Kunal Shah

The MPC has voted in favor of maintaining status quo on policy rates at 6.25 percent (repo rate) with one member dissenting on the resolution. In a classic turn of events in the last quarter, the disinflation seen in food prices (believed to be transitory) continued the downward movement during the month of April, and the early indicators in June also suggest lower prices in pulses, cereals and vegetables.

The recent numbers on CPI at 2.99 percent has thus positively surprised market participants and MPC members, the core CPI inflation has also surprised on the downside printing at new low of 4.4 percent. These developments in inflation readings have led RBI to revise down its own projections by 100-150bps. RBI now sees inflation to average ~3.5 percent in FY 18 from earlier projections of 4.5 percent. The RBI’s projections are well within the medium term target of CPI inflation of 4 percent.

In the current policy, MPC has thus left some hints of expected accommodation in future if projections fructifies. The committee probably wants to confirm the bias with actual realization of inflation before pressing the easing button. The still caution in the tone is because of following reasons; 1. Supply side: RBI believes the sharp deceleration in pulses & vegetables is basis the supply glut and imports, may not sustain in future and prices may mean revert. 2.Demand side: The cash re-monetization, rural wage growth & disbursement of allowances under pay commission award can spur consumption demand and put demand side pressures on prices. The farm loan waivers can also have indirect impact on prices.

There are however few compelling reasons for MPC for accommodation in our view: 1. The much needed stimulus to revive investments/private capital expenditure, lower cost of capital will improve return on investments and also lessen the burden on current debt. Current investments ensure lower prices in future. 2. The India Met forecast of 98 percent of normal monsoon, normal monsoon ensures elimination of tactical volatility in food prices, especially vegetables. 3. Persistence of negative output gap, capacity utilization is running at sub 75 percent, core CPI prints at less than 4.5 percent confirms the state of the economy. Bond markets had started expecting the dovish stance from RBI the day inflation printed lower, yields on 10y bonds have dropped from 6.85 percent to 6.65 percent in the anticipation.

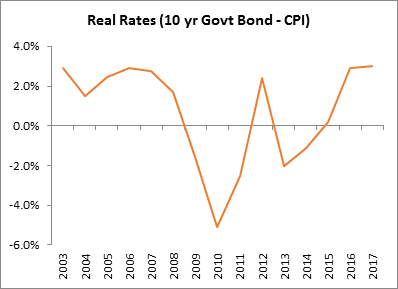

The deflation surprise will ensure the bond markets expectation from RBI to remain alive in upcoming policies. Yields on 10y government bonds may trade in the range of 6.40-6.70 percent. MPC may choose to accommodate marginally to support growth; (the committee will also keep in mind the impact on deposit rates for savers if they choose to ease sharply). Having just embarked on the journey of inflation targeting, MPC may want to see the realization of inflation targets before aggressively supporting growth reflecting its confirmation bias behavior. Beyond the policy rates, the smart drop in inflation and reasonable nominal yields should attract domestic & international flows to fixed income markets.The real rates offered on the debt instruments are attractive enough to absorb disappointments from monetary policy side.

We believe MPC may ease policy rates by 25bps in one of upcoming policies with some chances of further easing if monsoon performance is satisfactory and international oil prices remain below $55-60. Bond markets will watch global and domestic development closely and trade with a downward bias on yields.

Author is Fund Manager (Debt), Kotak Mahindra Old Mutual Life Insurance

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.