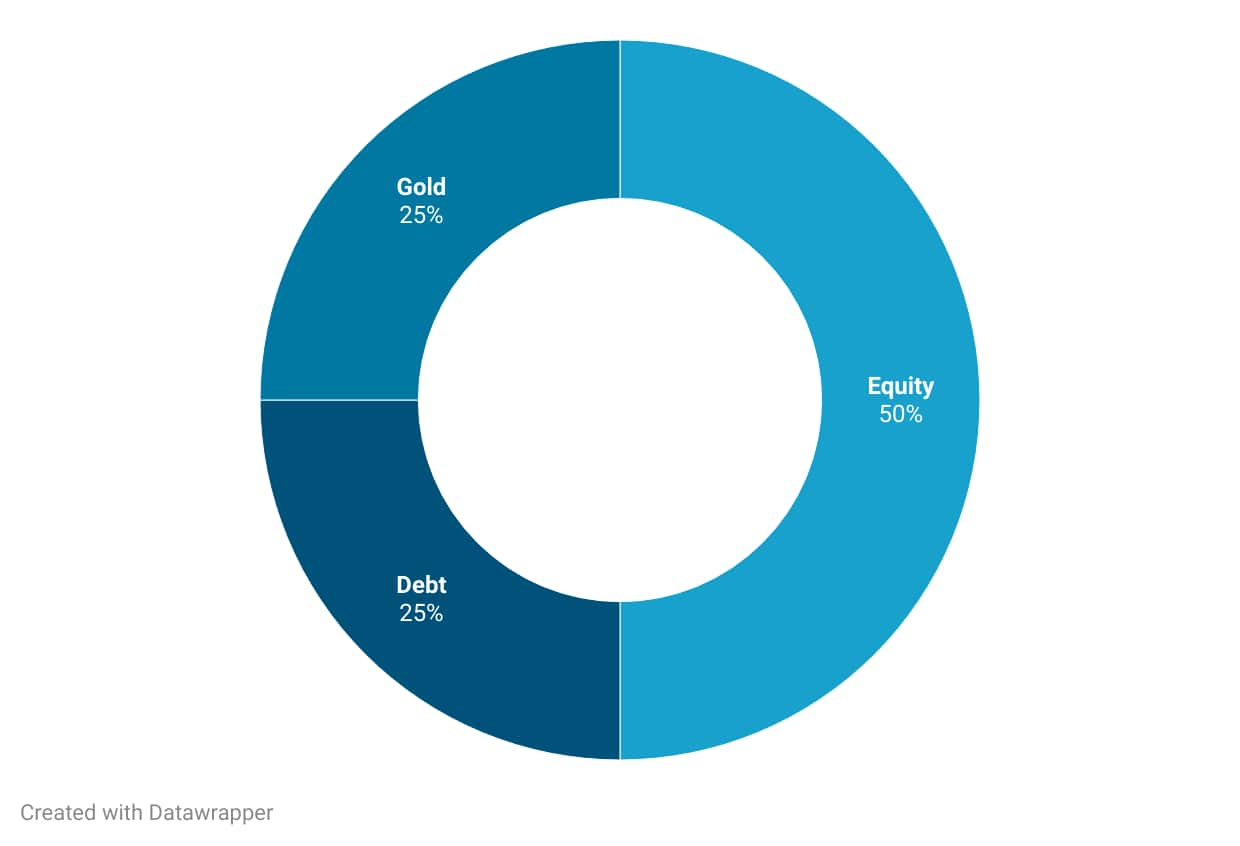

1) Equity weightage ranges from min 50% to max 75%

2) Commodities weightage ranges from min 5% to max 25%

3) Debt weightage ranges from min 5% to max 25%

4) Rebalanced once in 4 months.

5) Back tested on 10+ years of data.

6) Suitable for conservative investors.

Following are the back tested results of this strategy where the weightage switching is done depending on momentum and market volatility: high, medium or low.

During March 2020, Equity weight reduced to 50% (lowest range). The remaining was split equally between Gold & Debt.

During 2023–24, Equity and Gold had higher weights and Debt weightage was low.

It can be seen from the dynamic asset allocation switching that when Equity is trending downward the allocation towards Gold and Debt is increasing and Equity is decreasing.

Similarly, during an upward trending Equity market, the model is underweight Gold and Debt.

If you compare this strategy with the Nifty 500, the Nifty 500 gave superior returns during bullish years but carried higher risks.

In years like 2015, 2018, 2020, 2022, 2024, and 2025 the Mutli-Asset strategy offered better risk-adjusted returns.

Overall, the Multi Asset strategy had significantly lower drawdowns and lower volatility than the Nifty 500.

Given the current volatile market regime, this is the asset allocation according to the above model:

To summarise, here are the key takeaways for investors:

1. Expect higher than usual volatility: The global and domestic events of 2025 have reinforced that markets can swing unpredictably. Instead of reacting emotionally, adopt a structured approach.

2. Diversification is your best defence: A multi-asset portfolio that includes equity, debt, gold, and global exposure can cushion against sharp drawdowns and improve long-term consistency.

3. Leverage modern investment tools: Investors can now access multi-asset mutual funds, ETFs, or tailored portfolios curated by SEBI registered investment advisors that do the hard work of allocation and rebalancing. Use them to your advantage.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.