Jitendra Kumar Gupta

Moneycontrol Research

Voltamp Transformers was able to smoothly navigate the slowdown in India’s transmission & distribution space over the last 5-6 years thanks to its strategy of keeping its balance-sheet light. Its smart decisions to not borrow or create additional assets have paid off.

Since FY08, while annual sales remained in the region of about Rs 600 crore, the company kept on accumulating cash generated from its operations. Today, when the industry is on the verge of a turnaround, Voltamp is sitting on cash pile close to Rs 300 crore, which is about 25 percent of its market capitalisation. This is formidable in an industry which is suffering from excessive working capital and bloated balance sheets.

The excess cash holding, however, is suppressing the return ratios and making valuations look expensive. Hence, if one removes cash from capital employed, return on equity works out to a respectable 30 percent (against ROE of 14 percent reported in FY17) and price to earnings at around 14 times (based on FY18 earnings) which actually looks attractive.

Leadership in 220 KV

This debt-free company has a leadership position in the sub-220 KV transformer segment. The manufacturing capacity of the industry stands at around 1,37,000 mega volt amp (MVA). In this, the organised players account for about 70 percent of the total capacity. Voltamp’s capacity of 13000 MVA is close to 14 percent of the organised market. Importantly, in the sub-220 KV, Voltamp has higher market share.

Cheap & Clean – How Solar Power May Shape The Future of Modern India

The sub-220 KV transformers is used in smaller applications mainly by state utilities, solar and by the industrial clients. Thankfully, this particular segment has now seen a revival with orders coming from the state utilities and the solar sector. For instance, orders from the renewable energy space, which account for 20 percent of the revenue, grew two times in the last one year. This space is going to witness a similar demand with more and more capacity coming on stream.

This helps in growing the order book. Voltamp's order book, at the end of FY17, grew to about Rs 300 crore, up 25 percent on a year-on-year basis. With the higher orders, it was now able to improve its capacity utilisation significantly from 71 percent in FY16 to 78 percent in FY17. The company delivered 10189 MVA transformers in FY17 as against 8,367 MVA in FY16, indicative of the revival in its business.

This could also mean a strong earnings cycle, which was otherwise lying depressed.

Capex to Drive Earnings

It is important to remember that the company has ample financial resources to meet emergencies. At the peak of the business cycle in the FY09, on a sales turnover of Rs 742 crore, Voltamp made a profit of Rs 114.8 crore. Today, despite Rs 300 crore cash in books, its profits are about half of what they were at the peak of the cycle in FY09.

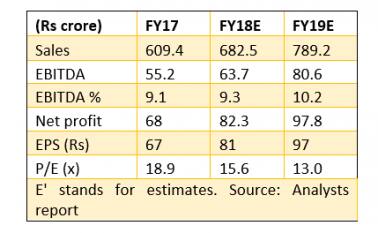

In FY09, the company used to make operating margins of about 24 percent, which dipped to around 4 percent in FY14 and now stands at 10 percent. Importantly, backed by improvement in utilisation, higher volumes and better realization, operating margins are expected to inch up further by around 400-500 basis points over the next two years. This should support earnings growth which is expected to be in the region of 20 percent in the coming years.

From FY19 onwards, the possible deployment of excess cash in the business for the creation of new capacities would improve its growth prospects and return ratios. Voltamp has already purchased some land and is patiently waiting for the market to revive and build additional capacity to grow further. It is expected that once the money is deployed in the business it will create value in terms of improving return ratios, which are depressed presently because of cash in the books.

The company has huge leeway in terms of creating growth. Currently, on a fixed-asset base of Rs 100 crore, the company is clocking a sales turnover of close to Rs 600 crore. Following that yardstick, if additional Rs 300 crore (cash in the business) is deployed in the business it gives enough visibility for future growth.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.