The government on August 29, 2023, cut the price of domestic liquefied petroleum gas (LPG) by Rs 200 per cylinder (14.2 kg) for households, marking an 18 percent reduction from the August 1 level. The move has spurred intense discussion ranging from its timing to how it can erase the incremental spreads of oil marketing companies (OMCs). A closer look, however, shows the move only realigns prices with the prevailing market dynamics. Nothing more, or less.

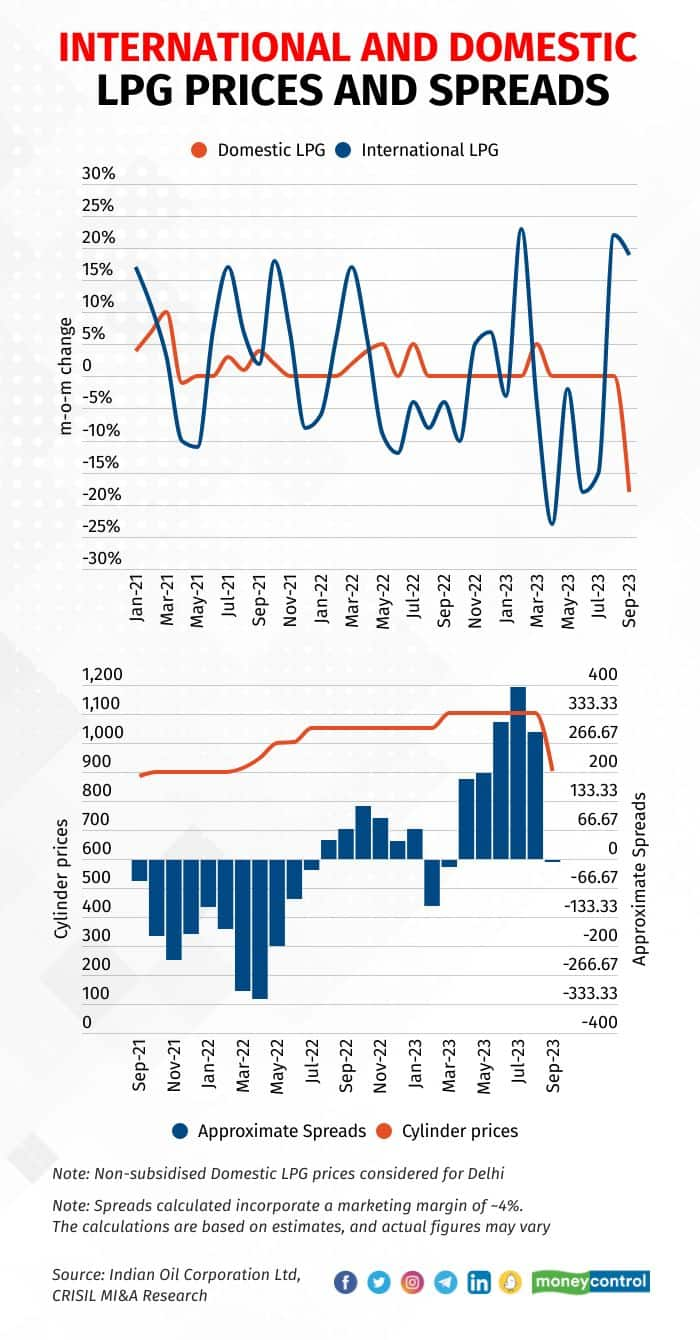

The decline in prices will not adversely impact the financial health of OMCs either. That’s because, over the past couple of years, volatility in the global LPG market had resulted in a disconnect between domestic and international prices. Now, domestic prices are nearly at equilibrium with international prices. Between September 2021 and March 2022, international LPG prices (f.o.b. Arabian Gulf) surged 35 percent from $664 per tonne to $898 per tonne. In comparison, domestic prices grew a mere 3 percent from Rs 884.5 per cylinder to Rs 913.2 per cylinder owing to the proactive approach of OMCs in offering relief to price-conscious households. As a result, OMCs saw negative spreads, leading to losses of Rs 28,000-32,000 crore between September 2021 and July 2022.

Then, during the first half of 2023, international LPG prices declined ~25 percent. However, domestic prices increased gradually by a cumulative 16 percent from Rs 949.5 per cylinder in April 2022 to Rs 1,102.5 per cylinder in April 2023 to reflect the pass-over of costs incurred over the preceding 18 months. The positive spreads of OMCs from April 2023, bolstered by a substantial grant of Rs 22,000 crore received in October 2022, have eased their financial woes.

Additionally, following a surge in global LPG prices in the wake of the Russia-Ukraine conflict, the government had provided a subsidy of Rs 200 per cylinder for up to 12 refills to Pradhan Mantri Ujjwala Yojana (PMUY)beneficiaries in May 2022. In March 2023, the government extended the subsidy by another year, despite a decline in global prices. This support, provided to 9.6 crore (31 percent of connections and 19 percent of demand) beneficiaries of PMUY, is essentially a reiteration of the previously budgeted subsidy in March 2023. In fact, the budget had already accounted for an increase of 26 percent in overall subsidy expenditure to Rs 7,680 crore from Rs 6,100 crore last fiscal.

In the complex interplay of political and economic factors that govern LPG consumption in India, the recent reduction in domestic LPG prices, coupled with supplementary support for the PMUY segment, is unlikely to exert any additional fiscal burden on the government or OMCs. Risks remain, however.

For full year 2023, CRISIL MI&A Research expects international LPG prices to be in the range of $550-600 per tonne, down 20 percent on-year. If international LPG prices rise from their current levels, the ability of OMCs to adjust prices in line with market dynamics will bear watching.

Jaydeep Dattani, Manager-Research, CRISIL Market Intelligence and Analytics also contributed to this article.

Hetal Gandhi is Director-Research and Paurin Zaveri is Analyst-Research, CRISIL Market Intelligence and Analytics. Views are personal, and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.